Puerto Rico Independent Consultant Programming Services General Agreement (User Oriented)

Description

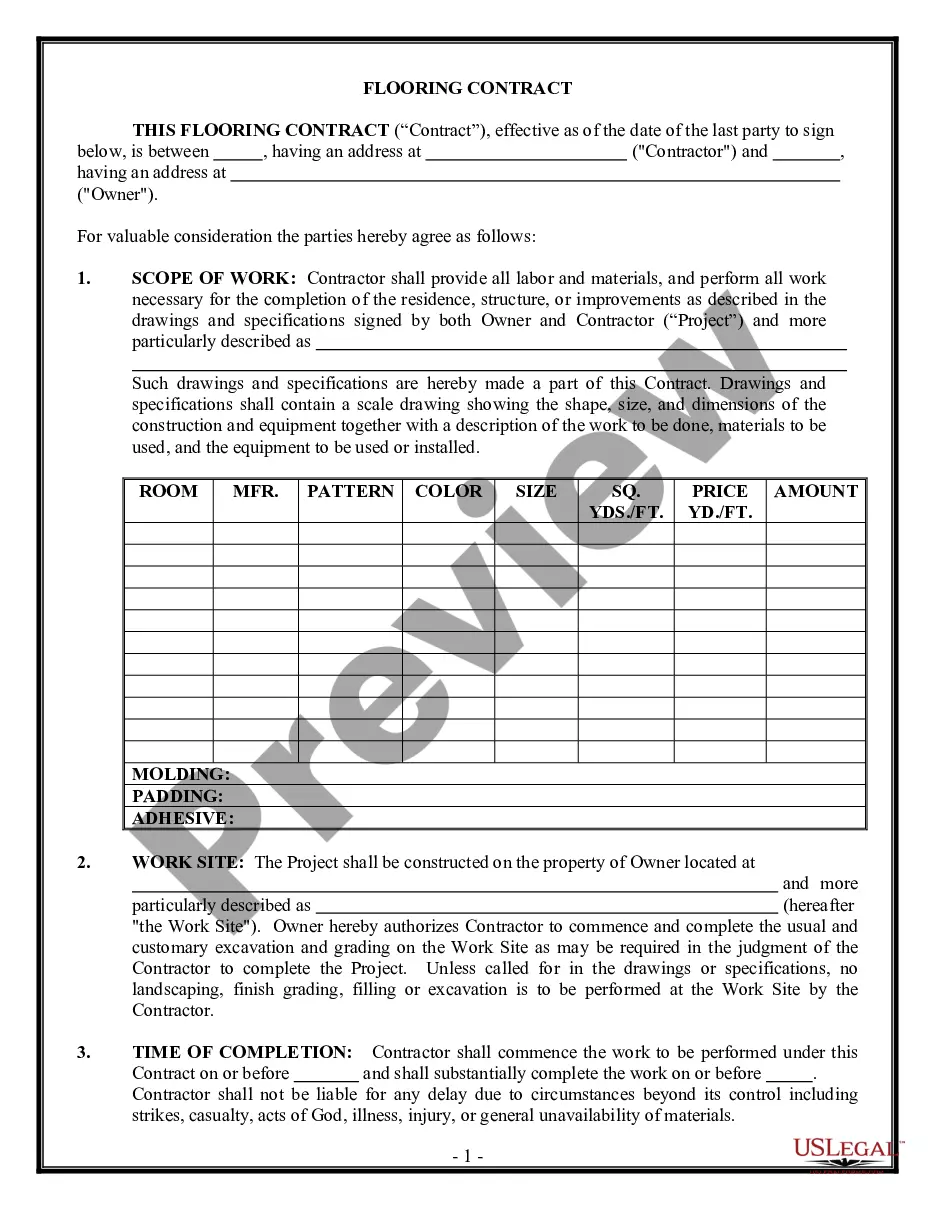

How to fill out Independent Consultant Programming Services General Agreement (User Oriented)?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Puerto Rico Independent Consultant Programming Services General Agreement (User Oriented) within seconds.

When the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your choice by clicking the Get Now button.

- If you have an account, Log In and download the Puerto Rico Independent Consultant Programming Services General Agreement (User Oriented) from the US Legal Forms library.

- The Download button will appear on every template you view.

- You can access all previously acquired forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your city/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

US citizens are subject to the same tax rules regardless of their location. The IRS will still consider an independent contractor as a US citizen if they perform the service abroad, even if the contractor is technically a tax resident of another country.

The best way to send money to overseas independent contractors is still PayPal. The payment receiver fees are 2.9% + $0.30 in the US and 3.9% + exchange fee for payments made internationally. Some companies prefer PayPal because it allows payment through a corporate credit card.

An individual is considered to be a bona fide resident of Puerto Rico only if he or she satisfies all of the following three conditions: (1) physical presence test, (2) tax home test, and (3) closer connection test. A special rule applies for the year of the move.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

In general, there are four ways to pay a floating employee.Register or make the person an employee of a local affiliate.Put the employee on the home-country payroll.Make the person a leased or assigned employee.Pay the worker as a legitimate independent contractor.02-Dec-2015

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

Be present in Puerto Rico for a minimum of 183 days in the tax year. Spend at least 549 days in Puerto Rico during the 3-year period of the current tax year and the 2 preceding years, including at least 60 days in Puerto Rico during each tax year.

How to approach paying foreign contractors. There is no requirement for U.S. companies to file an IRS 1099 Form to pay a foreign contractor. But as noted above, the company should require the contractor file IRS Form W-8BEN, which formally certifies the worker's foreign status.