Puerto Rico Sample of a Collection Letter to Small Business in Advance

Description

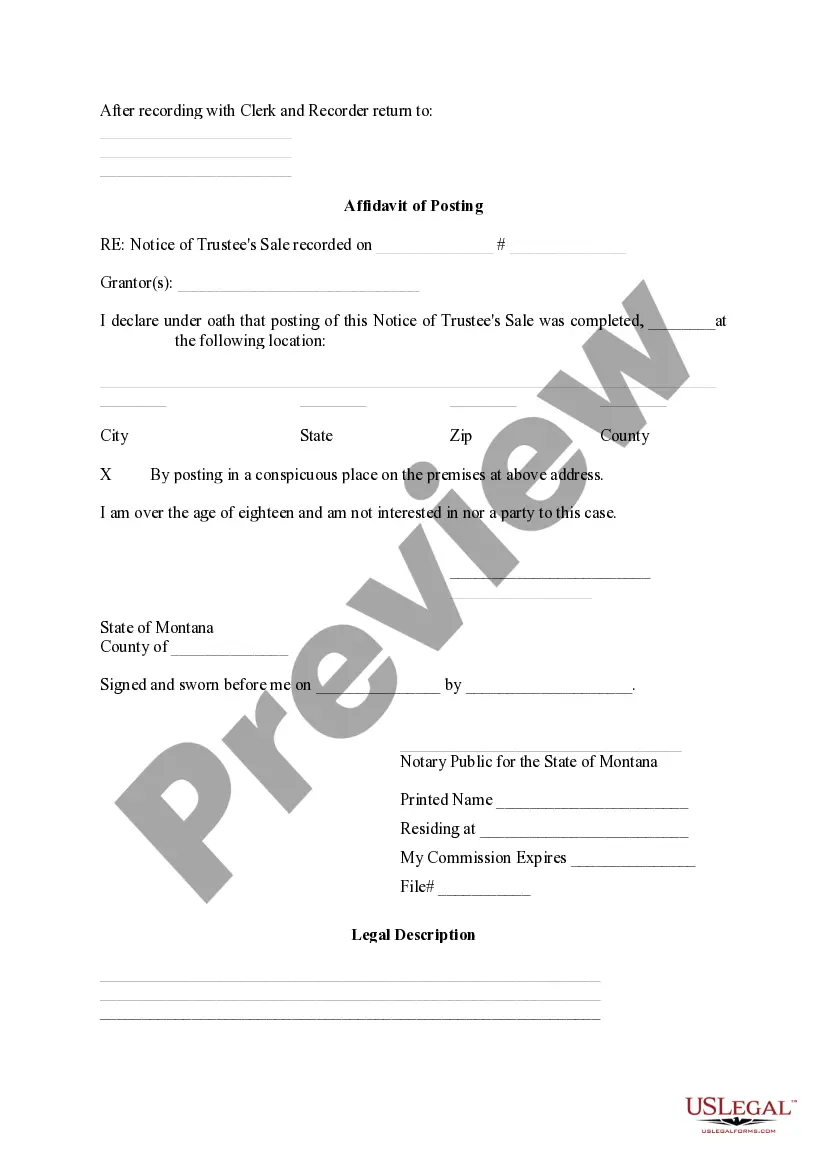

How to fill out Sample Of A Collection Letter To Small Business In Advance?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a range of legal form templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest editions of forms such as the Puerto Rico Sample of a Collection Letter to Small Business in Advance within minutes.

If you currently hold a monthly subscription, Log In and retrieve the Puerto Rico Sample of a Collection Letter to Small Business in Advance from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make changes. Fill out, edit, print, and sign the saved Puerto Rico Sample of a Collection Letter to Small Business in Advance.

Each template saved in your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- Ensure you have selected the correct form for your specific town/county.

- Click the Review button to examine the form's details.

- Check the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

The format of a collection letter should be professional and straightforward. Begin with your company's contact information, followed by the date, and the debtor’s information. Use clear headings for important sections like 'Outstanding Balance' and close with a polite request for payment. Utilizing a Puerto Rico Sample of a Collection Letter to Small Business in Advance can guide you in structuring your message effectively.

A collection letter must include specific details to ensure clarity and action. Start with the date, recipient's name, and address to personalize the communication. Clearly state the purpose of the letter, outline the amount owed, and provide a deadline for payment. Including a Puerto Rico Sample of a Collection Letter to Small Business in Advance can serve as a helpful reference for creating effective letters.

The 777 rule is a guideline that suggests sending seven collection notices over a seven-week period before escalating the matter. This approach allows you to communicate your intent effectively while giving the debtor a reasonable timeline to respond. Utilizing a Puerto Rico Sample of a Collection Letter to Small Business in Advance can aid in drafting these notices professionally, maximizing your chances of debt recovery. Consistency is key when managing collections.

Yes, you can face legal issues if you send someone to collections improperly. However, if you follow the proper guidelines and use a Puerto Rico Sample of a Collection Letter to Small Business in Advance, you reduce the risk of legal repercussions. This letter ensures that you communicate clearly and respectfully, which can protect your business interests. Always ensure compliance with relevant laws to safeguard against potential lawsuits.

An example of a collection notice includes a formal letter detailing the outstanding amount, the original due date, and the consequences of non-payment. This notice often prompts the debtor to take action by paying the debt. For a tailored approach, use a Puerto Rico Sample of a Collection Letter to Small Business in Advance, which outlines all necessary information in a professional format. Such letters increase the likelihood of receiving payment.

To send someone to collections in a small business, first, contact the customer and attempt to resolve the payment issue directly. If that does not work, document all communications and then consider using a professional collection agency. You can also prepare a Puerto Rico Sample of a Collection Letter to Small Business in Advance to formally request the payment. This letter serves as clear evidence of your attempt to collect the debt.

When writing a letter requesting proof of debt, begin with your details and the specific debt you are inquiring about. Clearly ask for verification, specifying what documentation you need. Maintain a courteous tone, as this sets the stage for constructive communication. A Puerto Rico Sample of a Collection Letter to Small Business in Advance can also provide a solid reference for your letter.

Writing an appeal letter for debt collection involves clearly stating your request for reconsideration of the debt. Start by including your information and the reason for your appeal. Offer any supporting documentation if available, and propose a reasonable alternative if applicable. Utilizing a Puerto Rico Sample of a Collection Letter to Small Business in Advance can aid in crafting a well-articulated letter.

A nice collection letter includes a friendly introduction, straightforward details about the debt, and a constructive tone. It reassures the debtor that you are willing to help them find a solution. For an effective example, refer to a Puerto Rico Sample of a Collection Letter to Small Business in Advance, which showcases a positive approach while maintaining professionalism.

The structure of a collection letter typically includes an introduction, body, and closing. Start with a polite greeting, then outline the debt details in the body, including the amount owed and payment deadlines. Finally, close with a call to action, encouraging the recipient to contact you or make a payment. Referencing a Puerto Rico Sample of a Collection Letter to Small Business in Advance will help ensure that all essential elements are included.