Puerto Rico Corporate Resolution for Sole Owner

Description

How to fill out Corporate Resolution For Sole Owner?

If you wish to compile, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site’s user-friendly and convenient search function to find the files you need.

A selection of templates for business and personal purposes are organized by category and state, or keywords.

Every legal document you acquire is yours indefinitely. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Compete and acquire, and print the Puerto Rico Corporate Resolution for Sole Owner with US Legal Forms. There are millions of professional and state-specific documents available for your business or personal needs.

- Utilize US Legal Forms to obtain the Puerto Rico Corporate Resolution for Sole Owner with just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Obtain button to get the Puerto Rico Corporate Resolution for Sole Owner.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form suitable for your state/country.

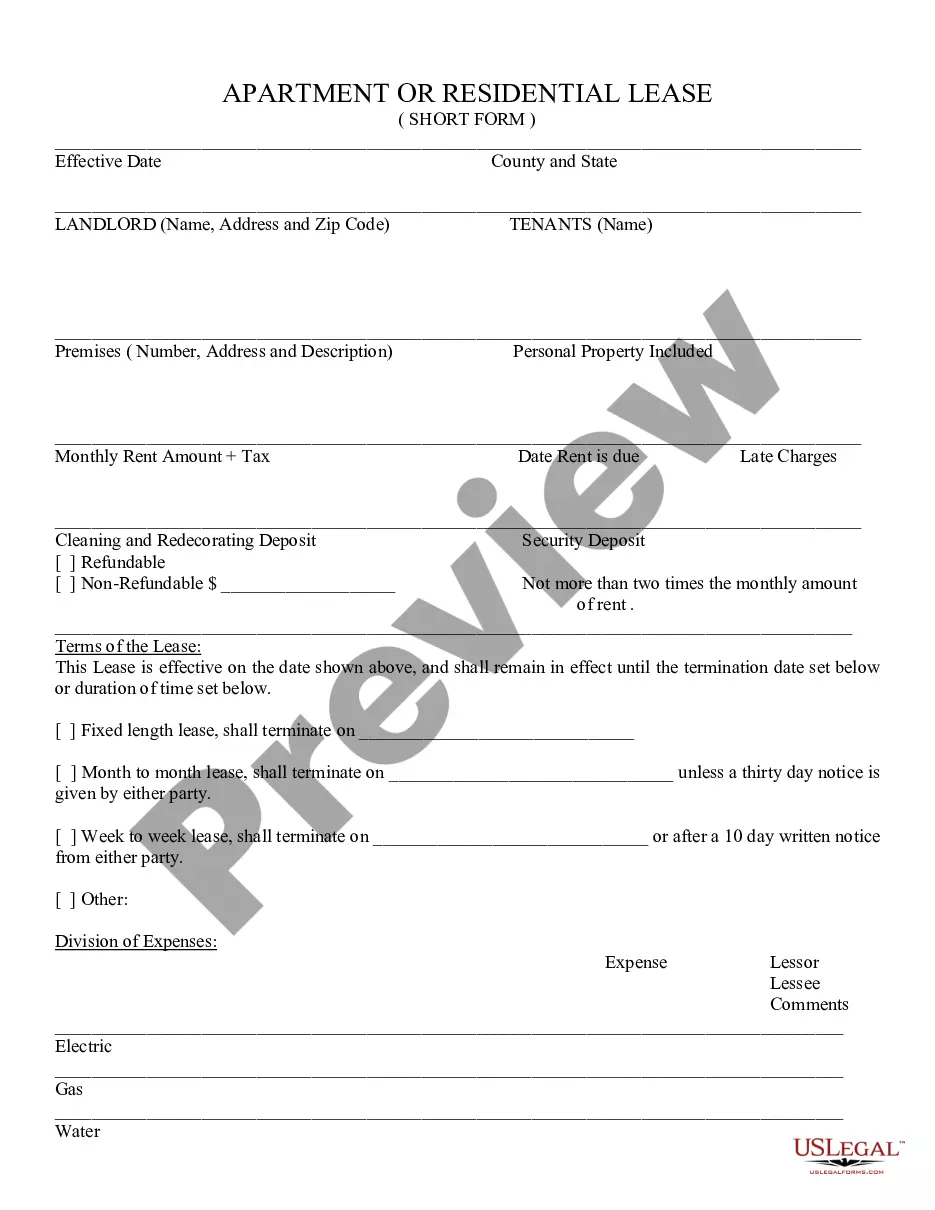

- Step 2. Use the Preview option to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find alternative versions of the legal form.

- Step 4. Once you have located the document you need, click the Get now button. Choose your preferred pricing plan and provide your information to create an account.

- Step 5. Complete the transaction. You can use your Мisa, Visa card, or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Corporate Resolution for Sole Owner.

Form popularity

FAQ

The shareholders own the corporation and are responsible for electing the directors. This is done when the corporation is first formed and usually continues on an annual basis.

It's totally possible. Your business can be comprised of only youprovided you get along well with yourself. You can be the CEO, Treasurer, Secretary, and the only shareholder of the company.

An S corporation separates you from your company completely, for both operational and tax purposes. The business is its own entity, and you as the owner are the sole shareholder and an employee. That division, however, comes with operational costs.

Even if your business has only one owneryouit can still be legally organized as a corporation, with you as the sole shareholder as well as the president and director. One-owner corporations are common.

Who are owners of a corporation? Shareholders are actual owners of a corporation, while the board of directors manages the corporation. The law acknowledges a corporation as a completely separate, legal entity.

Shareholders are actual owners of a corporation, while the board of directors manages the corporation.

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

How to Get a Certificate of Good Standing from the Puerto Rico Department of StateFiling fee ($15 for corporations, $25 for limited liability companies (LLCs), $0 for nonprofits)Entity name.Registration number.

With an S corporation that has a single shareholder, he or she can be called the president, CEO, or another title. S corporations with more than one shareholder can issue titles at the time of formation.