Real Property Transfer Declaration: The Real Property Transfer Declaration is used by the county assessors to establish the value of real property for property tax purposes. In addition, the form is used to properly adjsut sales for sales ratio analysis. This form must be attached to any property conveyance recording in the county clerk's office. This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and law.

Colorado Real Property Transfer Declaration

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Real Property Transfer Declaration: A legal document required in various jurisdictions within the United States which details the specifics of a transaction where title to real property is transferred between parties. This declaration typically includes information such as the property description, sale price, and buyer and seller information.

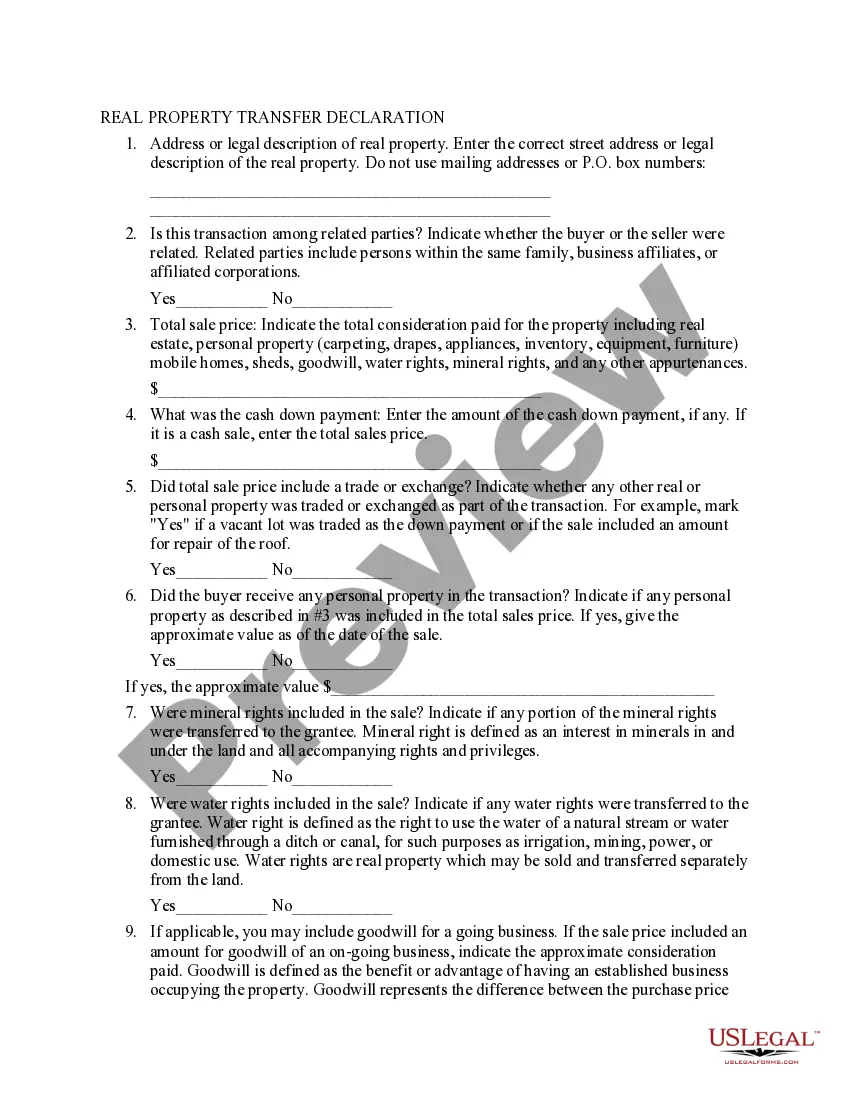

Step-by-Step Guide to Completing a Real Property Transfer Declaration

- Collect Necessary Information: Gather all pertinent details such as property descriptions, the names and addresses of all parties involved, and the final sale price.

- Obtain the Required Form: Each state or county might have a specific form. Check with local government offices or websites to download the correct form.

- Fill Out the Form: Complete the form carefully, ensuring all information is accurate and complies with local regulations.

- Ensure Proper Signatures: Make sure that all parties to the transaction sign the declaration, as required by law.

- Submit the Declaration: File the completed form with the appropriate local authorities, typically the county recorder or similar entity. A filing fee may apply.

- Keep a Copy: Ensure all parties retain copies of the submitted declaration for their records.

Risk Analysis

Failing to properly complete and submit a real property transfer declaration can lead to several legal complications including disputes over ownership, tax penalties, and delays in the property transfer process. Ensuring accuracy and compliance with local laws when filing this declaration is crucial to avoid penal repercussions or transaction disputes.

