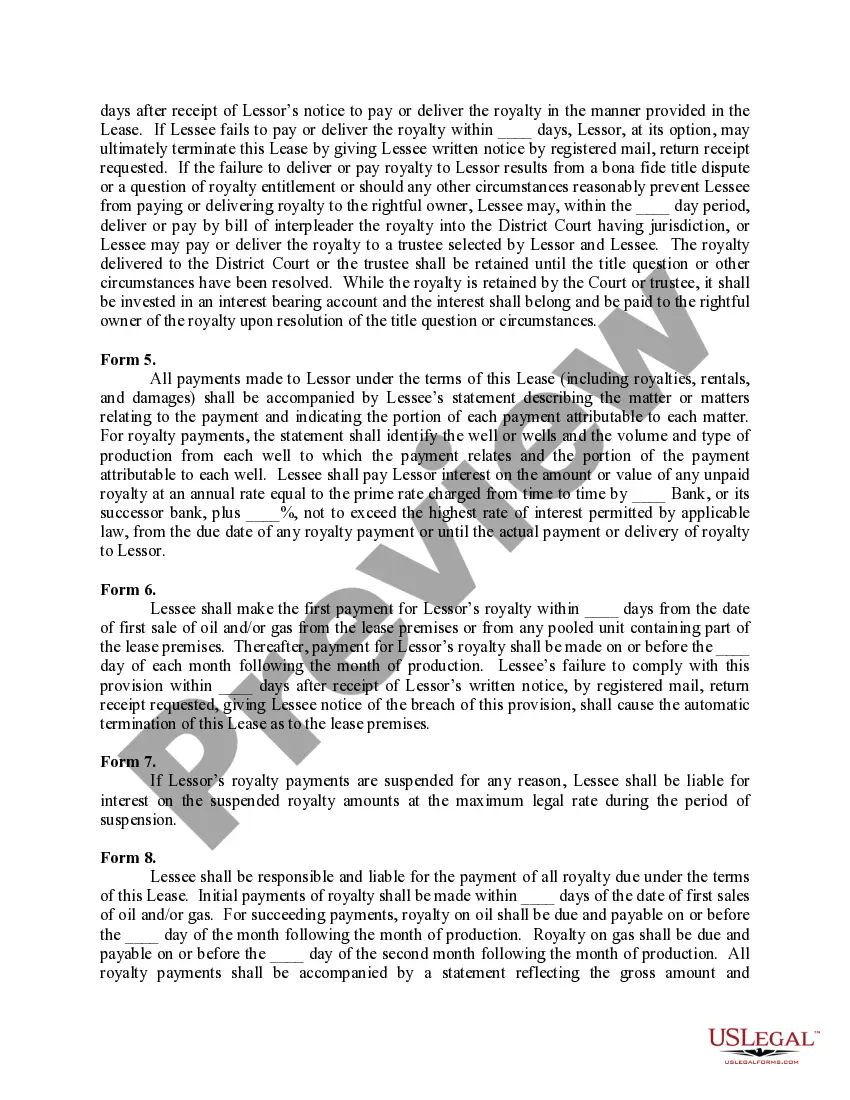

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Pennsylvania Royalty Payments

Description

How to fill out Royalty Payments?

If you have to full, obtain, or print authorized record templates, use US Legal Forms, the most important variety of authorized forms, which can be found online. Make use of the site`s simple and convenient lookup to discover the files you need. Numerous templates for business and specific functions are categorized by types and suggests, or key phrases. Use US Legal Forms to discover the Pennsylvania Royalty Payments in just a couple of clicks.

When you are already a US Legal Forms consumer, log in to your account and click on the Acquire switch to have the Pennsylvania Royalty Payments. You can even accessibility forms you in the past acquired in the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that correct town/country.

- Step 2. Utilize the Preview solution to look through the form`s content material. Never forget to see the description.

- Step 3. When you are not happy together with the develop, utilize the Search area on top of the display to get other versions of the authorized develop format.

- Step 4. Upon having found the shape you need, go through the Get now switch. Select the rates prepare you like and include your credentials to sign up to have an account.

- Step 5. Method the deal. You can use your charge card or PayPal account to accomplish the deal.

- Step 6. Choose the format of the authorized develop and obtain it on your own gadget.

- Step 7. Full, edit and print or indication the Pennsylvania Royalty Payments.

Every single authorized record format you purchase is the one you have permanently. You may have acces to every single develop you acquired with your acccount. Select the My Forms portion and decide on a develop to print or obtain once again.

Contend and obtain, and print the Pennsylvania Royalty Payments with US Legal Forms. There are millions of skilled and status-certain forms you may use for your business or specific requirements.

Form popularity

FAQ

In many cases, royalty payments happen once a month, but exactly when and how much artists get paid depends on their individual agreements with their record label or distributor.

Taxable Royalties Pennsylvania taxable income includes ?royalties.? See 72 P.S. §7303(a)(4). Royalties are not defined under the Tax Reform Code.

Royalties, active or passive, are subject to regular income tax. Items of passive income from abroad are subject to final tax.

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

The royalty rate or the amount of the royalty is typically a percentage based on factors such as the exclusivity of rights, technology, and the available alternatives. Royalty agreements should benefit both the licensor (the person receiving the royalty) and the licensee (the person paying the royalty).

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

Income required to be distributed to the beneficiaries is taxable to them regardless if it is distributed during the year. The trust or estate receives a deduction for distributions of income made to the beneficiaries. The distribution deduction is limited to the distributable net income (DNI) of the trust or estate.