Puerto Rico Corporate Resolution for LLC

Description

How to fill out Corporate Resolution For LLC?

Are you now situated in an area where you require documents for both business or specific purposes virtually every day? There are numerous legal document templates accessible online, yet obtaining forms you can trust isn’t simple.

US Legal Forms offers a vast selection of form templates, such as the Puerto Rico Corporate Resolution for LLC, which can be downloaded to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Puerto Rico Corporate Resolution for LLC template.

- Obtain the template you need and ensure it is for the correct city/county.

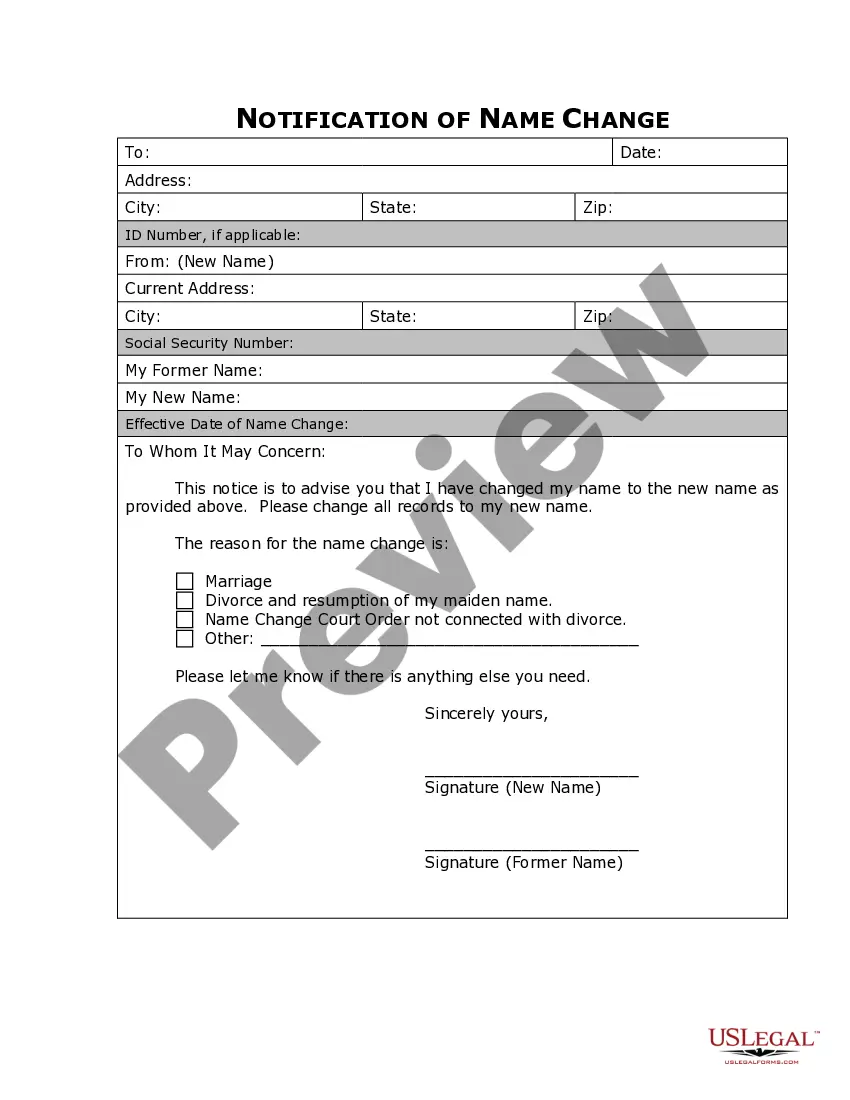

- Utilize the Review option to evaluate the template.

- Check the details to confirm that you have selected the correct form.

- If the template isn’t what you anticipated, use the Search field to find the form that fits your needs and requirements.

- Once you have the right template, click Buy now.

- Select the pricing option you prefer, provide the necessary information to set up your payment, and complete the order with your PayPal or Visa or Mastercard.

- Choose a suitable document format and download your copy.

Form popularity

FAQ

First, you must choose a company name and appoint a registered agent for your LLC....Name Your LLC.Designate a Registered Agent.Submit LLC Certificate of Formation.Write an LLC Operating Agreement.Get an EIN.Open a Bank Account.Fund the LLC.File State Reports & Taxes.

Limited liability companies (LLCs) are generally taxed as corporations. Accordingly if an LLC is organized under the laws of Puerto Rico it is taxed as a domestic corporation and if organized under the laws of any other country, including the United States, it is taxed as a foreign corporation.

The current corporate income tax (CIT) rate is comprised of an 18.5% normal tax and a graduated surtax (computed on the 'surtax net income'). The 'surtax net income' is basically the net taxable income subject to regular tax less a surtax deduction in the amount of 25,000 United States dollars (USD).

Alternatively, businesses organized under the laws of a state of the United States or a foreign country may register to be authorized to conduct business within Puerto Rico as a foreign corporation. These businesses must file with the Puerto Rico State Department a Certificate of Authorization to do Business.

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

Domestic Corporations Are those created under the General Corporations Act of Puerto Rico. That is, these are corporations of Puerto Rico. Foreign Corporations Are those created under the laws of other countries and states of the United States.

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits. State or local governments might levy additional LLC taxes.

Federal law requires payment of federal income tax from the following residents and corporations only: federal government employees in Puerto Rico, residents who are members of the United States military, those with income sources outside of Puerto Rico, those individuals or corporations who do business with the

2 As a result, although Puerto Rico belongs to the United States and most of its residents are U.S. citizens, the income earned in Puerto Rico is considered foreign- source income and Puerto Rico corporations are considered foreign.

Puerto Rico holds a unique position as an unincorporated U.S. territory. Under Internal Revenue Code (IRC) §933, Puerto Rico source income is excluded from U.S. federal tax.