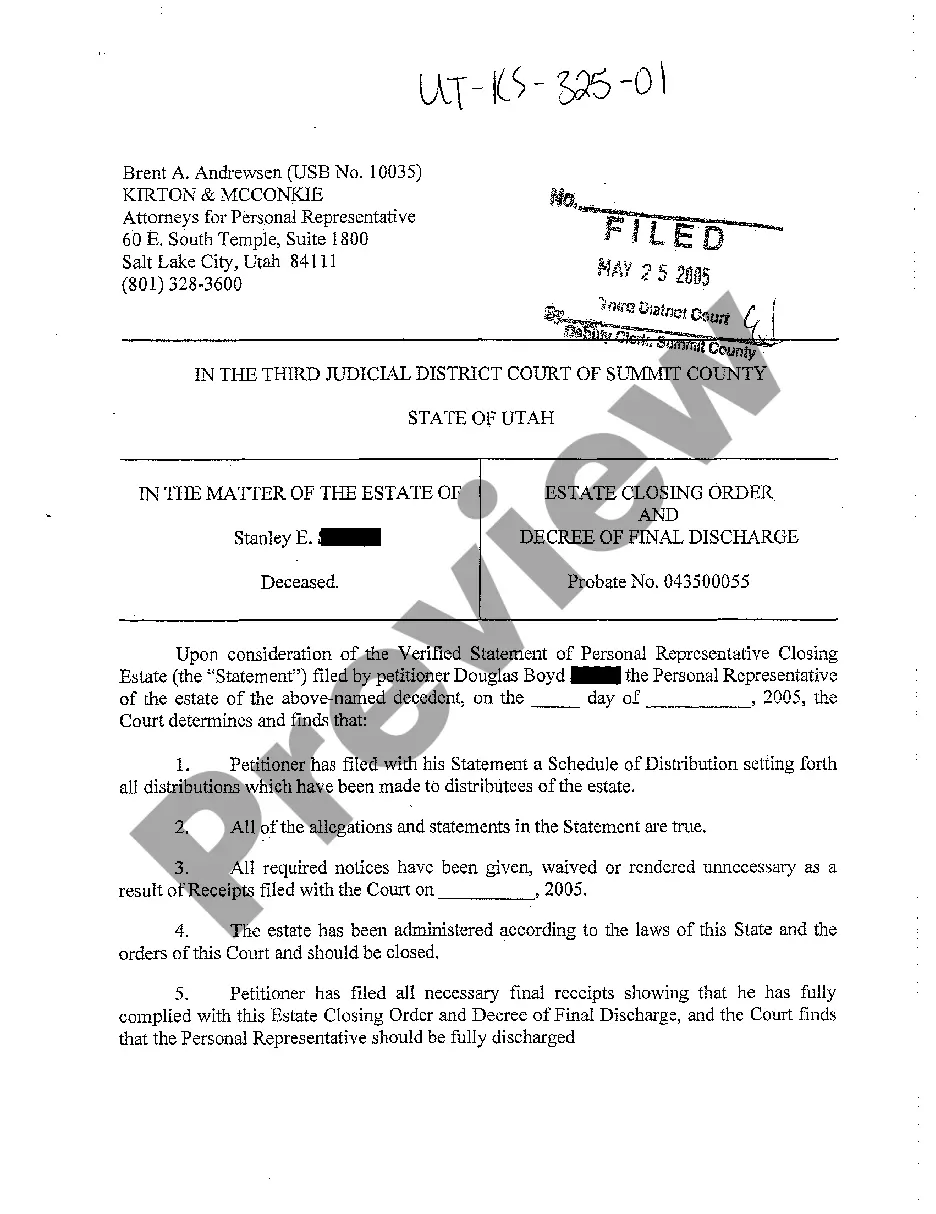

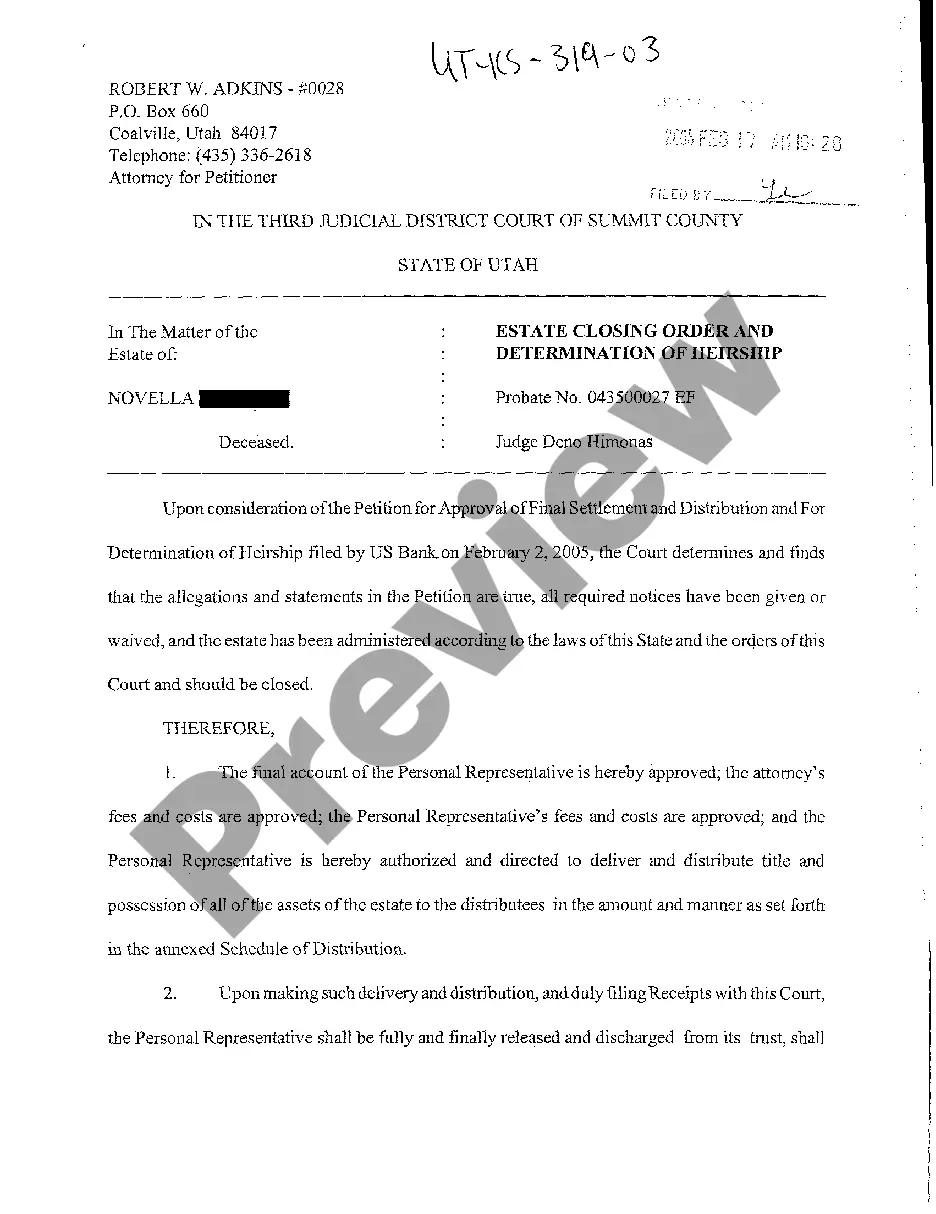

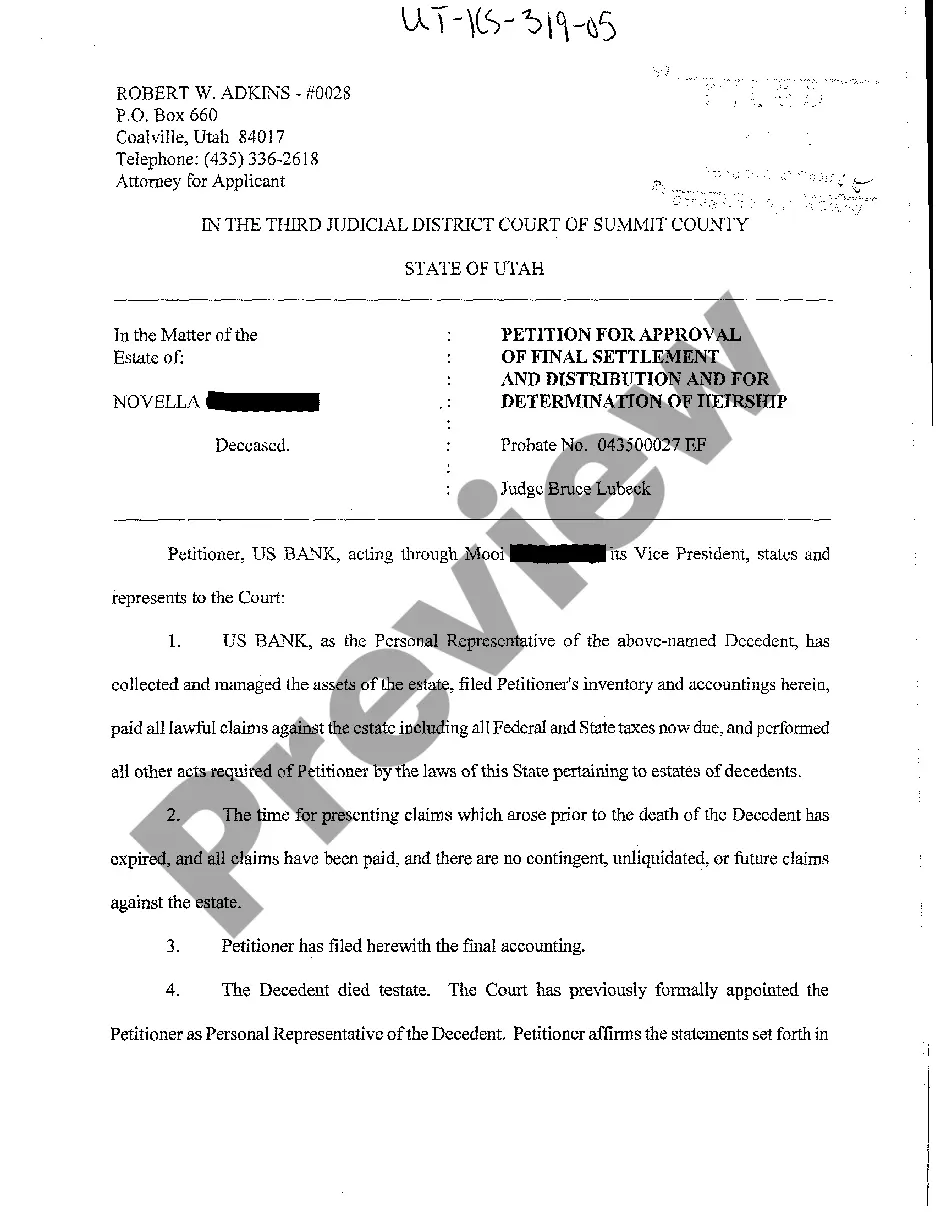

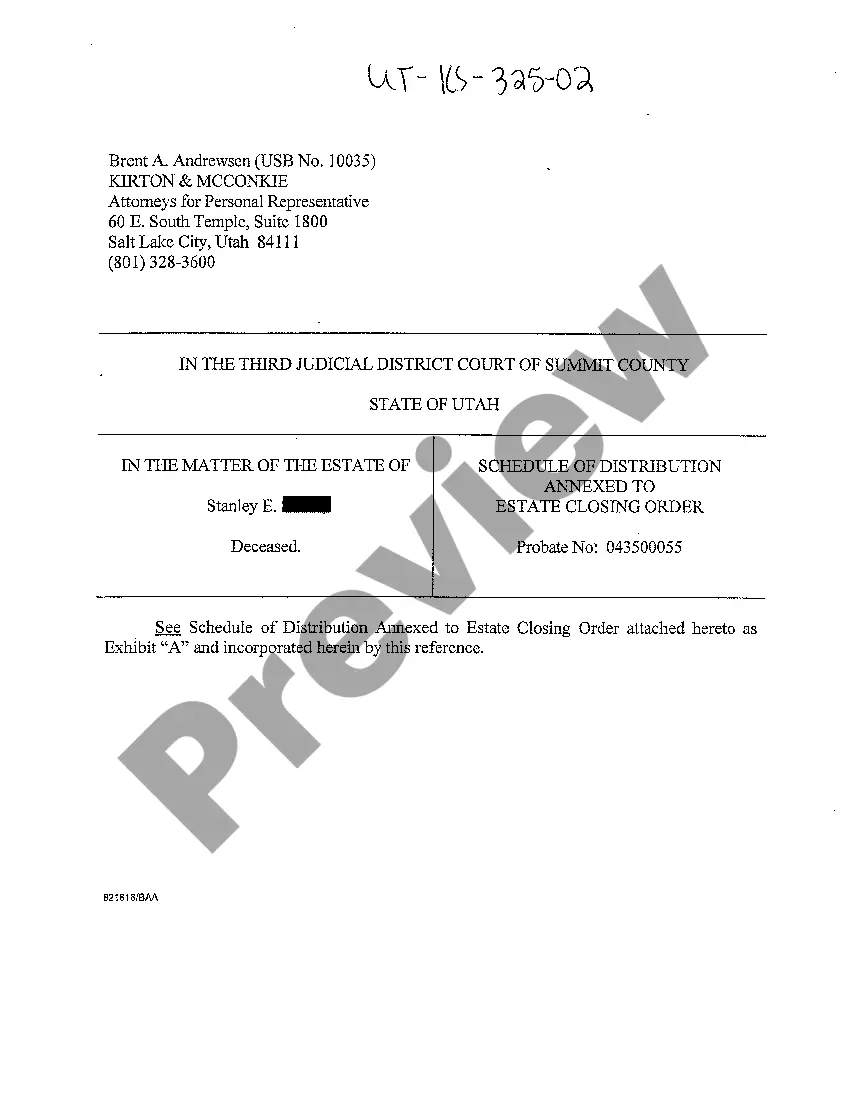

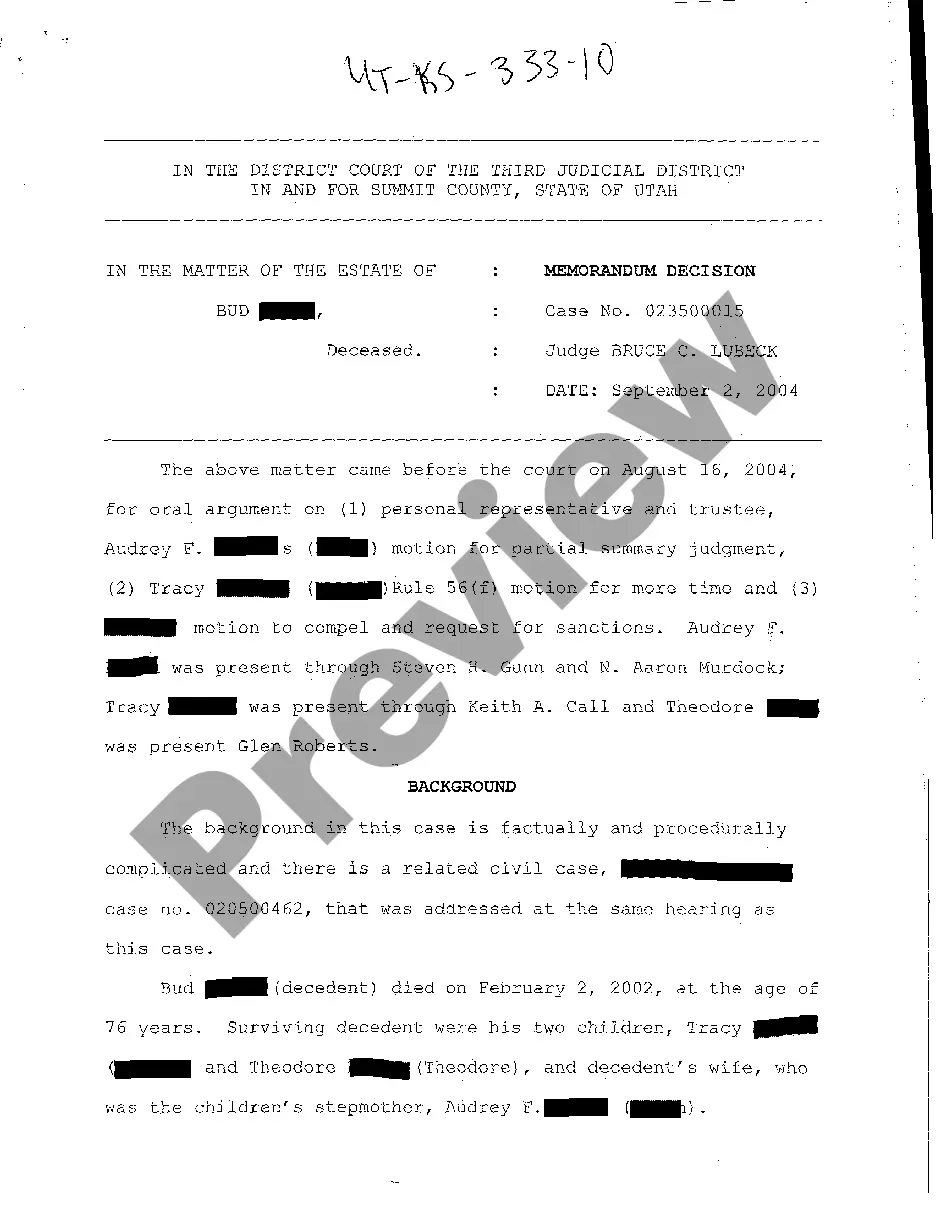

Utah Estate Closing Order and Decree of Final Discharge

Description

How to fill out Utah Estate Closing Order And Decree Of Final Discharge?

Among hundreds of free and paid templates that you find online, you can't be certain about their accuracy. For example, who made them or if they are competent enough to deal with what you need these people to. Always keep relaxed and use US Legal Forms! Discover Utah Estate Closing Order and Decree of Final Discharge samples made by professional lawyers and avoid the high-priced and time-consuming process of looking for an lawyer and then paying them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access all your previously saved examples in the My Forms menu.

