Puerto Rico General Form of Receipt

Description

How to fill out General Form Of Receipt?

Have you found yourself in a situation where you require documents for both professional or personal reasons almost all the time.

There are numerous legitimate form templates accessible online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers a vast array of form templates, such as the Puerto Rico General Form of Receipt, that are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive range of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess your account, simply Log In.

- Then, you can download the Puerto Rico General Form of Receipt template.

- In case you do not have an account and wish to start using US Legal Forms, follow these instructions.

- 1. Locate the form you require and verify that it corresponds to your specific city/state.

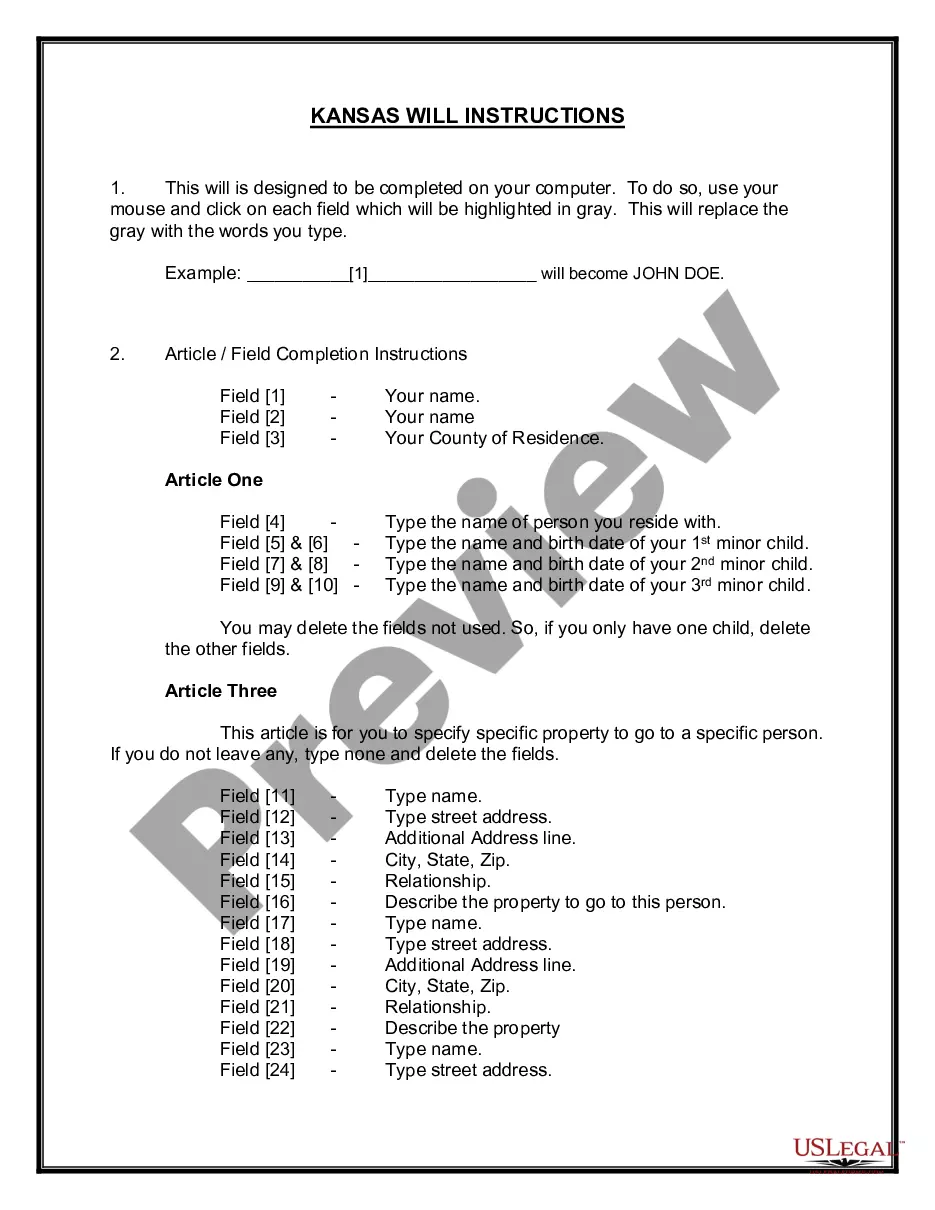

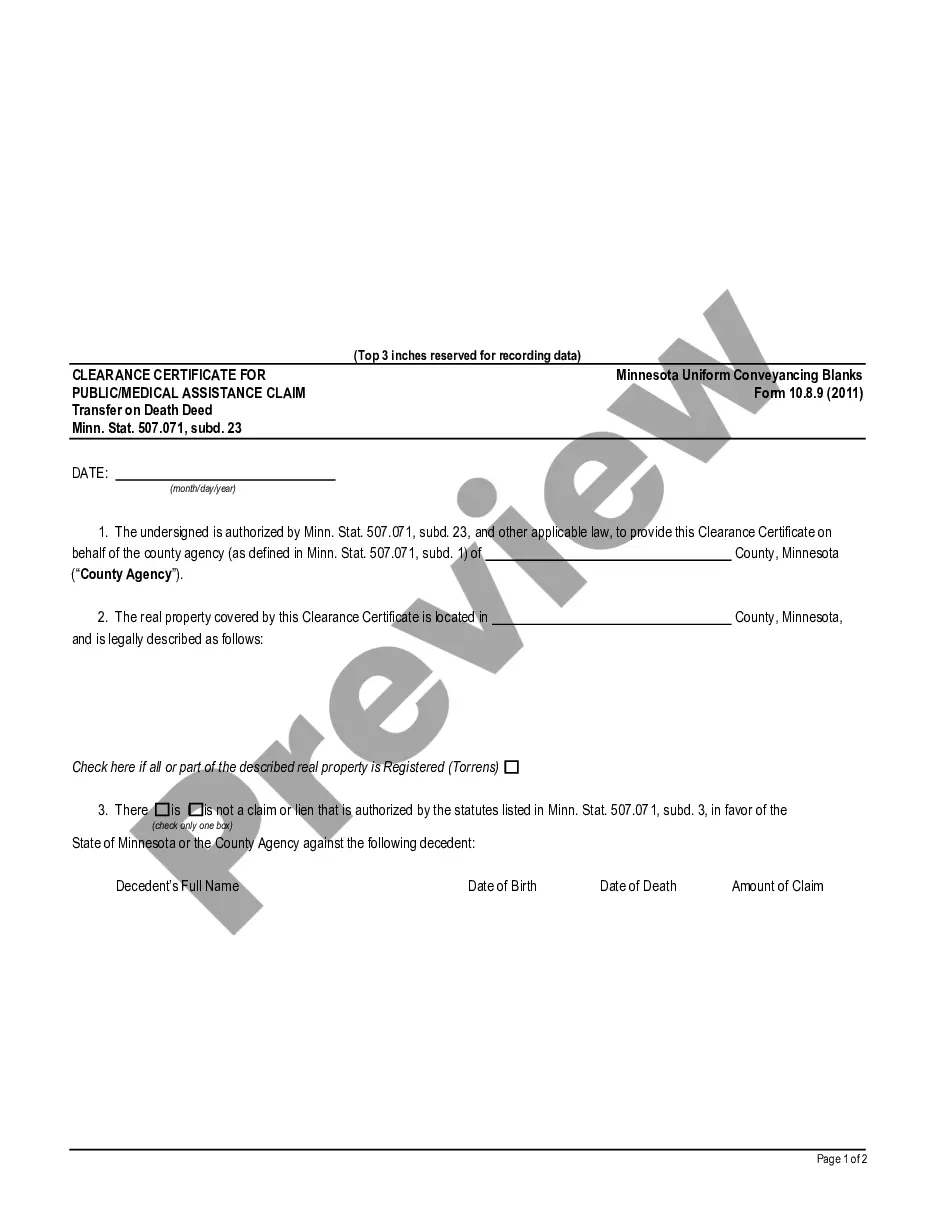

- 2. Use the Review option to examine the form.

- 3. Read the description to confirm that you have chosen the correct form.

- 4. If the form isn’t what you’re looking for, utilize the Search feature to find the form that fulfills your requirements.

- 5. Once you identify the appropriate form, click Get now.

- 6. Select the pricing plan you prefer, complete the requested details to set up your account, and process the payment using your PayPal or credit card.

- 7. Choose a convenient document format and download your copy.

- 8. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Puerto Rico General Form of Receipt at any time if necessary. Just click the required form to obtain or print the document template.

Form popularity

FAQ

To form a corporation in Puerto Rico, you must first choose a unique name for your business. Then, you need to file the Puerto Rico General Form of Receipt with the Department of State, which includes essential information about your corporation. After the initial paperwork is approved, you should obtain the necessary permits and licenses for operation. Consider using a reliable platform like US Legal Forms to streamline this process, as they provide easy access to required forms and helpful guidance.

To file a Puerto Rico sales tax return, you need to gather relevant sales data and complete the necessary documentation, including the Puerto Rico General Form of Receipt. You may submit this form through the Suri portal, where you can also track your submission status. Utilizing the online process simplifies the filing experience, allowing you to focus on growing your business while ensuring you meet your tax responsibilities. For detailed assistance, you can explore resources on the UsLegalForms platform.

