Puerto Rico Daily Cash Report

Description

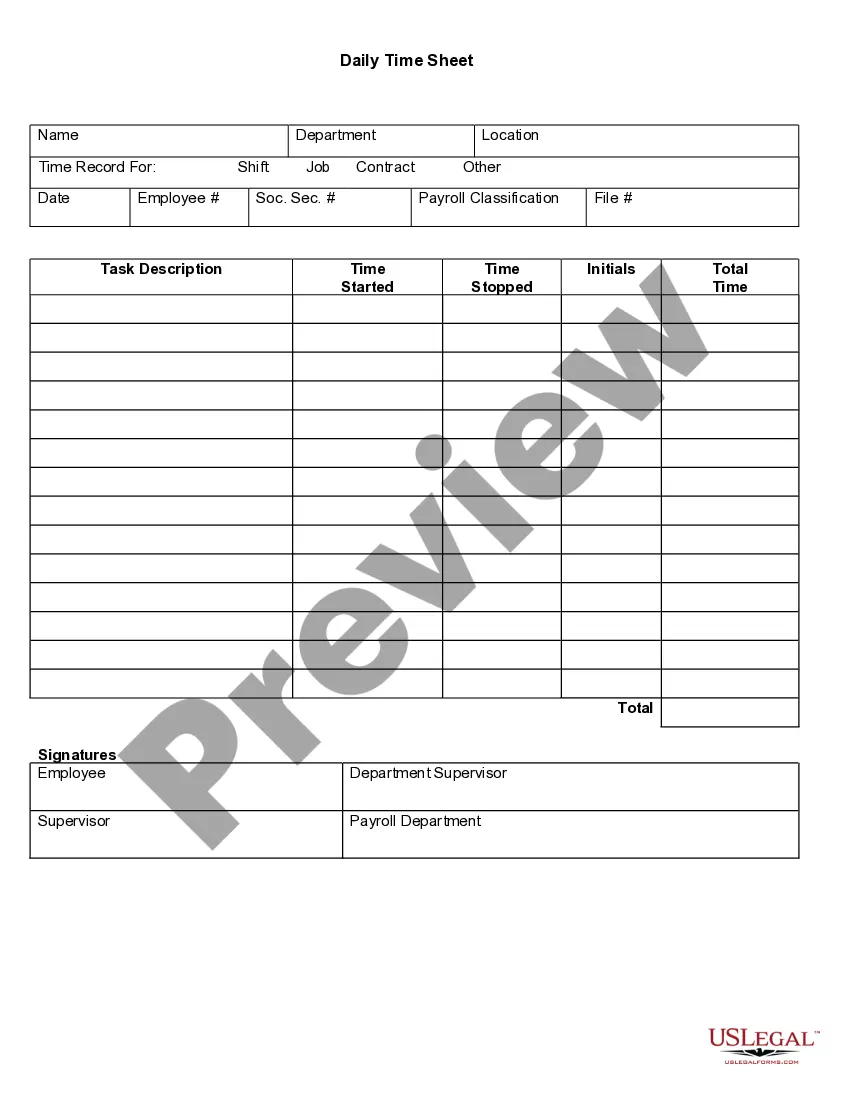

