Puerto Rico Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

Have you ever been in a situation where you require documents for various organizations or specific purposes almost every day? There are numerous legal document templates available online, but locating versions you can trust is not simple.

US Legal Forms provides thousands of document templates, including the Puerto Rico Sample Letter for Explanation of Insurance Rate Increase, which can be tailored to comply with federal and state regulations.

If you are already familiar with the US Legal Forms site and have an account, simply Log In. Then, you can download the Puerto Rico Sample Letter for Explanation of Insurance Rate Increase template.

- Find the document you need and ensure it is for the appropriate city/state.

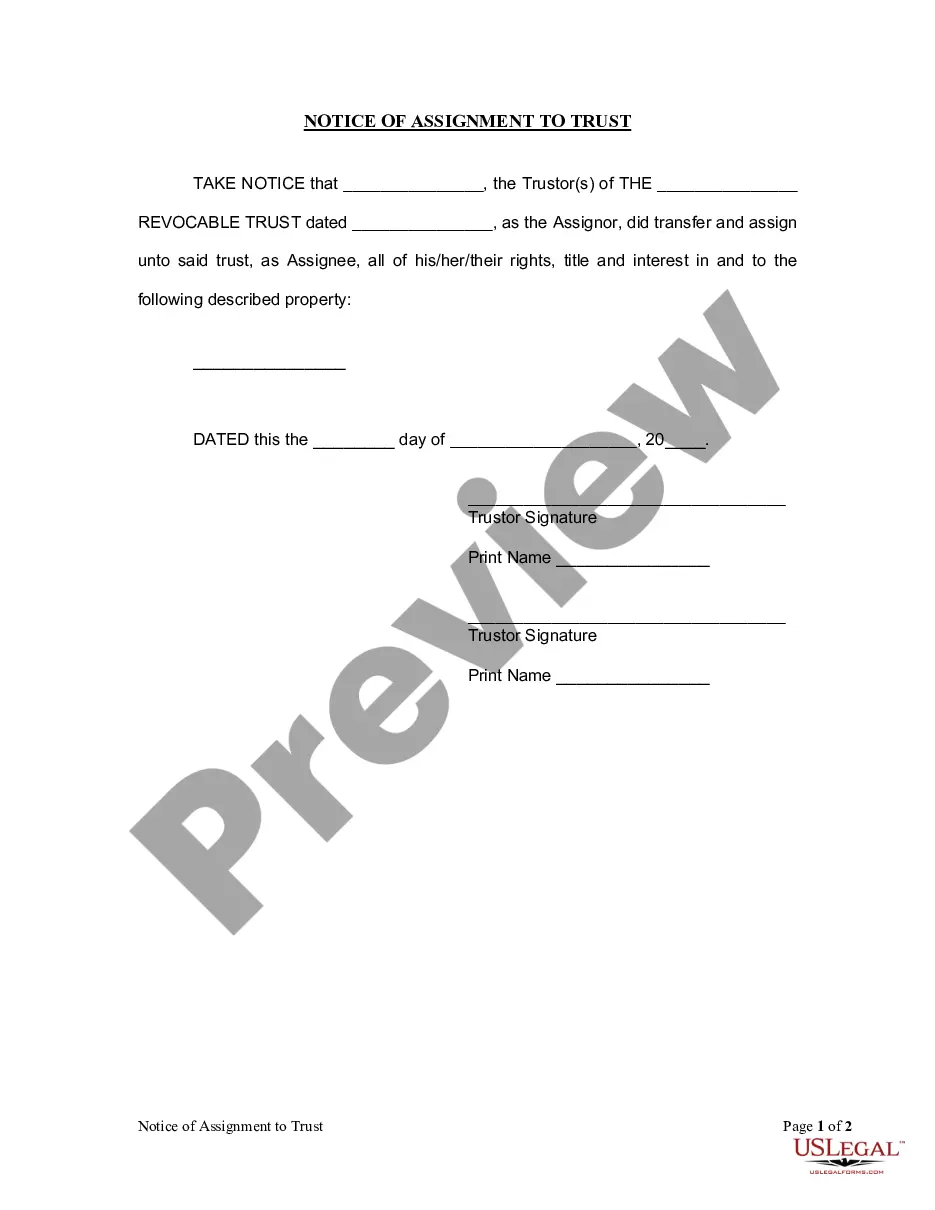

- Utilize the Review option to examine the form.

- Read the description to confirm that you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the template that suits your needs.

- Once you find the right document, click on Get now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using PayPal or a credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

When writing a letter to request a rate increase, start with a clear statement of purpose. Include relevant details, such as the reason for the request and any supporting documents that validate your case. To make the process easier, consider using a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase, which offers a structured format and ensures you cover all essential points. This can help convey your request professionally and effectively.

Yes, there is a 10% withholding rate that applies to certain types of income in Puerto Rico. This can affect wages and other earnings, impacting overall financial planning. If you are dealing with an insurance rate increase, utilizing a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase can help you clarify these deductions and their effects on your budget.

Yes, there are situations in Puerto Rico where certain items may incur a 10.5% tax. This often applies to specific goods and services that are not covered by the general sales tax rate. When creating a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase, you may want to account for such tax rates to provide clarity on insurance-related costs.

The 7% typically refers to the sales tax rate in Puerto Rico. This tax is added to most goods and services, impacting purchasing decisions for residents and visitors alike. Understanding the financial implications can be important, especially when drafting a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase that may include related expenses.

In Puerto Rico, grade levels range from kindergarten to 12th grade. The educational system is divided into elementary, middle, and high school levels. Parents often seek resources, like a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase, to navigate school-related expenses and ensure that their children receive quality education.

To write an effective letter addressing a rate increase, start by clearly stating the purpose of your communication. Utilize the Puerto Rico Sample Letter for Explanation of Insurance Rate Increase as a guide to include essential details about your current policy, the specifics of the increase, and your reasons for the inquiry. Make sure you maintain a professional tone while expressing your concerns, and provide any necessary documentation to support your case. This approach helps ensure that your letter is taken seriously and opens the door for a productive discussion with your insurance provider.

The minimum liability insurance requirement in Puerto Rico ensures that all drivers maintain a basic level of coverage for damages in case of an accident. Currently, the law mandates specific limits, which help protect both drivers and pedestrians. If your rates feel high compared to these minimums, consider drafting a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase to clarify the situation.

Chapter 61 of the Puerto Rico Insurance Code outlines regulations that govern the operations of insurance companies within the territory. It aims to promote consumer protection and ensure fair practices in the industry. If you feel confused by an insurance rate hike, a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase can help you express your concerns directly to your insurer.

For tax purposes, you must reside in Puerto Rico for at least 183 days during the tax year to be considered a resident. This rule is beneficial for individuals seeking to take advantage of Puerto Rico's tax incentives. If you are negotiating insurance rates while navigating residency, a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase can clarify your financial concerns.

The hair law in Puerto Rico relates to consumer rights concerning the insurance market, particularly in terms of unbundled services and potential additional charges. It's designed to ensure that consumers receive fair treatment and transparency from their insurers. If you need to challenge a rate increase, consider leveraging a Puerto Rico Sample Letter for Explanation of Insurance Rate Increase to formalize your appeal.