This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Pennsylvania Minimum Royalty Payments

Description

How to fill out Minimum Royalty Payments?

US Legal Forms - one of the largest libraries of legitimate varieties in America - delivers a wide range of legitimate papers web templates you can acquire or print out. Making use of the site, you can get a large number of varieties for organization and individual functions, sorted by types, says, or search phrases.You can get the newest types of varieties much like the Pennsylvania Minimum Royalty Payments in seconds.

If you already have a subscription, log in and acquire Pennsylvania Minimum Royalty Payments through the US Legal Forms local library. The Obtain key will appear on each and every kind you view. You get access to all in the past delivered electronically varieties from the My Forms tab of your accounts.

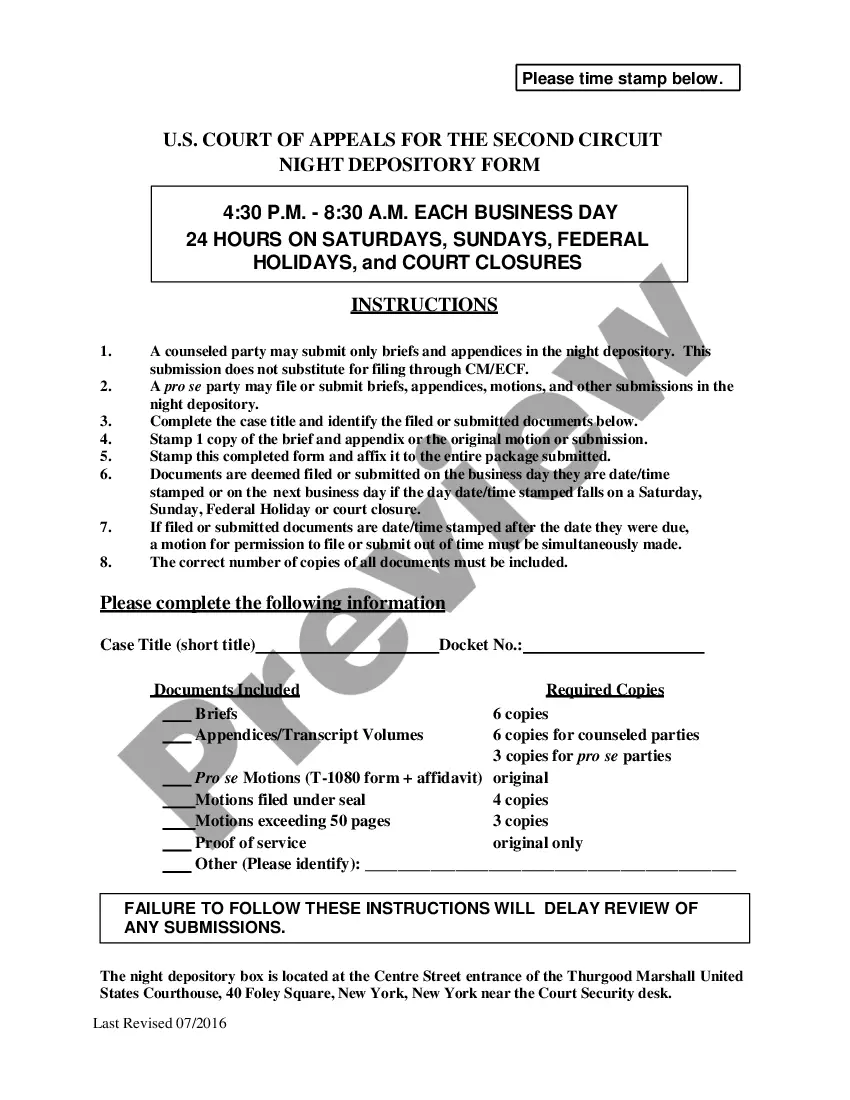

If you would like use US Legal Forms for the first time, listed here are easy recommendations to obtain started:

- Make sure you have picked out the best kind for your personal metropolis/region. Select the Preview key to review the form`s content. See the kind description to ensure that you have selected the appropriate kind.

- In case the kind does not suit your needs, take advantage of the Research discipline near the top of the monitor to obtain the one that does.

- If you are content with the form, validate your decision by simply clicking the Get now key. Then, choose the prices strategy you like and supply your accreditations to register to have an accounts.

- Procedure the deal. Make use of your charge card or PayPal accounts to perform the deal.

- Pick the formatting and acquire the form on your own device.

- Make alterations. Fill up, modify and print out and sign the delivered electronically Pennsylvania Minimum Royalty Payments.

Every template you included in your account does not have an expiration time and it is yours eternally. So, if you want to acquire or print out one more backup, just go to the My Forms section and then click about the kind you need.

Obtain access to the Pennsylvania Minimum Royalty Payments with US Legal Forms, probably the most comprehensive local library of legitimate papers web templates. Use a large number of expert and express-distinct web templates that satisfy your organization or individual requirements and needs.

Form popularity

FAQ

The mineral owner's interest in the spacing unit is calculated by dividing the number of acres owned by the mineral owner within the unit by the total number of acres in the unit (Acres Owned / Total Acres in Unit). This will result in a decimal.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.

Pennsylvania's Guaranteed Minimum Royalty Act of 1979 put the figure at 12.5 percent. But some leases allow drillers to share the costs of processing and transporting gas with landowners. These are known as post-production costs or gathering fees, and they show up as deductions from royalty checks.

Is the money I receive from a gas lease taxable? Yes, the income is taxable and should be reported on PA Schedule E and Line 6 Rents, Royalties, Patents or Copyrights of the PA-40. Income paid under a gas lease is normally reported by the payer on...

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

On July 11, 2006, the Pennsylvania General Assembly enacted the Dormant Oil and Gas Act. The purpose of the Act is to permit the development of underground oil and gas reserves when all owners of oil or gas interests cannot be located or identified.

Pennsylvania does not maintain ownership records of mineral properties and county governments often have these records. Therefore, the starting place should often be the County Recorder of Deeds Office. An older mineral deed may or may not be recorded in this office.

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.