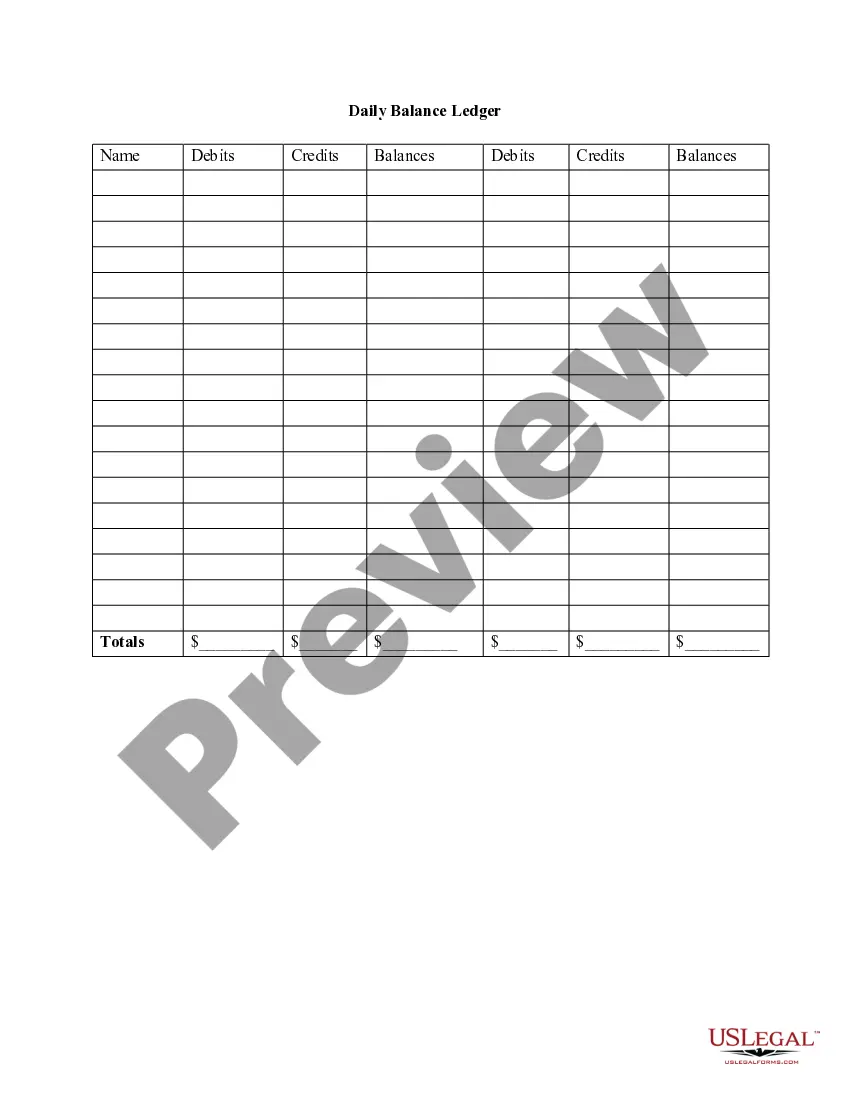

How to fill out Daily Cash Report?

