Puerto Rico Unrestricted Charitable Contribution of Cash

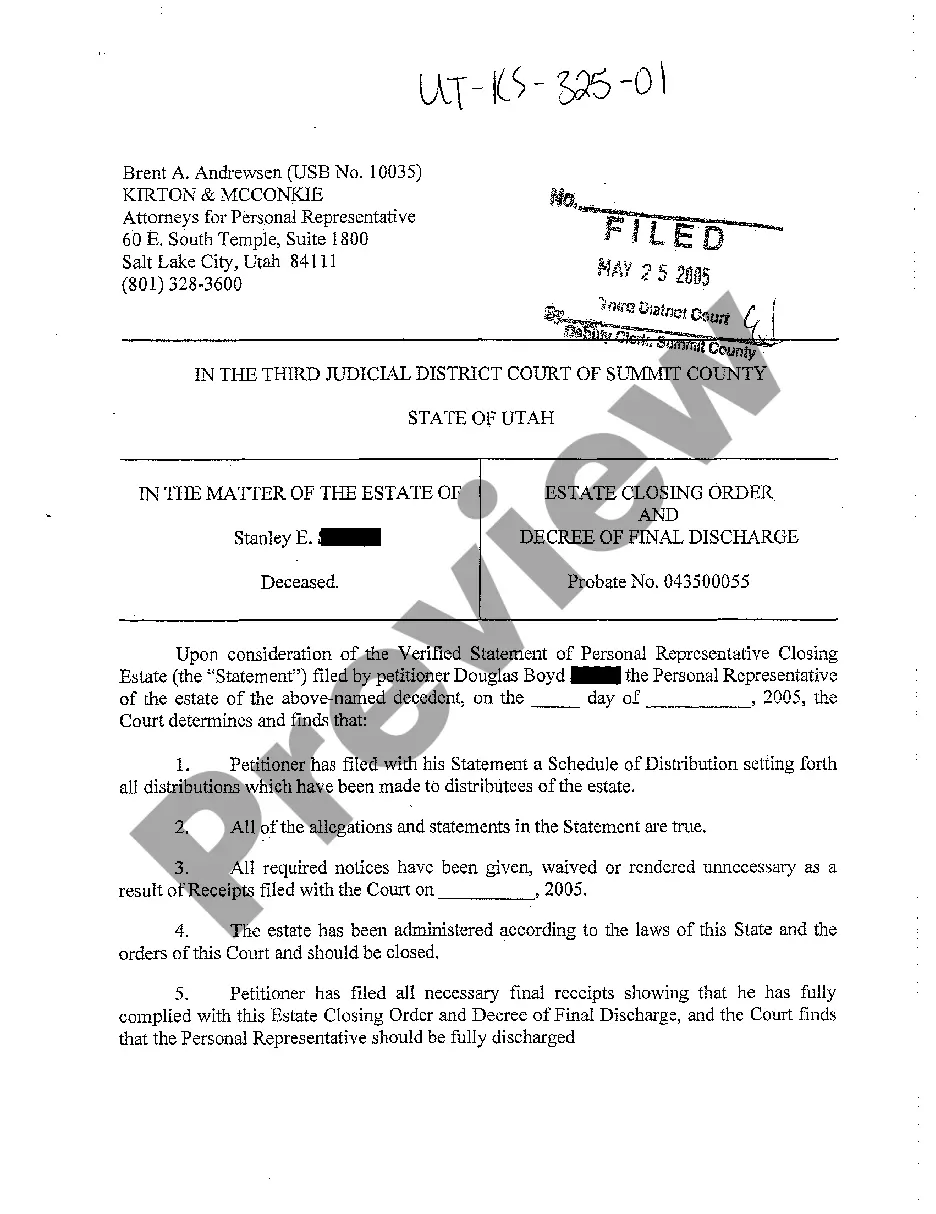

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you currently inside a position that you need to have documents for possibly enterprise or person uses almost every day time? There are tons of legal document themes accessible on the Internet, but discovering kinds you can rely on is not simple. US Legal Forms provides a huge number of develop themes, much like the Puerto Rico Unrestricted Charitable Contribution of Cash, which are written to satisfy federal and state demands.

Should you be currently familiar with US Legal Forms website and possess an account, basically log in. Afterward, you can download the Puerto Rico Unrestricted Charitable Contribution of Cash design.

Unless you come with an bank account and need to start using US Legal Forms, adopt these measures:

- Discover the develop you require and ensure it is for that right area/state.

- Take advantage of the Preview switch to review the shape.

- Read the information to ensure that you have selected the correct develop.

- In the event the develop is not what you are trying to find, use the Research industry to find the develop that meets your needs and demands.

- Once you discover the right develop, simply click Acquire now.

- Select the prices program you want, fill out the desired details to generate your money, and pay for your order utilizing your PayPal or bank card.

- Decide on a practical data file formatting and download your duplicate.

Locate each of the document themes you possess purchased in the My Forms menus. You can obtain a additional duplicate of Puerto Rico Unrestricted Charitable Contribution of Cash whenever, if necessary. Just click the required develop to download or produce the document design.

Use US Legal Forms, by far the most extensive assortment of legal types, to save time and prevent mistakes. The service provides skillfully produced legal document themes which you can use for an array of uses. Create an account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

As has been widely reported, Puerto Rico's Act #20 and Act #22 provides incentives for high net worth U.S. citizens to move to Puerto Rico and potentially reduce their 39.6% federal income tax (plus any applicable state tax) to a 0% ? 4% Puerto Rico income tax rate.

Charitable contributions will be allowed as a deduction to the extent they are made to charitable organisations qualified by the Secretary and provide services to residents of Puerto Rico. The contributions are subject to 50% of adjusted gross income (AGI).

Overall deductions for donations to public charities, including donor-advised funds, are generally limited to 50% of adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30% of AGI.

Non-Cash Contributions Must be received by donor the earlier of date of filing return for year of donation or due date, including extensions. Over $500 to $5,000: Contemporaneous written acknowledgment and you must file Form 8283 with your tax return.

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your federal AGI.

Your deduction for charitable contributions is generally limited to 60% of your AGI. For tax years 2020 and 2021, you can deduct cash contributions in full up to 100% of your AGI to qualified charities. There are limits for non-cash contributions.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.

A qualified contribution for purposes of the 25 percent taxable income limit is a charitable contribution made in cash during the 2020 and 2021 calendar years to churches, nonprofit educational institutions, nonprofit medical institutions, public charities, or any other organization described in IRC §170(b)(1)(A).