If you are making use of our website the first time, follow the guidelines below to get your Utah Estate Closing Order and Decree of Final Discharge quick:

- Ensure that the document you discover applies in your state.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or look for another example using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

As soon as you have signed up and paid for your subscription, you can use your Utah Estate Closing Order and Decree of Final Discharge as many times as you need or for as long as it stays active where you live. Edit it in your favored editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Closing a position refers to executing a security transaction that is the exact opposite of an open position, thereby nullifying it and eliminating the initial exposure. Closing a long position in a security would entail selling it, while closing a short position in a security would involve buying it back.

Position effect is the effect on the expression of a gene when its location in a chromosome is changed, often by translocation.The heterochromatin can spread stochastically and switch off the color gene resulting in the white eye sectors.

'Buy to close' is used when a trader is net short an option position and wants to exit that open position. Traders normally use a 'sell to open' order to establish open short option positions which the 'buy to close' order offsets.

Account holders receiving the following message 'Your account has been restricted to placing closing orders only' are limited to placing orders which serve to close or reduce existing positions (i.e., sell orders which close out or reduce existing long positions or buy orders which which close out or reduce existing

Traders will generally close positions for three main reasons: Profit targets have been reached and the trade is exited at a profit. Stops levels have been reached and the trade is exited at a loss. Trade needs to be exited to satisfy margin requirements.

To the average investor, investing in the stock market involves buying shares of stock.In this case the sell order closes out the investor's position in the stock, so the sell order is a closing order. Any stock market order that closes a position an investor or trader is carrying on his account is a closing order.

Closing a trade means that you are ending any active position. Long or short the position doesn't matter when you say you are closing it. Selling a trade, or going short, means to open an active position to the short side.

You can buy or sell to close the position prior to expiration. The options expire out-of-the-money and worthless, so you do nothing. The options expire in-the-money, usually resulting in a trade of the underlying stock if the option is exercised.

If the trader closes the futures position for a loss the funds are withdrawn from the traders account and their account balance will go down. Once trades are closed the margin that was being used for that trade is no longer needed and that margin is now available if the trader wants to place another futures order.