The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Pennsylvania Nonemployee Director Stock Option Plan

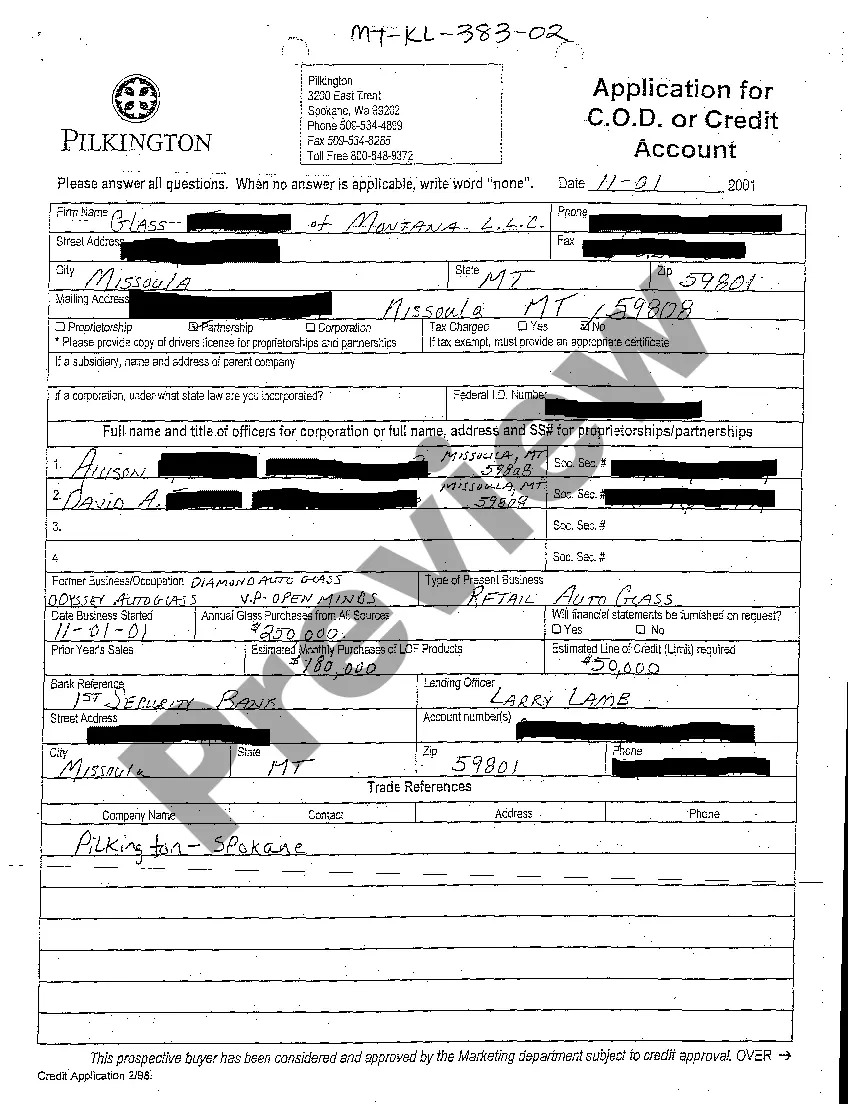

Description

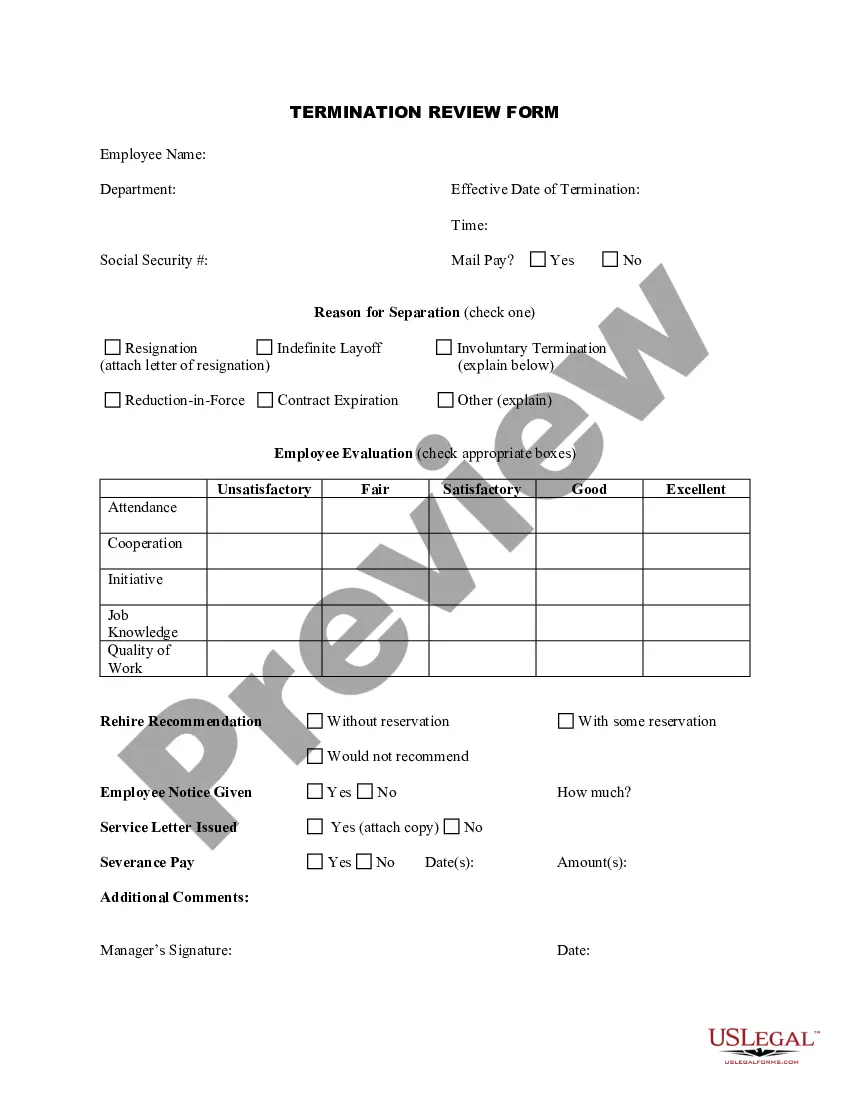

How to fill out Nonemployee Director Stock Option Plan?

Finding the right legal document template might be a have difficulties. Of course, there are a variety of themes available on the net, but how would you get the legal type you want? Take advantage of the US Legal Forms internet site. The support provides a huge number of themes, such as the Pennsylvania Nonemployee Director Stock Option Plan, which can be used for organization and private requirements. Each of the forms are checked out by experts and meet up with state and federal needs.

Should you be already listed, log in to your bank account and click the Down load key to get the Pennsylvania Nonemployee Director Stock Option Plan. Make use of your bank account to search through the legal forms you have ordered formerly. Proceed to the My Forms tab of your bank account and obtain yet another backup of your document you want.

Should you be a new customer of US Legal Forms, listed here are simple recommendations for you to comply with:

- Very first, be sure you have chosen the right type to your metropolis/region. You may look through the shape while using Preview key and browse the shape information to ensure this is the best for you.

- In case the type is not going to meet up with your preferences, utilize the Seach field to get the correct type.

- Once you are positive that the shape would work, click the Get now key to get the type.

- Opt for the costs strategy you desire and enter the essential info. Build your bank account and purchase an order utilizing your PayPal bank account or charge card.

- Choose the document format and download the legal document template to your product.

- Complete, modify and produce and indication the acquired Pennsylvania Nonemployee Director Stock Option Plan.

US Legal Forms is definitely the biggest library of legal forms in which you will find various document themes. Take advantage of the company to download expertly-manufactured paperwork that comply with express needs.

