A Unitrust refers to a trust from which a fixed percentage of the net fair market value of the trusts assets valued annually, is paid each year to a beneficiary. In these trusts, the donor transfers property to a trust after retaining the right to receive payments from the trust for a specified term. Once the term ends, the trust estate is paid to a public charity designated by the donor. During a unitrust's term, a trustee invests the unitrust's assets and pays a fixed percentage of the unitrust's current value, as determined annually, to the income beneficiaries. If the unitrust's value goes up, its payout increases proportionately. Likewise, if the unitrust's value goes down, the amount it distributes also declines. Payments must be at least five percent of the trust's annual value and are made out of trust income, or trust principal if income is not adequate.

Puerto Rico Charitable Remainder Unitrust

Description

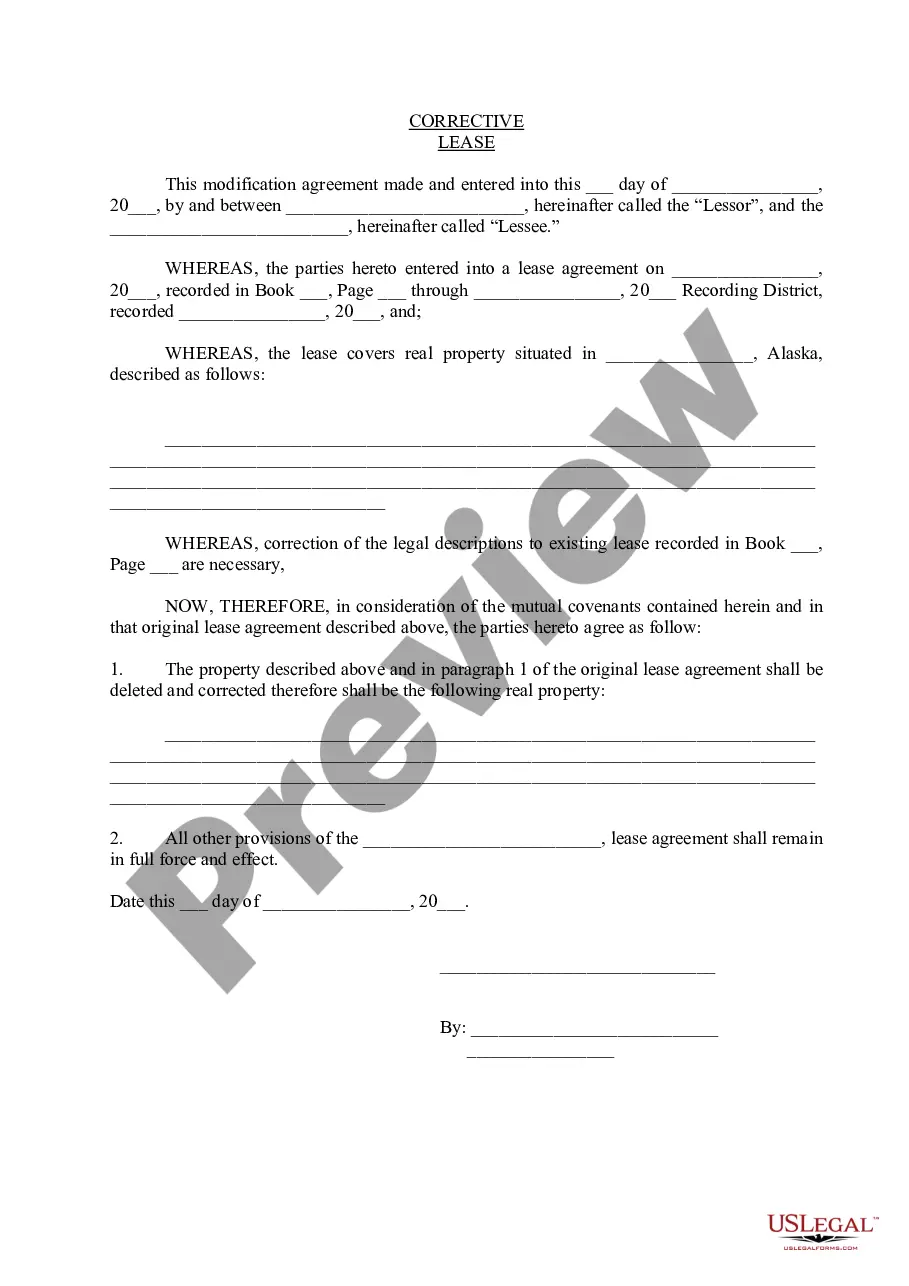

How to fill out Charitable Remainder Unitrust?

Locating the appropriate legal document template can be quite a challenge.

Clearly, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Puerto Rico Charitable Remainder Unitrust, which you can employ for personal and business purposes.

First, ensure that you have selected the correct form for your region/area. You can preview the form using the Review button and read the form description to confirm that it is suitable for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Puerto Rico Charitable Remainder Unitrust.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents tab of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

Disadvantages of CRT :Big back and take up space on a desk.Not suitable for very brightly environment because less bright than LCD.They are large, heavy and bulky.Consume a lot of electricity and also produce a lot of heat.Geometrical error at edges.Flickering at 50-80 Hz.Harmful DC and AC electric and magnetic fields.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

By the Charitable Strategies Group A Charitable Remainder Trust (CRT) is a gift of cash or other property to an irrevocable trust. The donor receives an income stream from the trust for a term of years or for life and the named charity receives the remaining trust assets at the end of the trust term.

While the estate owner may only have one beneficiary in mind when creating the charitable remainder unitrust, he or she does not have any limitations in how many recipients of trust payments exist. The number of trustors may remain restricted if also receiving income from the trust.

'Express trusts have been a part of the law of Puerto Rico since enactment of C§ 1-41 of the Act of April 23, 1928, No. 41, page 294. This Act was incorporated into the Civil Code of Puerto Rico by the final provisions of the Code, as amended April 28, 1930, No. 48, page 358, § 9.

Generally, the charitable deduction for contributions to a CRT with a public charity as its remainder beneficiary is limited to 50% of adjusted gross income (AGI).

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.