Puerto Rico Simple Receipt to Seller from Buyer

Description

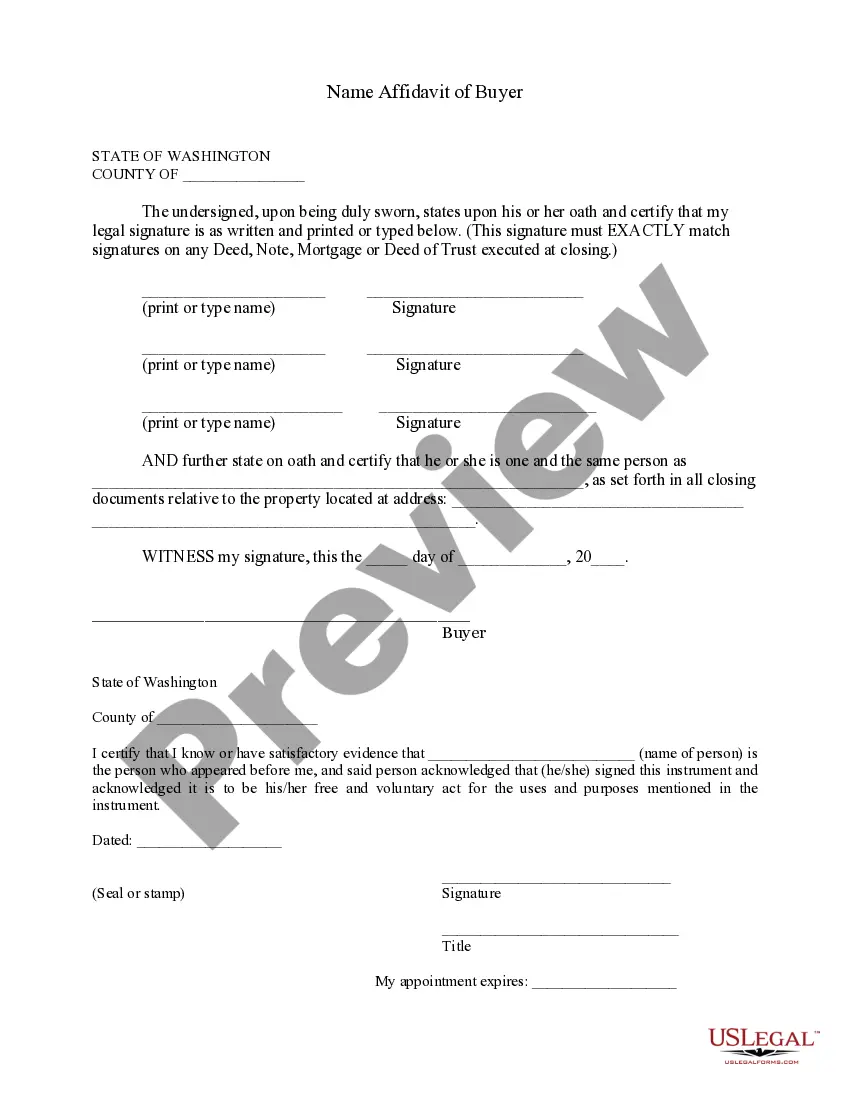

How to fill out Simple Receipt To Seller From Buyer?

You can dedicate significant time online looking for the legal documents template that satisfies the state and federal requirements you need.

US Legal Forms provides a vast collection of legal forms which can be assessed by experts.

You can conveniently download or print the Puerto Rico Simple Receipt to Seller from Buyer from their service.

If you wish to find another version of the form, use the Search box to locate the template that fits your requirements.

- If you have a US Legal Forms account, you can Log In and press the Download button.

- Then, you can complete, amend, print, or sign the Puerto Rico Simple Receipt to Seller from Buyer.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents section and click the relevant button.

- If you're accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure you've chosen the correct document template for the county/region you select.

- Check the form description to confirm you have selected the right one.

Form popularity

FAQ

Non-residents selling property in Puerto Rico are subject to a 15% tax on the gain derived from the sale. It's important to understand this tax requirement when planning your transaction. Utilizing platforms like uslegalforms can help you prepare the necessary documentation, including the Puerto Rico Simple Receipt to Seller from Buyer, ensuring you remain compliant.

Puerto Rico has a sales and use tax.

So, if you live in the US and you operate a business that you hold through a Puerto Rican corporation, that Puerto Rican corporation is ETBUS and therefore subject to US tax (at a very high rate) on at least a portion of its income.

The announcement is related to Act 22, which seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income once an individual becomes a resident of Puerto Rico.

Act 22 seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all interest and dividends realized after the individual becomes a bona fide resident of Puerto Rico.

Puerto Rico has a statewide sales tax rate of 10.5%, which has been in place since 2006. Municipal governments in Puerto Rico are also allowed to collect a local-option sales tax that ranges from 1% to 1% across the state, with an average local tax of 1% (for a total of 11.5% when combined with the state sales tax).

If a service for export business qualifies for the tax benefits under Chapter 3 of the Incentives Act, the net income stemming from the business is subject to a 4% Puerto Rican corporate tax. Further, distributions from earnings and profits is not subject to Puerto Rican income tax.

Puerto Rico established in January of 2021 that businesses making more than $100,000 in total gross sales or at least 200 transactions in Puerto Rico annually are required to register with the Puerto Rico Department of Treasury and collect and remit Puerto Rico sales tax.

Act 22, or the Individual Investors Act, targets high net worth investors with the promise of 0% tax on interest, dividends, and capital gains obtained while residing in Puerto Rico as a bona fide resident.

Further, Resident Individuals must apply for and obtain a tax exemption decree under Act 60. To obtain access to the approved and signed tax exemption decree, a one-time fee of $5,000 must be satisfied and deposited into a special fund to promote the relocation of Resident Individuals to Puerto Rico.