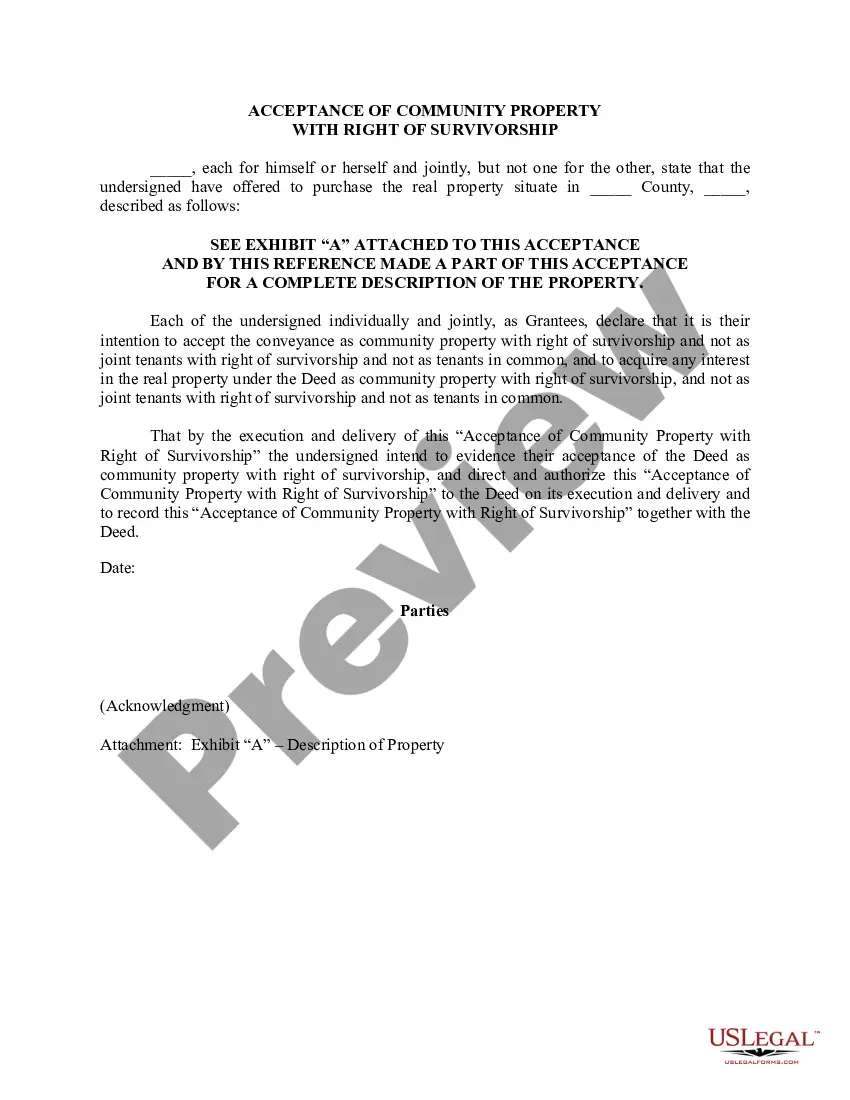

Pennsylvania Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

It is possible to invest time on-line trying to find the legitimate file template that fits the federal and state requirements you want. US Legal Forms provides a huge number of legitimate forms which are analyzed by professionals. You can actually acquire or produce the Pennsylvania Deed (Including Acceptance of Community Property with Right of Survivorship) from the service.

If you have a US Legal Forms bank account, it is possible to log in and then click the Obtain key. Following that, it is possible to complete, edit, produce, or indication the Pennsylvania Deed (Including Acceptance of Community Property with Right of Survivorship). Every single legitimate file template you acquire is the one you have permanently. To obtain another duplicate associated with a purchased kind, visit the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms website the first time, stick to the basic instructions under:

- Initial, make sure that you have selected the correct file template for that state/metropolis that you pick. See the kind outline to ensure you have chosen the correct kind. If readily available, utilize the Review key to check throughout the file template also.

- In order to find another edition of the kind, utilize the Look for discipline to obtain the template that meets your requirements and requirements.

- After you have discovered the template you need, simply click Acquire now to continue.

- Choose the pricing plan you need, key in your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal bank account to purchase the legitimate kind.

- Choose the format of the file and acquire it to your device.

- Make modifications to your file if possible. It is possible to complete, edit and indication and produce Pennsylvania Deed (Including Acceptance of Community Property with Right of Survivorship).

Obtain and produce a huge number of file layouts while using US Legal Forms web site, which provides the biggest variety of legitimate forms. Use specialist and condition-certain layouts to deal with your business or personal requirements.

Form popularity

FAQ

Joint tenancy with right of survivorship means that the last surviving owner (or tenant) will own the property automatically on the death of oth- er owners. For example, James, Megan and Donald own land jointly with right of survivorship. James dies. Megan and Donald then each own half of the property.

In Pennsylvania, real estate cannot be transferred via a TOD deed. Instead, the owner of the property can utilize a will, a living trust, or joint ownership to transfer property upon death. These methods should be discussed with an experienced estate planning attorney to understand their implications fully.

A house cannot stay in a deceased person's name, and instead ownership must be transferred ing to their Will or the State's Succession Law. Once the new owner is determined, that person must file for a new deed for the home with the county recorder's office.

Tenancy in common provides no right of survivorship The important distinction between tenancy in common and other types of co-ownership is that, upon death, each owner's interest passes to his heirs or those named in his will.

Jointly owned property with right of survivorship, except between husband and wife, including but not limited to real estate, securities, bank accounts, etc., is taxable to the extent of the decedent's fractional interest in the joint property (calculated by dividing the value of the joint property by the number of ...

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

One of the pitfalls of community property is something that is also one of its selling points ? all assets obtained during the marriage are owned 50/50. This can become a problem if one spouse dies and leaves their half of a property to someone other than their surviving spouse.

When joint tenants have right of survivorship, it means that the property shares of one co-tenant are transferred directly to the surviving co-tenant (or co-tenants) upon their death. While ownership of the property is shared equally in life, the living owners gain total ownership of any deceased co-owners' shares.