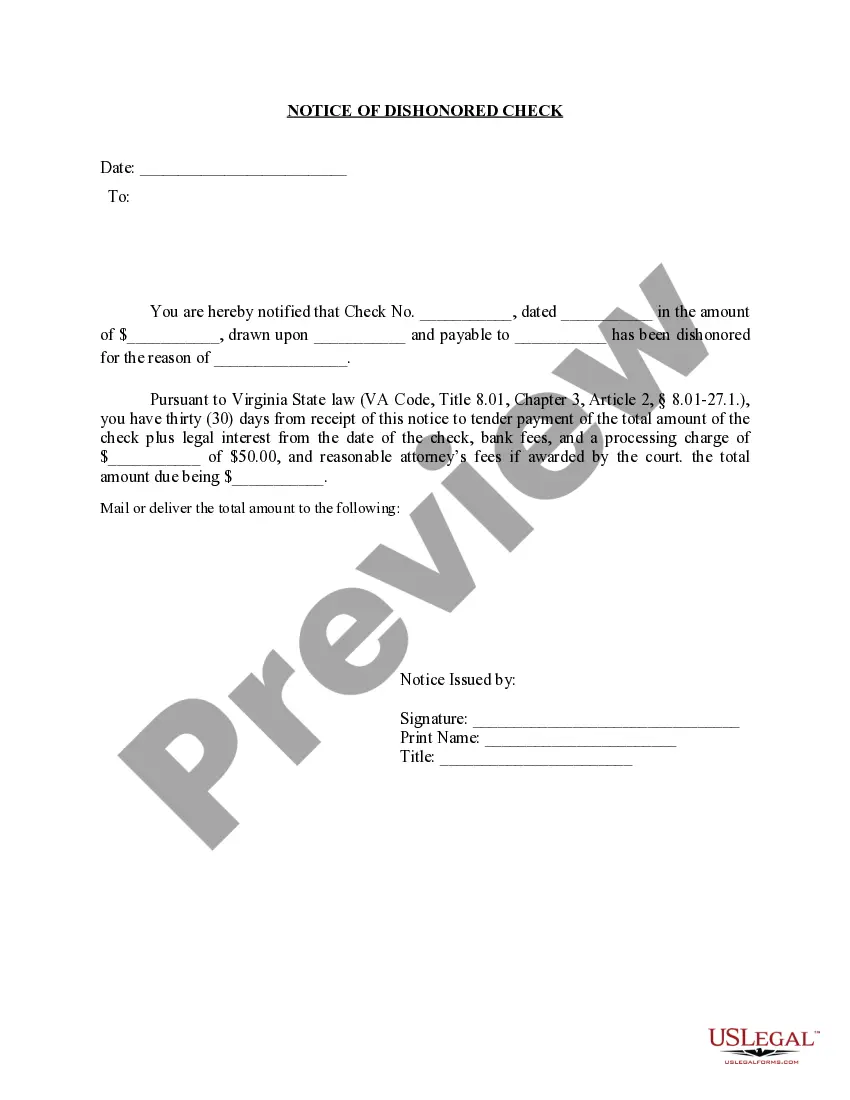

This form is used to promote conservation, increase the ultimate recovery of Unitized Substances of the specified lands and to protect the rights of the owners, it is deemed necessary and desirable to enter this Agreement, in conformity with (Applicable State Statute), to unitize the oil and gas rights in the Unitized Formation in order to conduct Unit operations for the conservation and utilization of Unitized Substances as provided in this Agreement.

Pennsylvania Unitization Agreement

Description

How to fill out Unitization Agreement?

If you have to full, obtain, or print out authorized file web templates, use US Legal Forms, the largest selection of authorized kinds, which can be found online. Use the site`s easy and practical lookup to get the files you will need. Various web templates for enterprise and person functions are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to get the Pennsylvania Unitization Agreement within a few mouse clicks.

When you are currently a US Legal Forms buyer, log in in your profile and click the Obtain option to find the Pennsylvania Unitization Agreement. You can even entry kinds you earlier saved from the My Forms tab of your profile.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the appropriate area/land.

- Step 2. Take advantage of the Preview option to look through the form`s articles. Don`t forget about to read through the information.

- Step 3. When you are unhappy together with the form, make use of the Search discipline on top of the display screen to locate other versions from the authorized form web template.

- Step 4. Once you have identified the form you will need, click on the Buy now option. Opt for the prices prepare you choose and add your qualifications to sign up for the profile.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal profile to finish the financial transaction.

- Step 6. Select the format from the authorized form and obtain it in your system.

- Step 7. Total, edit and print out or indication the Pennsylvania Unitization Agreement.

Each authorized file web template you buy is your own eternally. You possess acces to each form you saved inside your acccount. Click the My Forms portion and decide on a form to print out or obtain yet again.

Remain competitive and obtain, and print out the Pennsylvania Unitization Agreement with US Legal Forms. There are millions of expert and status-particular kinds you can use for the enterprise or person requires.

Form popularity

FAQ

On July 11, 2006, the Pennsylvania General Assembly enacted the Dormant Oil and Gas Act. The purpose of the Act is to permit the development of underground oil and gas reserves when all owners of oil or gas interests cannot be located or identified.

Your county office of Recorder of Deeds will also have information about ownership of mineral rights. You may want to consult an attorney or a professional who specializes in deeds and land titles to determine ownership.

Pennsylvania allows property owners to separate the surface rights and the subsurface rights, which are oil, gas or mineral rights. When nothing is done, the property owner owns everything, surface and subsurface rights. The property owner may choose to sell or lease these subsurface rights.

Mineral rights can be sold in any Pennsylvania county for anything from $500/acre to $5,000+/acre. Isn't that a pretty wide range? The reason for such a range is because the ranges depend on where you are located in Pennsylvania. The cost of your property is heavily influenced by where you are located.

The general rule of thumb for the value of mineral rights in Texas is 2x to 3x the lease bonus you received. For example, if you got $500/acre when you leased your property, you might expect to sell for somewhere between $1,000 to $1,500/acre if you were to sell mineral rights in Texas.

Pennsylvania does not maintain ownership records of mineral properties and county governments often have these records. Therefore, the starting place should often be the County Recorder of Deeds Office. An older mineral deed may or may not be recorded in this office.

The mineral owner's interest in the spacing unit is calculated by dividing the number of acres owned by the mineral owner within the unit by the total number of acres in the unit (Acres Owned / Total Acres in Unit). This will result in a decimal.

Since the start of the fracking boom, Southwestern Pennsylvania has been a hotspot for gas. Fracking companies flooded in, promising jobs, tax revenue, and community investment. But as problems mount, the truth has become clearer.