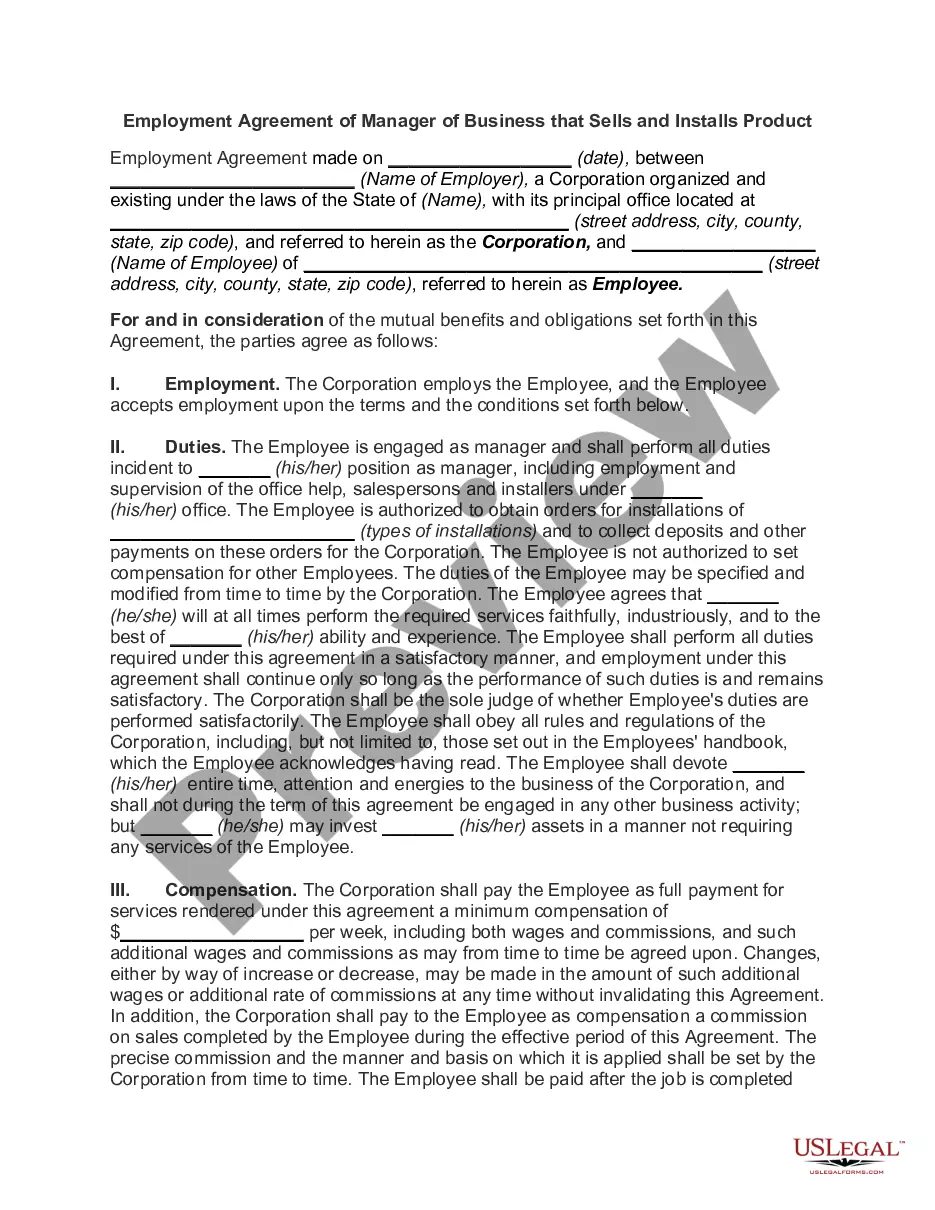

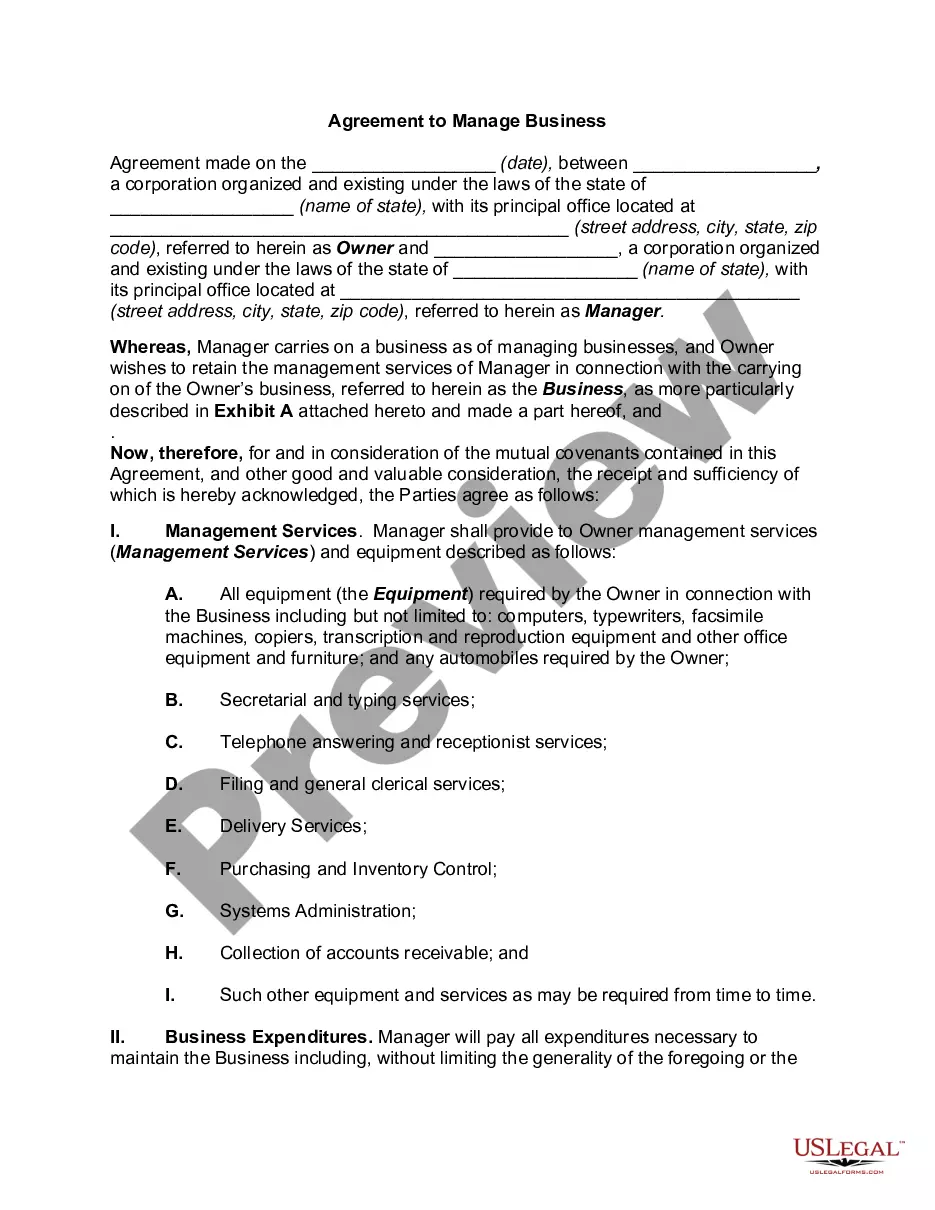

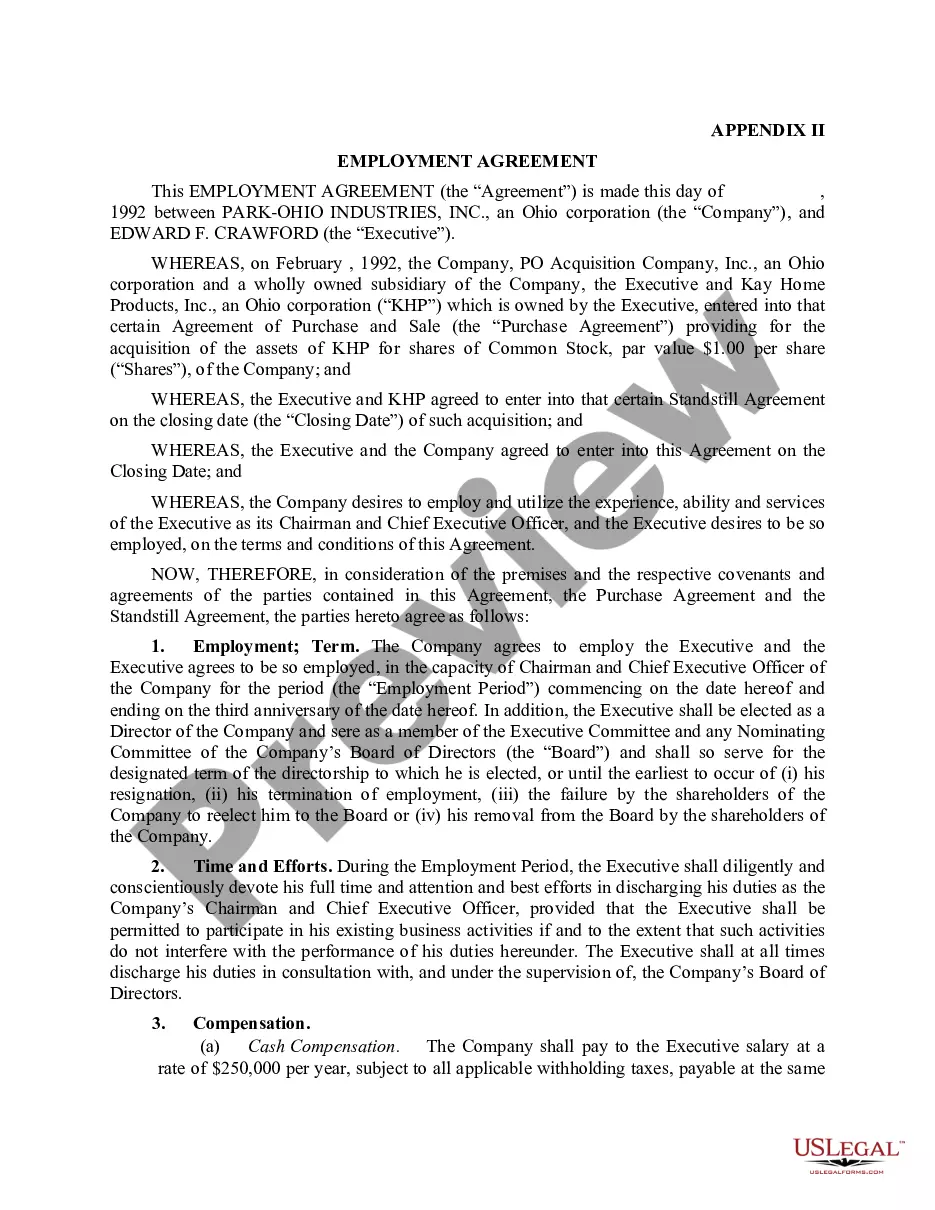

A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly. Many of these types of corporations are small firms that in the past would have been operated as a sole proprietorship or partner¬ship, but have been incorporated in order to obtain the advantages of limited liability or a tax benefit or both. This type of employment agreement might be in order for the chief operating officer of such a corporation.

Maryland Employment of Executive or General Manager in a Closely Held Corporate Business

Description

How to fill out Employment Of Executive Or General Manager In A Closely Held Corporate Business?

