Puerto Rico Charitable Remainder Inter Vivos Annuity Trust

Description

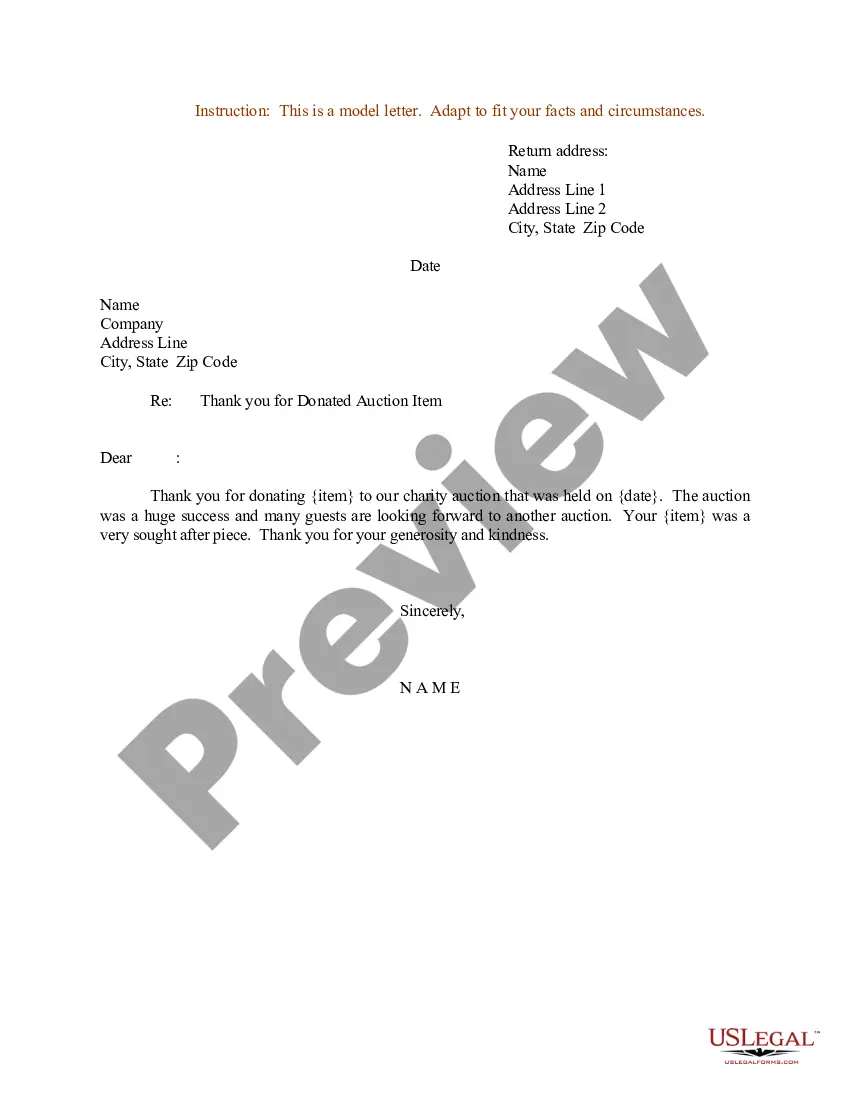

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

Selecting the correct legal document format can be challenging.

There is no doubt that numerous templates are accessible online, but how do you find the legal type that you require.

Take advantage of the US Legal Forms platform. The services provide a vast array of templates, including the Puerto Rico Charitable Remainder Inter Vivos Annuity Trust, which you can utilize for both business and personal purposes.

You can review the form using the Review button and examine the form details to make sure it is suitable for you.

- Each of the templates is reviewed by experts and complies with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Download button to retrieve the Puerto Rico Charitable Remainder Inter Vivos Annuity Trust.

- Use your account to search through the legal templates you have previously purchased.

- Navigate to the My documents tab of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your region/state.

Form popularity

FAQ

Creating a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust involves several key steps. First, you need to determine the assets that you want to place into the trust. Then, draft a trust document outlining the terms and conditions of the trust, including the beneficiaries and the annuity payments. Finally, you'll need to fund the trust and ensure it complies with Puerto Rican laws, which is where platforms like US Legal Forms can assist you in streamlining the process to ensure compliance and ease of use.

While a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust offers numerous benefits, there are potential pitfalls to consider. One major risk is the possibility of paying capital gains tax upon the sale of assets within the trust. Furthermore, once you set up the trust, you cannot easily alter its terms without legal assistance, which can limit your flexibility over time. It’s essential to weigh these factors carefully before moving forward.

The primary difference lies in their structure and flexibility. A charitable gift annuity provides fixed payments for life to the donor, while a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust allows the donor to receive income for a specified term, with the remainder going to charity. Additionally, the trust can accommodate multiple beneficiaries and varying asset types, offering greater customization.

Yes, you can add assets to a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust after it has been established. This flexibility allows you to continue supporting charitable causes while adapting to your financial situation. However, it’s advisable to consult with a legal expert to ensure the trust retains its benefits and complies with relevant regulations.

Creating a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust involves several key steps. First, you must determine your assets and decide how you want to distribute income. Next, consult with a legal advisor to draft the trust document, ensuring compliance with Puerto Rico laws and IRS regulations. Finally, fund your trust by transferring assets, making sure to accurately file any necessary paperwork.

A common misconception about Puerto Rico Charitable Remainder Inter Vivos Annuity Trusts is that they provide immediate tax deductions comparable to other charitable contributions. While they do offer tax advantages, the immediate deduction is not one of them. It's important to understand that the benefits include income for a specified period and charitable giving, but not always the immediate tax break.

An inter vivos charitable remainder trust is established during the lifetime of the grantor, allowing them to retain income from the trust while benefiting a charity. This trust type offers tax advantages and funds a charitable purpose instead of waiting until after death. By setting up a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust, you can enjoy immediate benefits while ensuring a future charitable impact.

A charitable remainder trust (CRT) provides income to beneficiaries for a specified period, after which the remaining assets go to charity. In contrast, a charitable lead trust (CLT) pays income to charity first, with the remaining assets eventually going to the beneficiaries. Understanding these differences can help you select the right structure for your charitable intentions, especially when considering a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust.

Yes, you can include an annuity in a charitable remainder trust, specifically in a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust. This type of trust provides fixed periodic payments to the beneficiaries and ultimately benefits a chosen charity. By incorporating an annuity, you can achieve both income and charitable goals effectively.

Currently, Form 5227 cannot be filed electronically; it must be submitted in paper format. This requirement may seem inconvenient, but it ensures that the specific details of charity-focused trusts, such as a Puerto Rico Charitable Remainder Inter Vivos Annuity Trust, are accurately documented. You can find detailed filing instructions on the IRS website to guide you through the process.