Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

Are you presently in a circumstance where you require documents for either business or personal purposes nearly every day.

There are numerous legitimate document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms offers thousands of template documents, including the Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution, which are designed to comply with federal and state regulations.

Once you find the right form, click on Buy now.

Choose the pricing plan you want, provide the necessary details to set up your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the appropriate city/county.

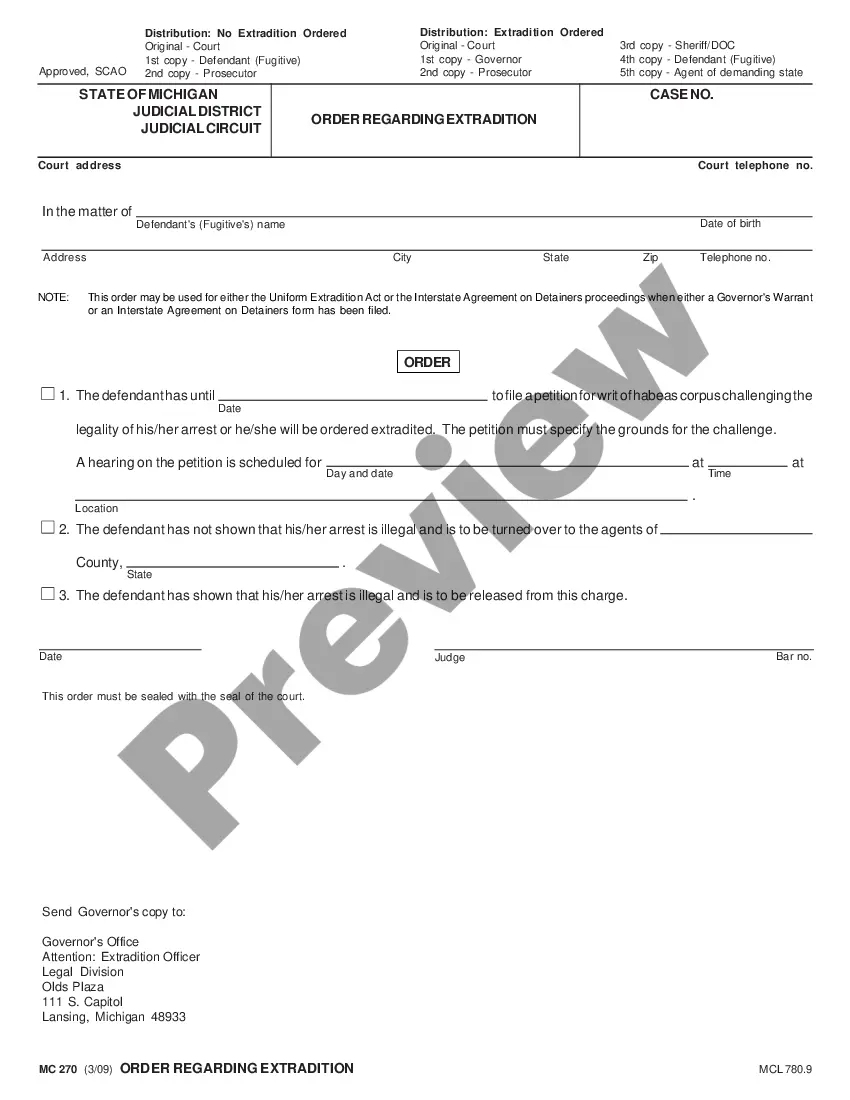

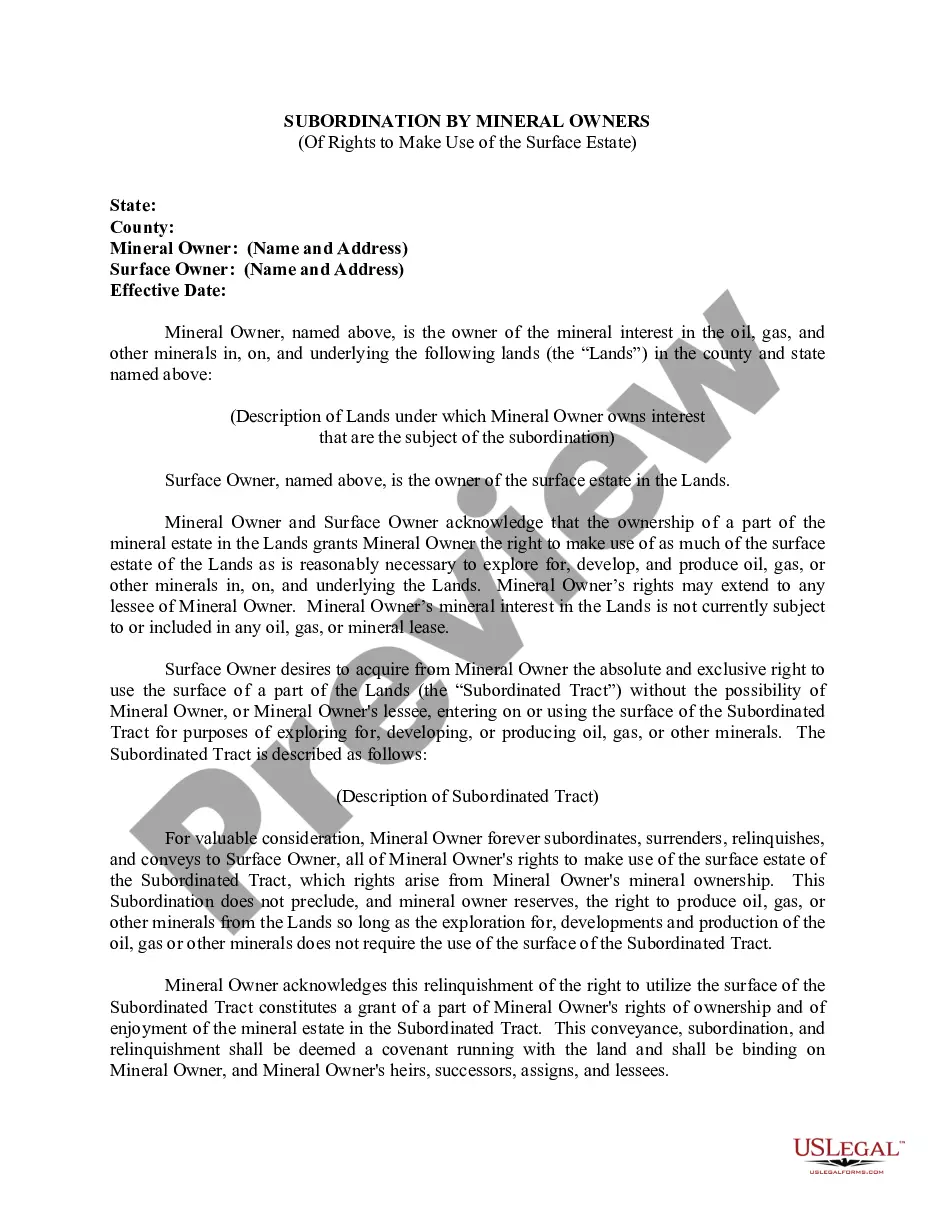

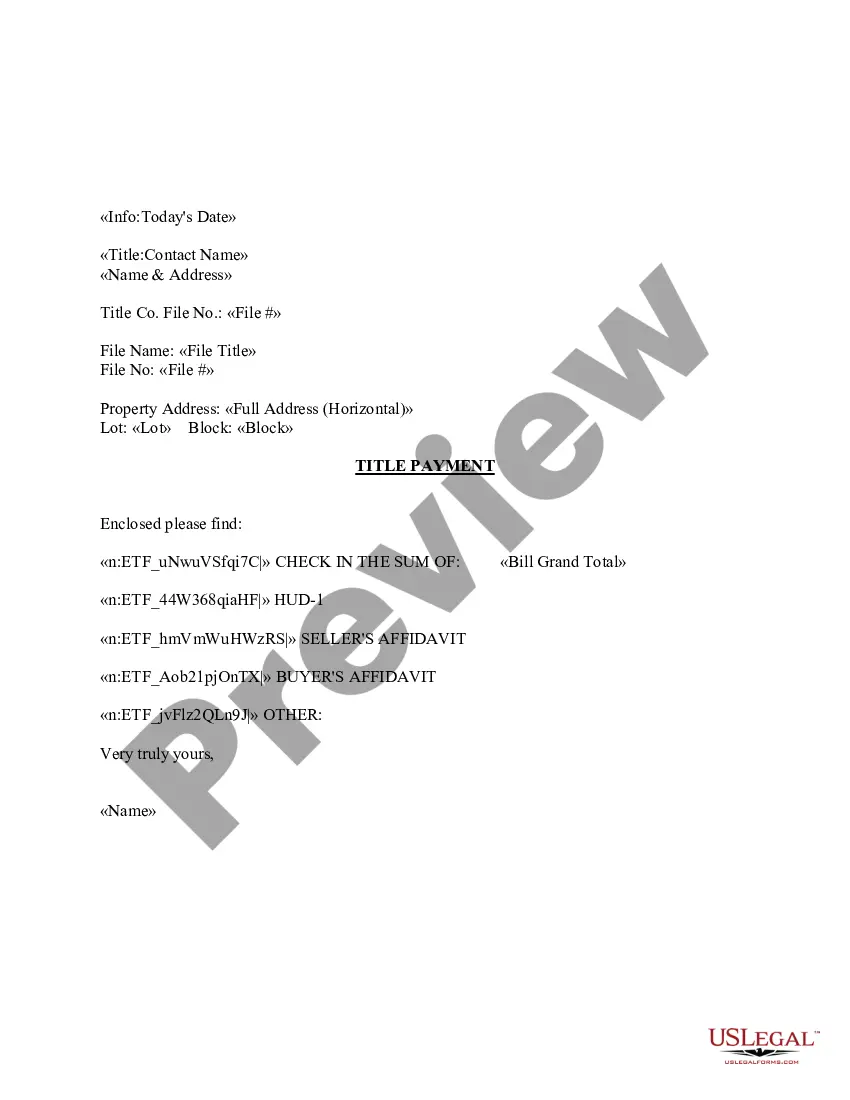

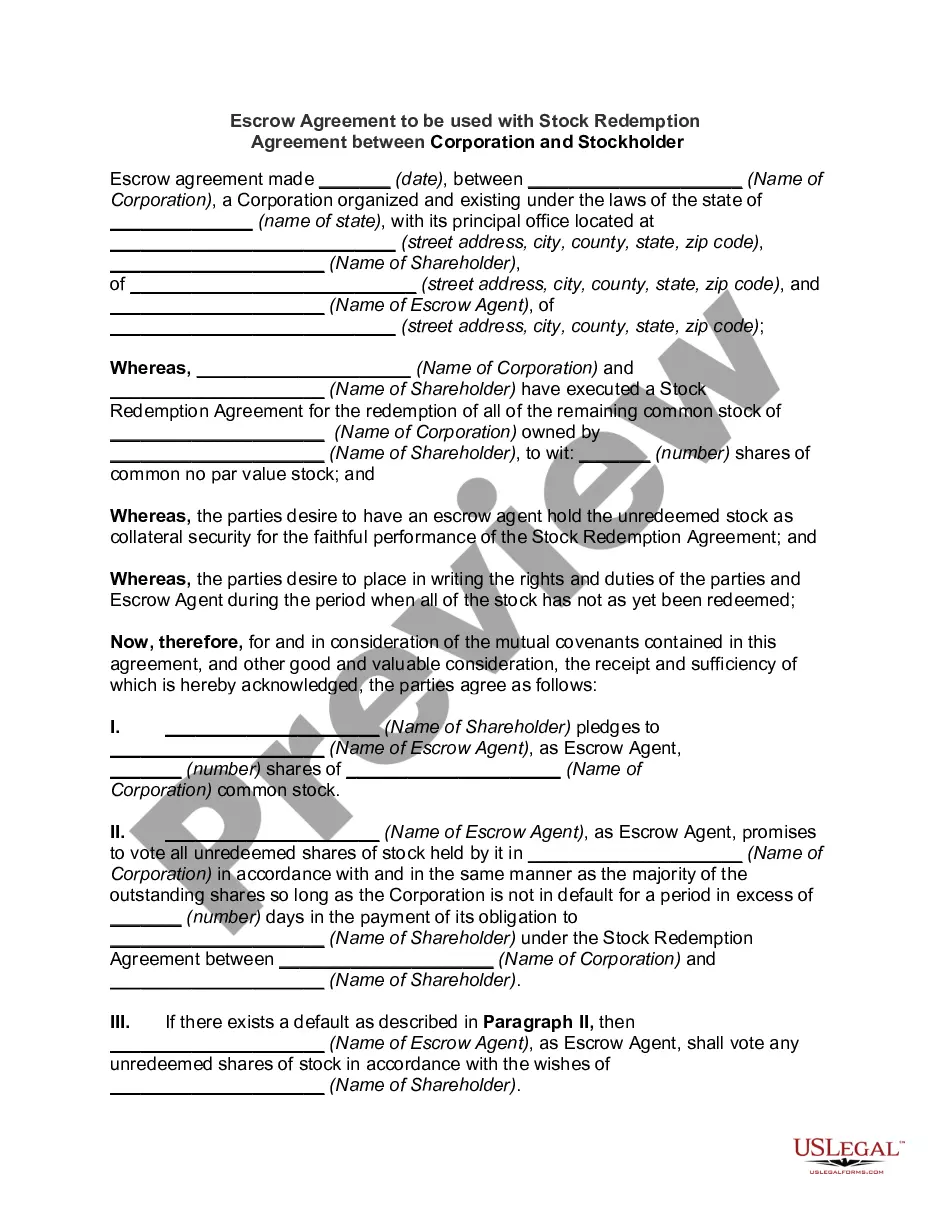

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Starting a nonprofit organization in Puerto Rico involves several steps, including forming a board, filing articles of incorporation, and applying for tax-exempt status. You must also adhere to local laws and regulations governing nonprofit operations. Platforms like uslegalforms can assist you in navigating the start-up process and establishing a solid foundation for your Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution.