Key Takeaways

- Understanding the importance of accurately filling out a real property transfer declaration is crucial for a smooth transaction.

- Each state may have different requirements and forms, making it important to verify local regulations.

- Common mistakes include incorrect property descriptions and omitted signatures, both of which can delay or void the property transfer process.

Common Mistakes & How to Avoid Them

- Incorrect Information: Double-check all entries for accuracy against official documents.

- Omission of Signatures: Ensure all required parties have signed before submission.

- Utilizing Incorrect Forms: Always use the most current form as per your local jurisdiction's requirements.

FAQ

- Where can I find the real property transfer declaration form? Typically, the form is available on the website of the local county recorder or clerk's office.

- Is there a fee to file the declaration? Yes, most jurisdictions require a nominal fee to process the declaration.

- Can the declaration be filed electronically? In some counties, electronic filing is available. It's advisable to check with local authorities.

How to fill out Colorado Real Property Transfer Declaration?

The greater the number of documents you need to prepare, the more anxious you become.

You can find a vast array of Colorado Real Property Transfer Declaration blanks available online, but you're unsure which ones to trust.

Eliminate the trouble and simplify finding templates with US Legal Forms. Obtain professionally drafted documents that are designed to comply with state regulations.

Provide the required information to create your account and complete the purchase with PayPal or a credit card. Choose a preferred document format and obtain your copy. Access all the files you acquire in the My documents section. Navigate there to generate a new copy of the Colorado Real Property Transfer Declaration. Even when using professionally drafted forms, it is still crucial to consider consulting a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, Log In to your account, and you will locate the Download button on the Colorado Real Property Transfer Declaration’s page.

- If you've never utilized our platform before, complete the registration process by following these steps.

- Ensure the Colorado Real Property Transfer Declaration is applicable in your state.

- Verify your selection by reviewing the description or using the Preview mode if available for the chosen file.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

In Colorado, certain transactions qualify for exemptions from the real property transfer tax. For instance, transfers between spouses, transfers by gift, and certain types of government transactions may be exempt. It's crucial to consult the Colorado real property transfer declaration to identify applicable exemptions and ensure compliance. If you need assistance understanding these regulations, the US Legal Forms platform provides valuable resources and templates to make the process easier.

To transfer ownership of a property in Colorado, begin by preparing the necessary legal documents, such as a quit claim deed or warranty deed. Ensure you complete the Colorado real property transfer declaration, as it is essential for tax and record-keeping purposes. After completing these documents, sign and notarize them, then file them with the county clerk in the county where the property is located to finalize the transfer.

The Colorado real property transfer declaration is a document that records the transfer of property ownership within the state. It outlines essential details such as the property's value, the nature of the transaction, and any exemptions applicable. This declaration is important for tax assessment purposes and helps ensure compliance with local regulations. Understanding this declaration can simplify property transactions and avoid potential legal issues.

Filling out a Colorado quit claim deed is straightforward. Start by downloading the deed form from a reliable source, ensuring it meets state requirements. Include accurate details about the property, such as the legal description, and both the grantor's and grantee's names. Finally, sign the document in front of a notary public and file it with your local county clerk, making sure to reference the Colorado Real Property Transfer Declaration.

The TD 1000 form, also known as the Colorado Real Property Transfer Declaration, is a vital document used in real estate transactions. It provides information about the sale or transfer of property, including details about the buyer and seller. Completing this form is essential for assessing the property's value for tax purposes and ensuring compliance with state regulations. To make this process easier, US Legal Forms offers templates and guidance to help you fill out the TD 1000 accurately.

Myth #4 The TD-1000 is recorded with the deed and is public information. NOT TRUE! The TD-1000 is not public and is available only to the assessor, the home buyer and seller, and the property tax administrator.

The TD-1000 declaration form is used to alert an assessor's office concerning sales that may not accurately reflect a property's value. This declaration form must be completed and signed by either the grantor (seller) or grantee (buyer).

The real property transfer declaration (TD-1000) is one data set among many data sets that assists county assessors in properly determining the value of real property for the purpose of their bi-annual assessments of real property.

The TD-1000 declaration form is used to alert an assessor's office concerning sales that may not accurately reflect a property's value. This declaration form must be completed and signed by either the grantor (seller) or grantee (buyer).

Purpose: The Real Property Transfer Declaration provides essential information to the County Assessor to help ensure fair and uniform assessments for all property for property tax purposes.This penalty may be imposed for any subsequent year that the buyer fails to submit the declaration until the property is sold.