Form popularity

FAQ

Shares of stock received or purchased through a stock plan are considered income and generally subject to ordinary income taxes. Additionally, when shares are sold, you'll need to report the capital gain or loss. Learn more about taxes, when they're paid, and how to file your tax return.

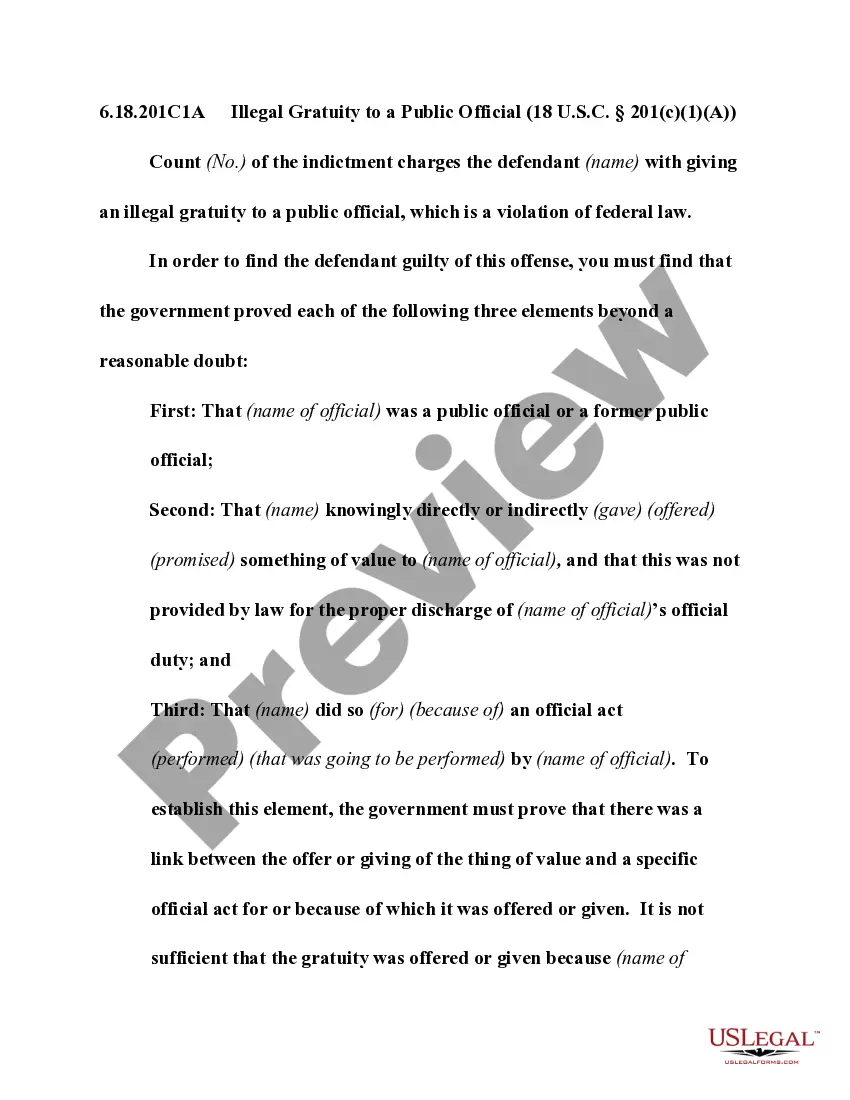

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

With NSOs, you pay ordinary income taxes when you exercise the options, and capital gains taxes when you sell the shares. With ISOs, you only pay taxes when you sell the shares, either ordinary income or capital gains, depending on how long you held the shares first.

When do I pay income tax on stock options? Stock options are taxable as compensation on the date they are exercised or when any substantial restrictions lapse.

When you exercise nonqualified stock options, your employer will most likely withhold a flat 22% for federal income taxes. However, you might be under-withheld if you're in the 32%, 35%, or 37% tax bracket. Stock options can be advantageous but can also create unexpected tax consequences.