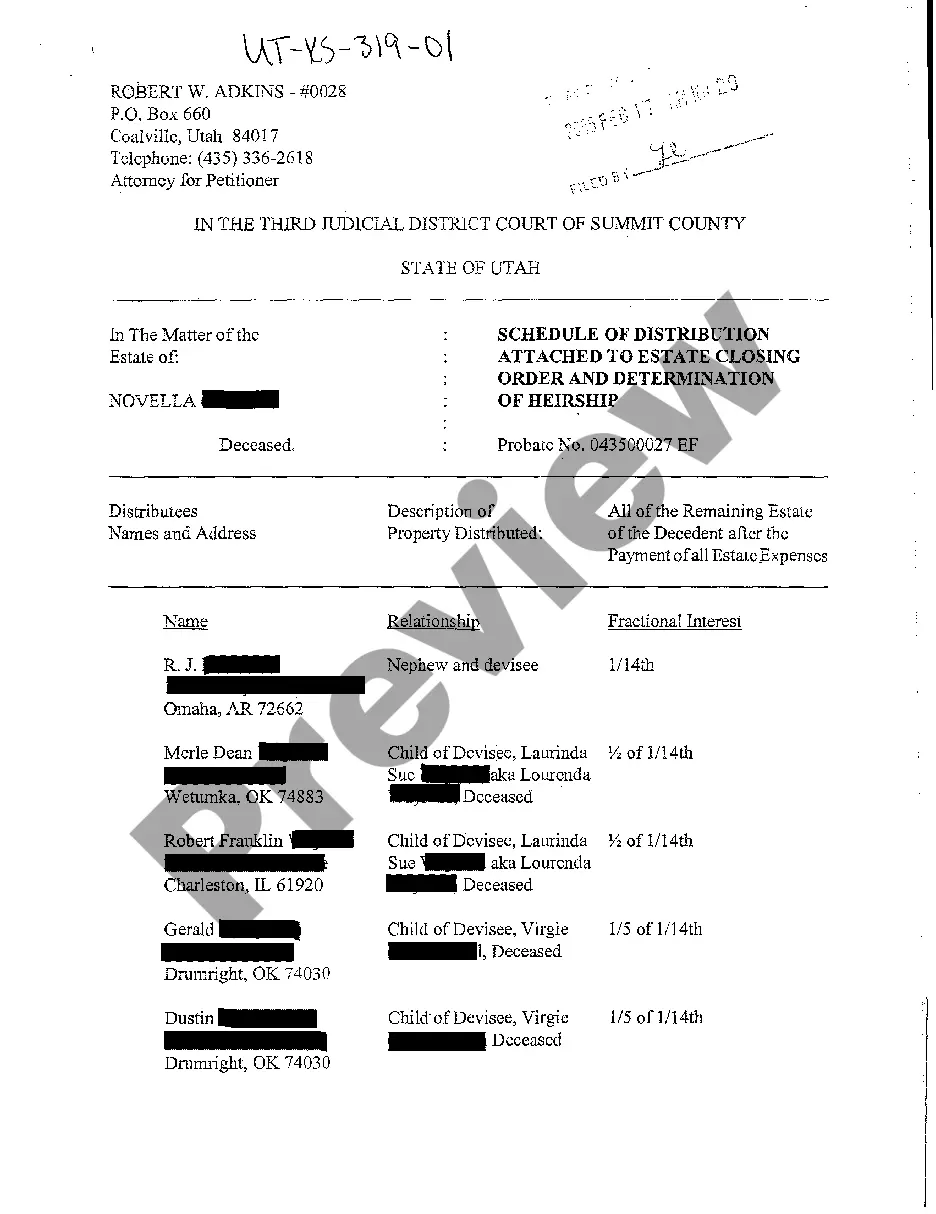

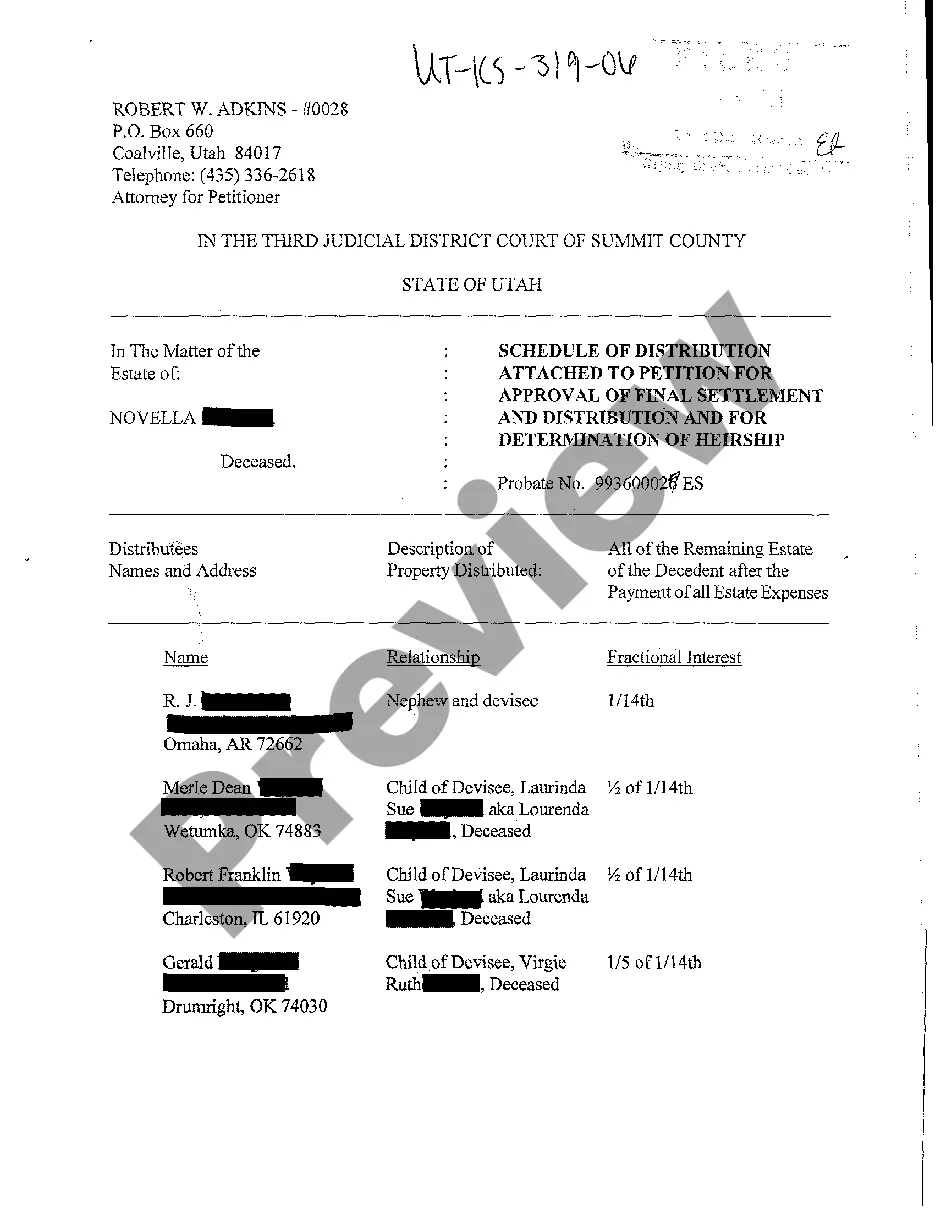

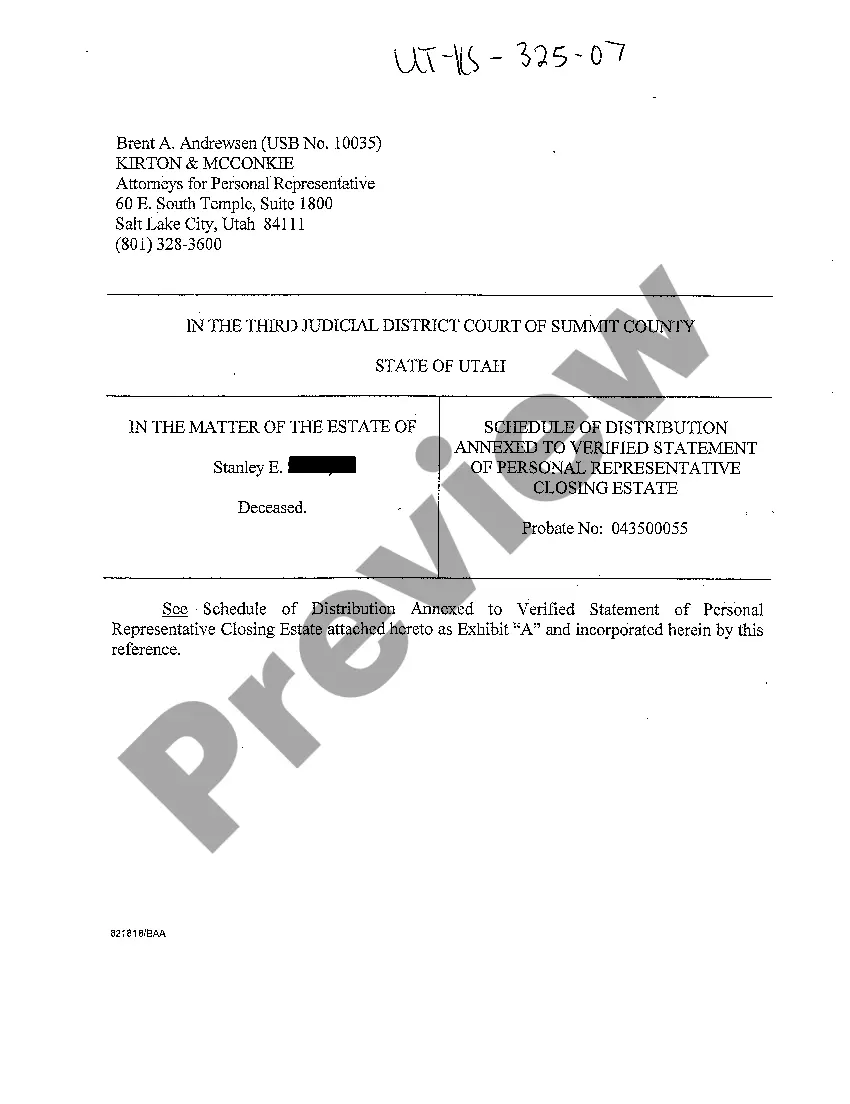

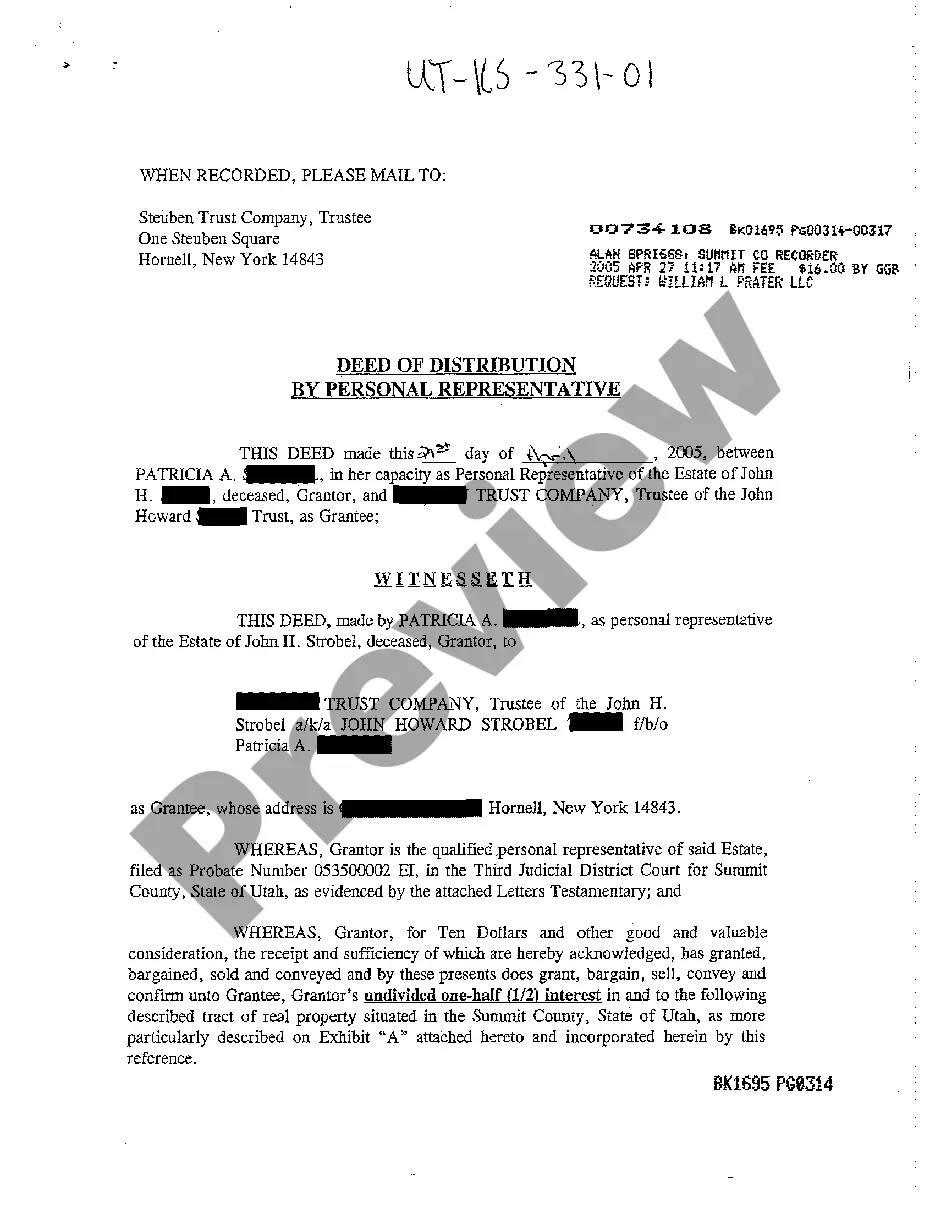

Utah Schedule of Distribution Annexed to Estate Closing Order

Description

How to fill out Utah Schedule Of Distribution Annexed To Estate Closing Order?

Among lots of paid and free samples that you’re able to get online, you can't be sure about their accuracy. For example, who created them or if they are competent enough to deal with the thing you need these people to. Keep relaxed and make use of US Legal Forms! Find Utah Schedule of Distribution Annexed to Estate Closing Order templates developed by skilled legal representatives and avoid the expensive and time-consuming process of looking for an attorney and then paying them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access all of your earlier acquired templates in the My Forms menu.

If you’re utilizing our platform the very first time, follow the instructions below to get your Utah Schedule of Distribution Annexed to Estate Closing Order quick:

- Make certain that the file you find applies in the state where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you have signed up and purchased your subscription, you can use your Utah Schedule of Distribution Annexed to Estate Closing Order as many times as you need or for as long as it stays active in your state. Revise it in your favorite online or offline editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

A personal representative has the discretion to make a partial distribution of assets during the administration of the estate.Once final expenses have been made and the estate is ready to close, the personal representative can distribute the remaining assets to the beneficiaries.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

After the Grant of Probate has been issued, our Probate Solicitors estimate that for a straightforward estate, it will take another 3 to 6 months before the funds can be distributed to the beneficiaries.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.