Are you in a situation where you require documents for various business or particular reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of templates, including the Maryland Employment of Executive or General Manager in a Closely Held Corporate Business, which are crafted to meet state and federal requirements.

When you find the right form, click Buy now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card. Choose a convenient document format and download your copy. Access all the document templates you’ve purchased in the My documents section. You can obtain another copy of the Maryland Employment of Executive or General Manager in a Closely Held Corporate Business at any time. Just click on the required form to download or print the document template. Use US Legal Forms, the largest collection of legal documents, to save time and avoid mistakes. The service provides expertly crafted legal document templates for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maryland Employment of Executive or General Manager in a Closely Held Corporate Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review option to inspect the form.

- Read the description to ensure you have selected the appropriate document.

- If the form does not meet your needs, use the Search section to find the document that fits your requirements.

Form popularity

FAQ

Yes, S Corporations are required to file a tax return even if they have no income. They must file Form 1120S to report their financial activities, which also helps maintain compliance with state and federal rules. Knowing this requirement is vital for anyone involved in the Maryland Employment of Executive or General Manager in a Closely Held Corporate Business.

S Corporation owners can be considered employees if they also receive a salary from the corporation. This classification allows them to participate in various employee benefits like health insurance. Understanding how this affects your role in the corporation is crucial in the context of Maryland Employment of Executive or General Manager in a Closely Held Corporate Business.

Certain corporations are exempt from filing Form 1120, including some S Corporations and qualified personal service corporations. Furthermore, corporations that have had no taxable income and do not owe any taxes for the tax year may also bypass this form. Therefore, it is essential to assess your business's classification in the context of Maryland Employment of Executive or General Manager in a Closely Held Corporate Business.

Yes, C Corporations are required to file Form 1120 regardless of income. This form documents your corporation's income, gains, losses, deductions, and credits. Filing Form 1120 keeps you compliant with both federal and state tax authorities and aligns with the principles of Maryland Employment of Executive or General Manager in a Closely Held Corporate Business.

C Corporation owners are not required to take a salary, but it is often beneficial for both tax and operational reasons. By taking a salary, you can ensure that you comply with IRS guidelines while enjoying the advantages that come with being an employee of your corporation. Therefore, knowing how your compensation ties into the Maryland Employment of Executive or General Manager in a Closely Held Corporate Business can shape your decision.

The requirement to file a tax return without earned income largely depends on other factors such as your filing status and gross income. If you hold a business structure like an S Corporation, filing may still be necessary even without earned income. Ultimately, understanding the rules related to California Employment of Executive or General Manager in a Closely Held Corporate Business will help clarify your tax obligations.

Even if your business has no income, you may still need to file a tax return depending on your business structure. For instance, the IRS usually requires C Corporations to file regardless of income. Therefore, it is essential to understand the implications related to your specific business type in the context of Maryland Employment of Executive or General Manager in a Closely Held Corporate Business.

Filling out the Maryland MW507 form requires some basic information about you and your employment status. Start by providing your personal details, including your name, Social Security number, and address. Ensure you enter your correct filing status and the number of allowances you claim. By accurately completing the MW507, you help facilitate your compliance with the Maryland Employment of Executive or General Manager in a Closely Held Corporate Business regulations.

Maryland Benefit Corporation law enables businesses to operate with a dual purpose: to generate profit and to create a positive impact on society and the environment. This law is particularly relevant when considering Maryland Employment of Executive or General Manager in a Closely Held Corporate Business. By adopting this structure, companies can appeal to stakeholders interested in socially responsible practices while ensuring sustainable operations.

Code 2 402 in Maryland pertains to the requirements for corporate formation and structure, detailing how corporations must operate in compliance with state laws. This includes various provisions for leaders and managers, relevant to Maryland Employment of Executive or General Manager in a Closely Held Corporate Business. Knowledge of this code is essential for ensuring lawful establishment and governance of a corporate entity.