Puerto Rico Affidavit by an Attorney-in-Fact in the Capacity of an Administrator of an Estate

Description

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Administrator Of An Estate?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are many legitimate document templates available online, but finding reliable ones is not easy.

US Legal Forms offers a vast array of form templates, such as the Puerto Rico Affidavit by an Attorney-in-Fact in the Role of an Estate Administrator, designed to meet state and federal requirements.

Once you locate the correct form, click on Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and make a purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Affidavit by an Attorney-in-Fact in the Role of an Estate Administrator template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

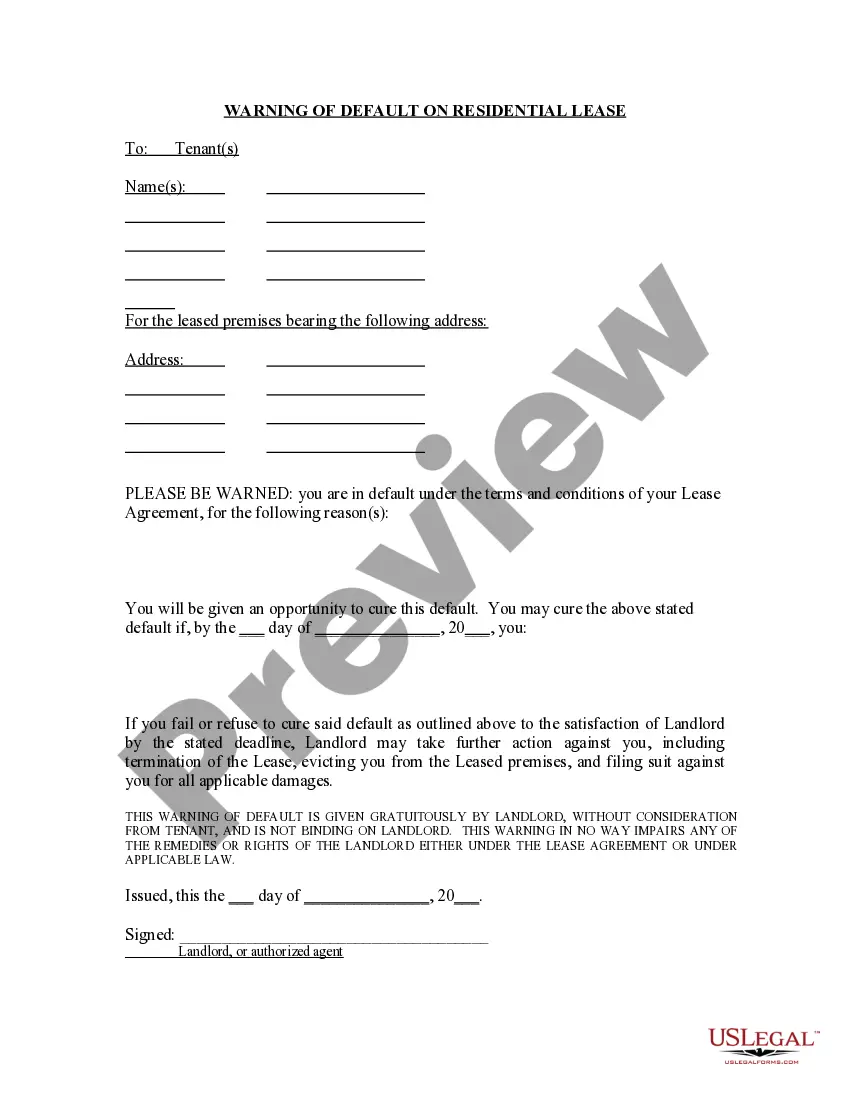

- Utilize the Review button to evaluate the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you seek, utilize the Lookup section to find the form that suits your requirements.

Form popularity

FAQ

In applying for the grant of administration, you must file the following documents in any probate registry of the BC Supreme Court: Submission for estate grant, in court form P2. ... Affidavit of the applicant for grant of administration without will annexed, in court form P5. ... Affidavit of delivery, in court form P9.

The executor can use the simplified probate process in Pennsylvania if the value of the decedent's personal property does not exceed $50,000. While there may be some savings in utilizing the small estate process, this process does not eliminate the requirement to pay any creditors and taxes that may be due.

Small Estate Definition In Pennsylvania, an estate qualifies as "small" if its qualified gross value is <$50,000 and it contains no real property (i.e., real estate) owned solely by the decedent. In calculating estate value, you should value assets as of the date of death, and ignore any debts.

Inheritance Rights of Spouse: But, Pennsylvania does give the surviving spouse the right to claim an elective share of one-third to one-half of the estate no matter what the will states. The surviving spouse must go to court in order to object what a will states or claim an elective share.

All real estate in Puerto Rico is subject to the probate system. This system is based on a "forced heir" policy, that states that all children need to receive from the decedent (the person that died).

When Can You Use a Settlement of Small Estate in Pennsylvania? Pennsylvania's small estate proceeding is called a "settlement of small estate on petition." This procedure is available if all of the property left behind is worth $50,000 or less.

The court shall have exclusive power to remove a personal representative when he: (1) is wasting or mismanaging the estate, is or is likely to become insolvent, or has failed to perform any duty imposed by law; or (2) Deleted.

--Any employer of a person dying domiciled in this Commonwealth at any time after the death of the employee, whether or not a personal representative has been appointed, may pay wages, salary or any employee benefits due the deceased in an amount not exceeding $10,000 to the spouse, any child, the father or mother, or ...