Puerto Rico Simple Partnership Agreement

Description

How to fill out Simple Partnership Agreement?

Have you found yourself in the situation where you require documents for either business or personal use almost every day.

There are countless legal document templates accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms offers a vast array of document templates, including the Puerto Rico Simple Partnership Agreement, designed to comply with both state and federal regulations.

Once you identify the correct document, click Buy now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and complete your purchase using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Afterward, you can download the Puerto Rico Simple Partnership Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is suitable for your specific city/region.

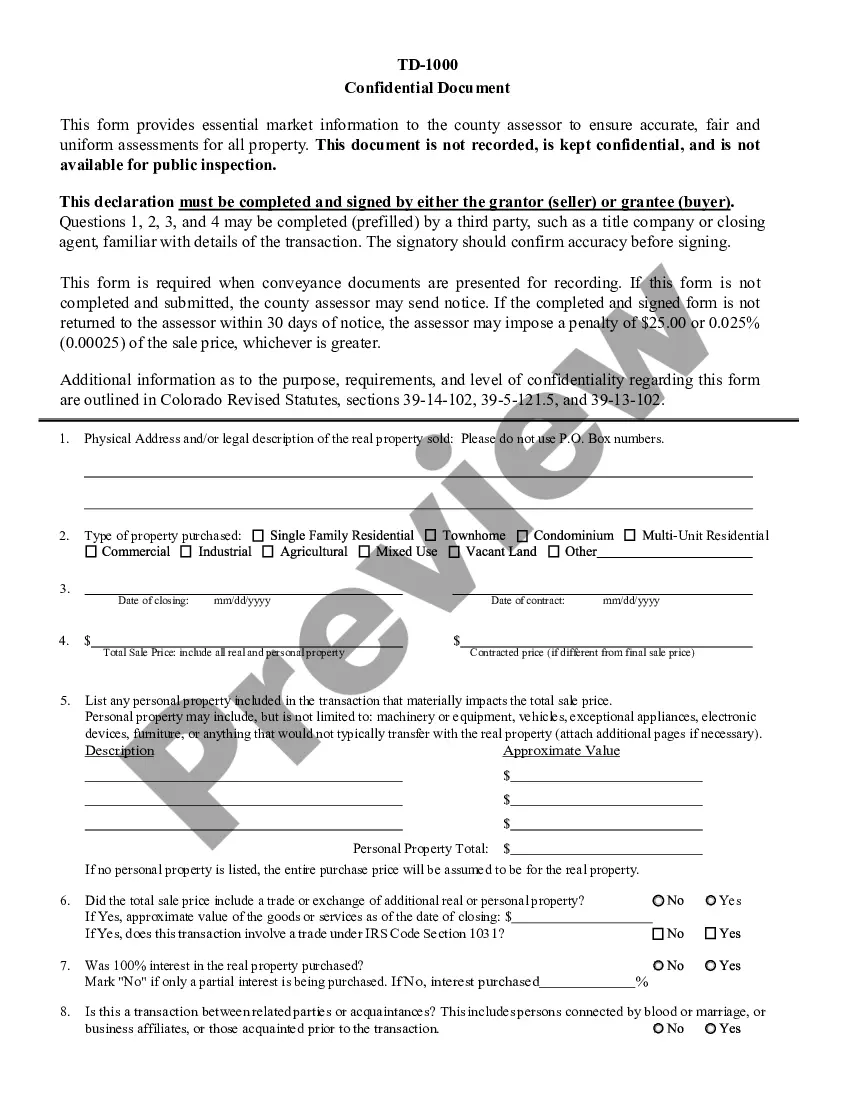

- Utilize the Review button to examine the form.

- Check the details to confirm you have chosen the correct document.

- If the document isn't what you are looking for, use the Search field to find the document that fits your requirements.

Form popularity

FAQ

Yes, if your partnership operates in Puerto Rico, you need to file federal income tax returns, depending on your unique situation. Partnerships typically report income, deductions, and credits on the partners' individual tax returns, using the information from the Puerto Rico Simple Partnership Agreement. This agreement plays a significant role in organizing your tax documents and ensuring accuracy.

Filing requirements for a partnership can vary by jurisdiction. Generally, partnerships in Puerto Rico must register their business name and file an income tax return as an entity. A Puerto Rico Simple Partnership Agreement can serve as a crucial tool for maintaining compliance and managing responsibilities.

In Puerto Rico, partnerships typically do not have a specific state form that must be filed at the start. However, once established, they must comply with local regulations, which might include filing an annual report. Creating a Puerto Rico Simple Partnership Agreement can help ensure you meet all necessary requirements.

While a partnership does not need to file a particular form to start, it needs to comply with local business registration requirements. In Puerto Rico, partners may need to file a Certificate of Partnership with the Department of State. A Puerto Rico Simple Partnership Agreement can simplify this process by clearly defining the partnership structure.

The primary document used to form a partnership is the partnership agreement. This agreement outlines each partner's roles, capital contributions, and distribution of profits. A well-crafted Puerto Rico Simple Partnership Agreement can prevent misunderstandings and protect your interests.

To form a partnership, you need at least two partners who agree to share the profits and losses of a business. It is essential to outline each partner’s contributions, responsibilities, and the partnership's purpose. A Puerto Rico Simple Partnership Agreement can formalize these details, providing clarity and ensuring a smooth operation.

In most cases, a partnership agreement does not need to be notarized to be legally binding. However, having it notarized can add an extra layer of authenticity and credibility. A Puerto Rico Simple Partnership Agreement can benefit from notarization, especially if the details are crucial to your partnership, as it can help establish trust and commitment among partners.

A general partnership often operates without a formal written agreement, relying instead on the state’s default rules. However, this approach can lead to disagreements among partners because expectations are not explicitly defined. To prevent misunderstandings and safeguard your partnership's interests, consider establishing a Puerto Rico Simple Partnership Agreement. It will help clarify each partner's role and responsibilities, fostering a cooperative environment.

While a written partnership agreement is not legally required, it is highly beneficial. A formal agreement can protect the interests of all partners by detailing the rights and responsibilities involved. In Puerto Rico, drafting a Simple Partnership Agreement can help ensure that each partner's contributions and roles are clearly outlined, making it easier to resolve potential issues in the future.

You can form a partnership without a written agreement, but it is not recommended. Without an agreement, you might face challenges defining roles, responsibilities, and profit sharing. A Puerto Rico Simple Partnership Agreement will help outline these elements clearly, promoting smoother operations and reducing the chances of conflict.