Alabama Transfer of Property under the Uniform Transfers to Minors Act

Description

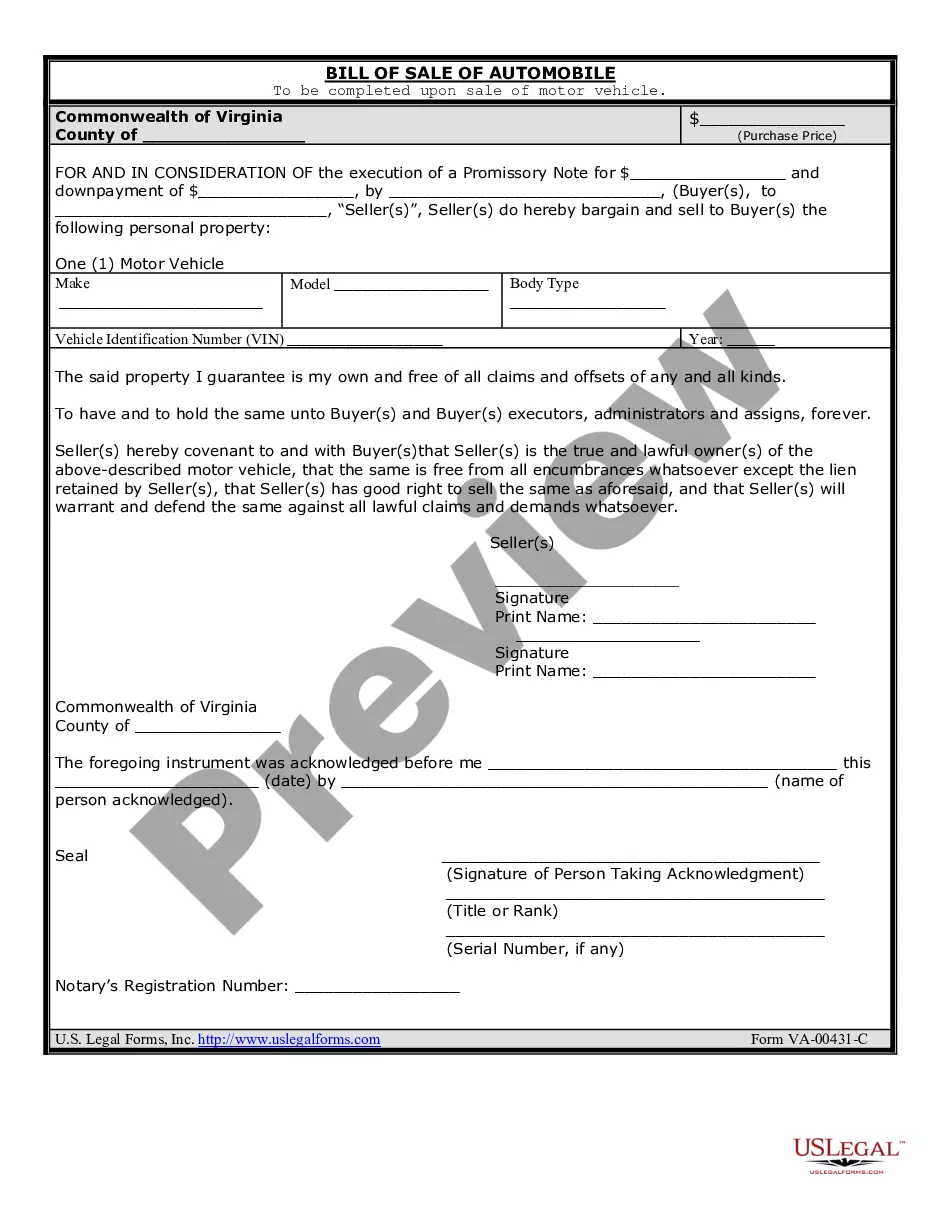

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Have you been in a position that you need to have files for possibly business or specific uses virtually every time? There are tons of lawful document layouts available online, but locating types you can rely on is not effortless. US Legal Forms delivers a huge number of type layouts, much like the Alabama Transfer of Property under the Uniform Transfers to Minors Act, which can be created to meet federal and state demands.

In case you are already acquainted with US Legal Forms web site and have an account, simply log in. Following that, it is possible to obtain the Alabama Transfer of Property under the Uniform Transfers to Minors Act template.

Unless you provide an profile and wish to begin to use US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for your right area/state.

- Take advantage of the Preview button to examine the form.

- Browse the description to actually have selected the proper type.

- If the type is not what you`re searching for, utilize the Lookup discipline to get the type that meets your requirements and demands.

- When you get the right type, just click Buy now.

- Opt for the pricing prepare you need, fill in the necessary information to produce your account, and purchase the order with your PayPal or bank card.

- Select a convenient paper structure and obtain your copy.

Find each of the document layouts you might have purchased in the My Forms food selection. You may get a more copy of Alabama Transfer of Property under the Uniform Transfers to Minors Act anytime, if needed. Just go through the necessary type to obtain or print out the document template.

Use US Legal Forms, probably the most extensive selection of lawful forms, to save lots of efforts and steer clear of blunders. The support delivers appropriately made lawful document layouts which you can use for a selection of uses. Generate an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

The Uniform Gifts to Minors Act (UGMA) allows individuals to give or transfer assets to underage beneficiaries. The act, which was developed in 1956 and revised in 1966, is commonly used to transfer assets from parents to their children.

The Uniform Transfers To Minors Act (UTMA) is a uniform act drafted and recommended by the National Conference of Commissioners on Uniform State Laws in 1986, and subsequently enacted by all U.S. States, which provides a mechanism under which gifts can be made to a minor without requiring the presence of an appointed ...

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.

UTMA allows the property to be gifted to a minor without establishing a formal trust. The donor or a custodian manages the property for the minor's benefit until the minor reaches a certain age. Once the child reaches a specified age set by the state, the child will have full control over the property.

The UTMA allows the donor to name a custodian, who has the fiduciary duty to manage and invest the property on behalf of the minor until that minor becomes of legal age.

The term Uniform Transfers to Minors Act (UTMA) refers to a law that allows a minor to receive gifts without the aid of a guardian or trustee. Gifts can include money, patents, royalties, real estate, and fine art.

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.