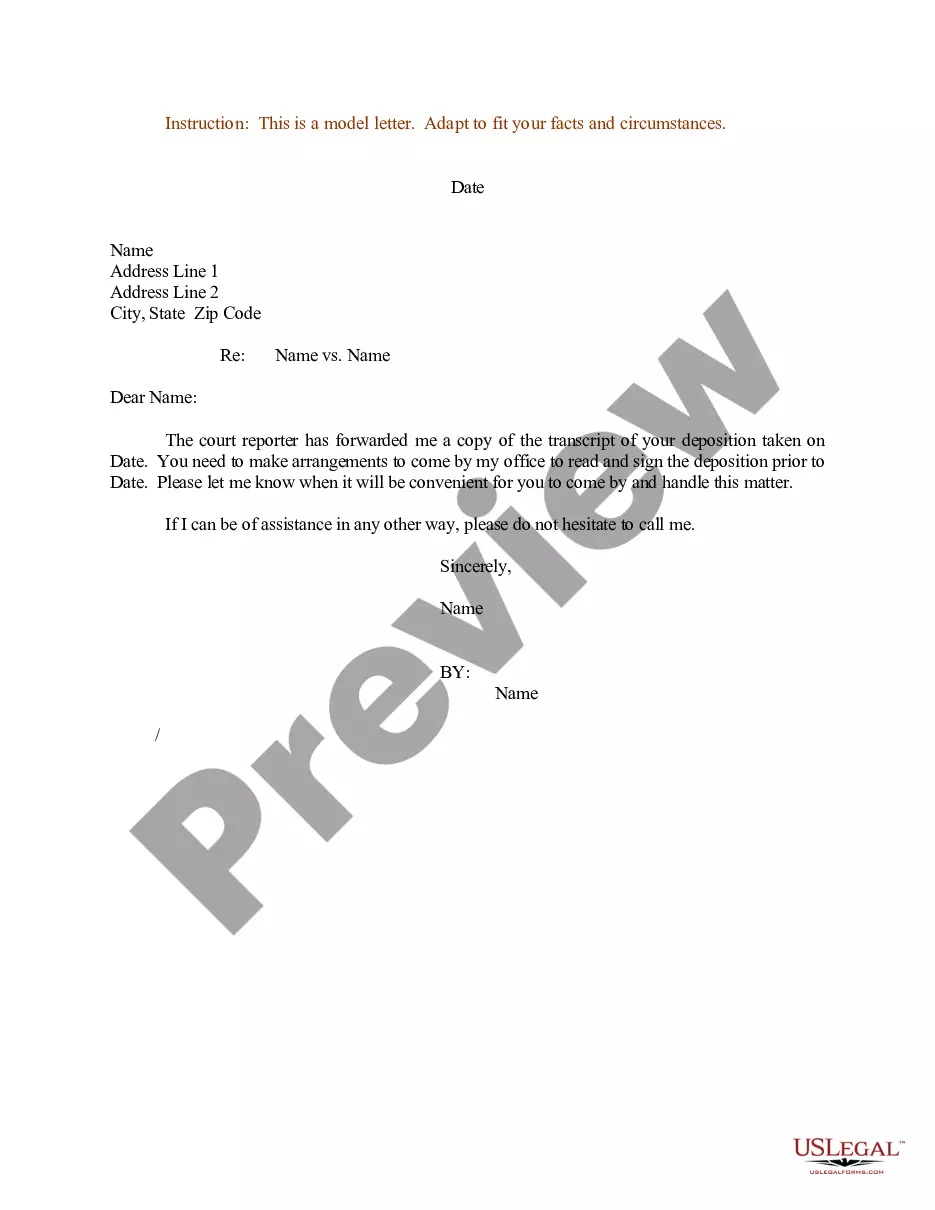

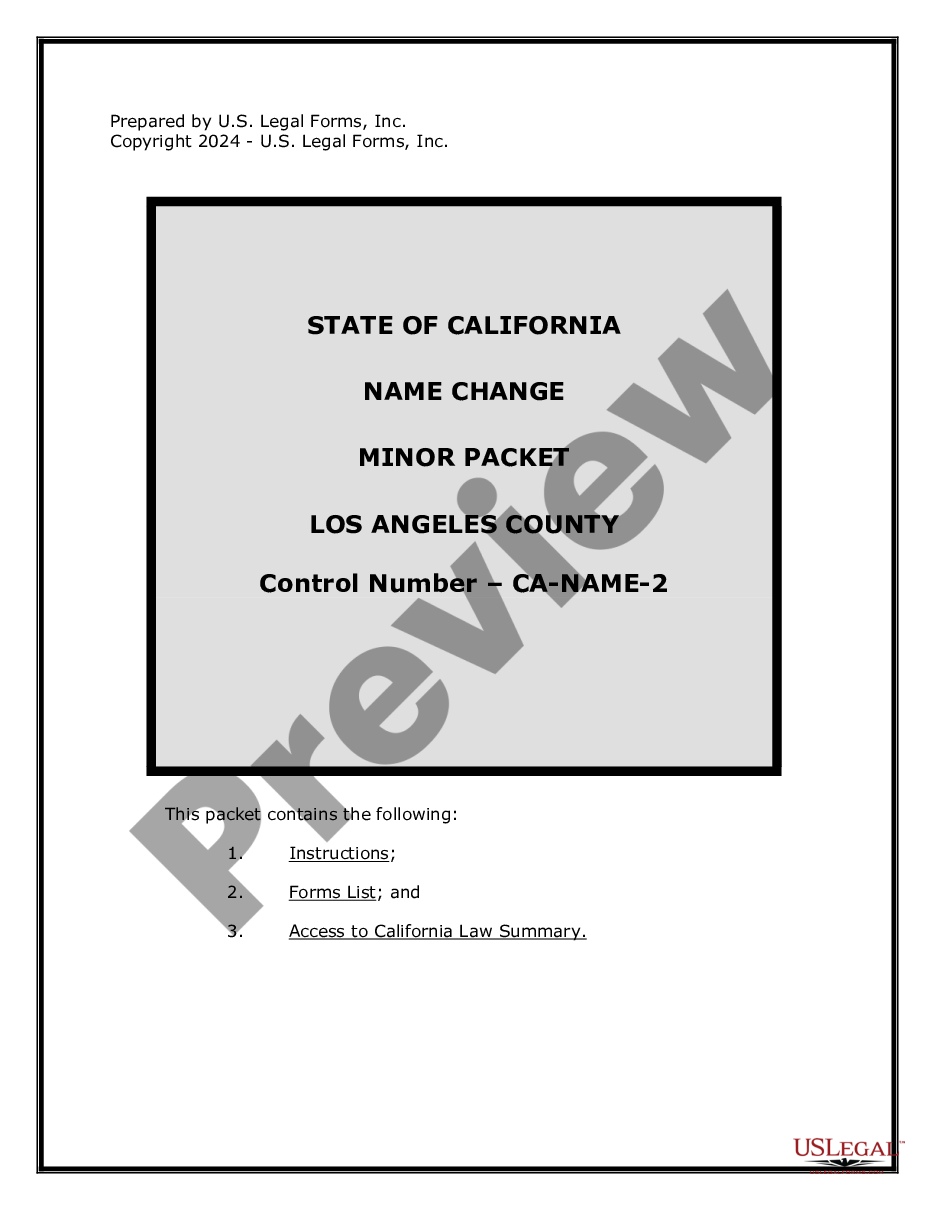

Selecting the appropriate certified document format can be rather challenging. Naturally, there are numerous templates available online, but how do you obtain the certified form you desire? Utilize the US Legal Forms website. The platform provides a vast array of templates, such as the Puerto Rico Daily Cash Report, which you may use for both business and personal purposes.

All forms are reviewed by professionals and comply with federal and state regulations. If you are already registered, Log In to your account and click on the Download button to access the Puerto Rico Daily Cash Report. Use your account to browse the certified forms you have previously ordered. Go to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are some straightforward steps for you to follow: Firstly, ensure you have chosen the correct form for your respective city/state. You can review the form using the Review option and examine the form details to confirm that it suits your needs. If the form does not meet your requirements, utilize the Search field to find the appropriate form.

Utilize the service to acquire professionally crafted documents that comply with state requirements.

- When you are certain the form is correct, click on the Get now button to retrieve the form.

- Select the pricing plan you want and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the certified document format to your device.

- Fill out, modify, print, and sign the retrieved Puerto Rico Daily Cash Report.

- US Legal Forms is the largest collection of certified forms where you can access various document templates.

Form popularity

FAQ

Federal law requires a person to report cash transactions of more than $10,000 to the IRS.

Since you cannot prepare and file or e-File a Puerto Rico Tax Return on eFile.com or anywhere online, you can contact the Puerto Rico Department of the Treasury for information on how to do this.

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business.

If you are a bona fide resident of Puerto Rico during the entire tax year, you'll file the following returns:A Puerto Rico tax return (Form 482) reporting your worldwide income.A U.S. tax return (Form 1040) reporting your worldwide income. However, this 1040 will exclude your Puerto Rico income.

TurboTax does not support Puerto Tax returns.

Yes, since you are a Puerto Rico resident, you must file the Puerto Rico income tax return reporting all your earnings, and you may claim a credit in such return for any income taxes paid to the United States.

Federal law states that all cash payments in excess of 200b$10,000200b must be reported to the IRS. This applies to the businesses accepting the cash and to the financial institutions receiving it for deposit. These laws exist to help the government prevent terrorist activities and other financial crimes.

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300 PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business.

Residents of Puerto Rico who aren't required to file a U.S. income tax return must file Form 1040-SS or Form 1040-PR with the United States to report self-employment income and if necessary, pay self-employment tax.

Each person who is engaged in a trade or business that, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file Form 8300.