Puerto Rico is a territory of the United States, but it is not a fully incorporated state, which affects its legal and tax framework. This status allows Puerto Rico to establish its own laws, including tax incentives that differ from those on the mainland. Understanding this context is essential if you're considering supporting a Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution.

Individuals or entities that meet specific criteria, such as residency and business activities, qualify for tax exemptions in Puerto Rico. Common beneficiaries include those engaged in eligible business ventures that promote economic development and charitable contributions. This makes it easier to allocate funds towards a Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution.

Incorporating in Puerto Rico requires filing documents with the Department of State and choosing a business structure that fits your goals, such as an LLC or corporation. You'll also need a registered agent and possibly a business plan. It's beneficial to consider working with platforms like uslegalforms, which can guide you through creating a Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution.

A corporation incorporated in Puerto Rico is considered a domestic corporation within Puerto Rico, but it is viewed as a foreign corporation by the U.S. Internal Revenue Service. This unique status creates specific tax obligations and benefits, enabling businesses to strategically plan. Understanding this designation can help you make informed decisions regarding contributions to a Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution.

Living on $2000 a month in Puerto Rico is possible for many residents, depending on their lifestyle choices and location. While major cities have higher living costs, rural areas can offer more affordable housing and lower expenses. Individuals often find that by budgeting wisely, they can enjoy a comfortable life, making it feasible to contribute to a Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution.

Yes, endowments can often be donor-restricted, meaning that donors decide how the funds can be used. This ensures that the endowment aligns with the specific mission or vision of the donor while supporting the Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding these restrictions is essential for organizations to effectively manage and utilize the funds.

A restricted endowment is a fund established to provide income for specific purposes as dictated by the donor. This type of endowment can support educational, religious, or charitable initiatives, in line with the Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution framework. These funds are vital for organizations looking to secure funding for long-term projects while honoring donor intentions.

Donor imposed restrictions are guidelines set by donors on how their contributions can be used. These restrictions can specify the purpose of the funds, duration of the support, or conditions for use, aligning with the goals of the Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding these restrictions is critical for organizations to ensure compliance and maintain donor trust.

The '5% rule' for endowments typically refers to the guideline that organizations should disburse at least 5% of an endowment's average market value each year. This amount can be used to support the charity’s activities and ensure it fulfills the criteria of the Puerto Rico Restricted Endowment to Educational, Religious, or Charitable Institution. This practice helps maintain the endowment while actively contributing to the organization's mission.