Suri is an online portal developed by the Puerto Rico Department of Treasury. This platform allows taxpayers to manage their tax-related tasks, including submitting the Puerto Rico General Form of Receipt. By using Suri, individuals and businesses can streamline their tax processes, ensuring compliance while saving time and resources. You can easily access this user-friendly interface to navigate your tax obligations effortlessly.

Puerto Rico is considered a US territory, and residency in Puerto Rico is recognized for certain legal purposes. However, tax obligations may differ from those in the continental United States. Having the Puerto Rico General Form of Receipt can clarify your status and aid in understanding residency implications.

Whether you need to file a federal tax return from Puerto Rico depends on your individual situation. Generally, if you are a resident and meet specific income thresholds, you may be required to file. The Puerto Rico General Form of Receipt can help you keep track of your income and expenses, aiding in your federal filing obligations.

Yes, Puerto Rico is a US territory, which means it operates under US laws in many respects. However, it has its own tax system. This unique status may affect how forms like the Puerto Rico General Form of Receipt are handled.

Residents of Puerto Rico who earn a certain amount of income must file a Puerto Rico tax return. Both individuals and entities may have this obligation. Understanding your requirements, along with the relevant Puerto Rico General Form of Receipt, ensures compliance with local tax laws.

To download an e-filing receipt, simply log into your tax account on the designated platform. Look for the section that deals with submitted forms and select the appropriate year. By managing your documents effectively, the Puerto Rico General Form of Receipt can help streamline this process.

Puerto Rico form 482 pertains to the declaration of the actual tax withheld on rental payments. This form captures relevant information regarding the payment and tax obligations. With a Puerto Rico General Form of Receipt, you ensure that you have a record of these transactions for your tax filings.

Form 480.6 C is a document used in Puerto Rico for reporting services. It involves reporting income subjected to withholding taxes. When you receive a Puerto Rico General Form of Receipt, it helps you understand the transactions and taxes involved.