Puerto Rico Software Support Agreement

Description

Software is often divided into two categories: Systems Software includes the operating system and all the utilities that enable the computer to function; and Applications Software includes programs that do real work for users (e.g., word processors, spreadsheets, and database management systems).

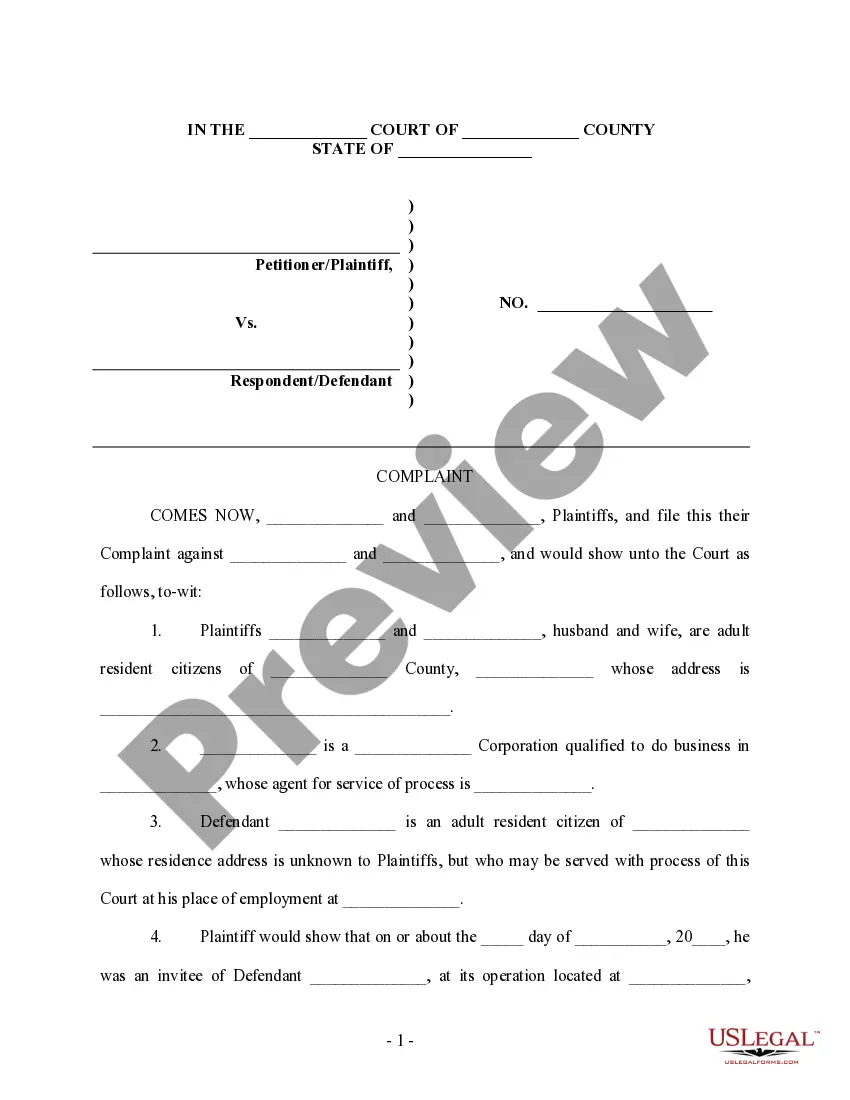

How to fill out Software Support Agreement?

If you desire to finish, retrieve, or create valid document designs, utilize US Legal Forms, the finest collection of legal forms, which can be accessed online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

A selection of templates for commercial and personal uses is sorted by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Check the My documents section and select a form to print or download again.

Complete and download, and print the Puerto Rico Software Support Agreement with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Puerto Rico Software Support Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Puerto Rico Software Support Agreement.

- You can also retrieve forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to look for other forms in the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Puerto Rico Software Support Agreement.

Form popularity

FAQ

The equivalent of a 1099 in Puerto Rico is known as Form 480.6, which reports services provided to a payee. This form is critical for both tax reporting and compliance purposes. When drafting your Puerto Rico Software Support Agreement, keeping this reporting requirement in mind will help maintain transparency and accountability.

Form 480.6 C is used in Puerto Rico to report income derived from services rendered, particularly for those who are self-employed or receive compensation under certain contracts. It plays an important role in tax compliance for businesses operating within Puerto Rico. Ensuring your Puerto Rico Software Support Agreement acknowledges these forms will streamline financial reporting.

Residents of Puerto Rico generally do not need to file US federal tax returns unless they meet specific income thresholds or have other factors that require reporting. However, they must file a local income tax return in Puerto Rico. When preparing your Puerto Rico Software Support Agreement, it is important to clarify the tax obligations to avoid duplication or confusion.

Rule 60, often associated with Puerto Rico's Civil Procedure Rules, pertains to the relief from judgments or orders. It allows parties to seek amendments under specific circumstances, providing an avenue for correction. Integrating this understanding into your Puerto Rico Software Support Agreement can ensure that all legal bases are covered should future disputes arise.

The nexus threshold in Puerto Rico is determined by various factors including sales, property, and payroll amounts within the jurisdiction. Businesses must evaluate their activities to understand their tax obligations. When drafting a Puerto Rico Software Support Agreement, acknowledging the nexus threshold can protect you from unexpected tax liabilities.

In Puerto Rico, the limit for qualified retirement plans is similar to federal limits but may include specific adjustments. Employers and employees should be aware of these limits when structuring their retirement plans, which can impact financial planning. Consulting our legal forms can help you design a Puerto Rico Software Support Agreement that respects these limits.

Nexus for Puerto Rico income tax is established when an individual or business has a significant presence in Puerto Rico, which could include office locations or employees working on the island. This presence triggers tax responsibilities under local tax laws. If you are creating a Puerto Rico Software Support Agreement, it is essential to consider how nexus may impact the agreement's terms.

The nexus threshold refers to the level of business activity or presence that a company must have in a state, such as Puerto Rico, to be subject to local tax regulations. Understanding this concept is crucial when drafting a Puerto Rico Software Support Agreement, as it may affect compliance obligations and tax responsibilities. By using our services, you can ensure that your agreement aligns with the current nexus laws.