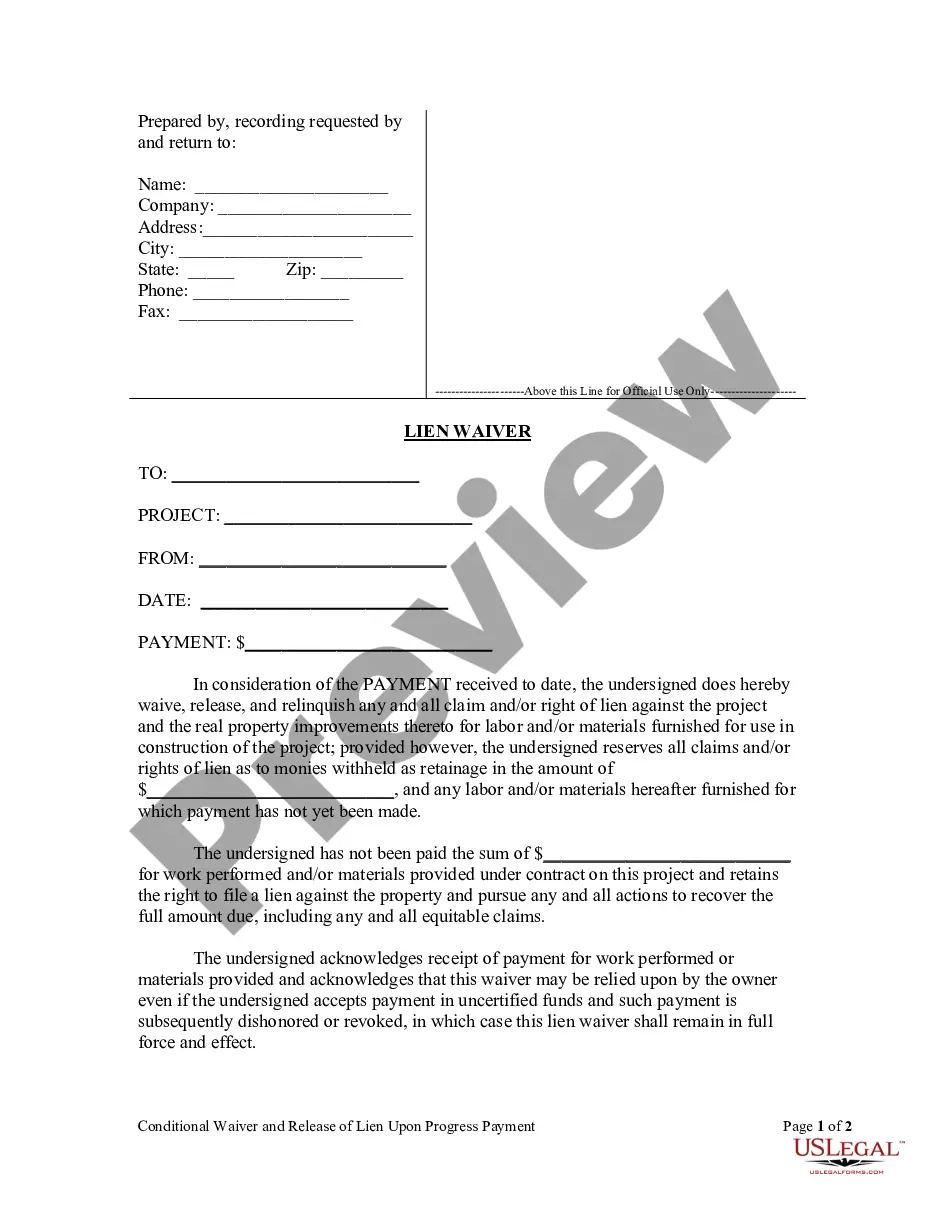

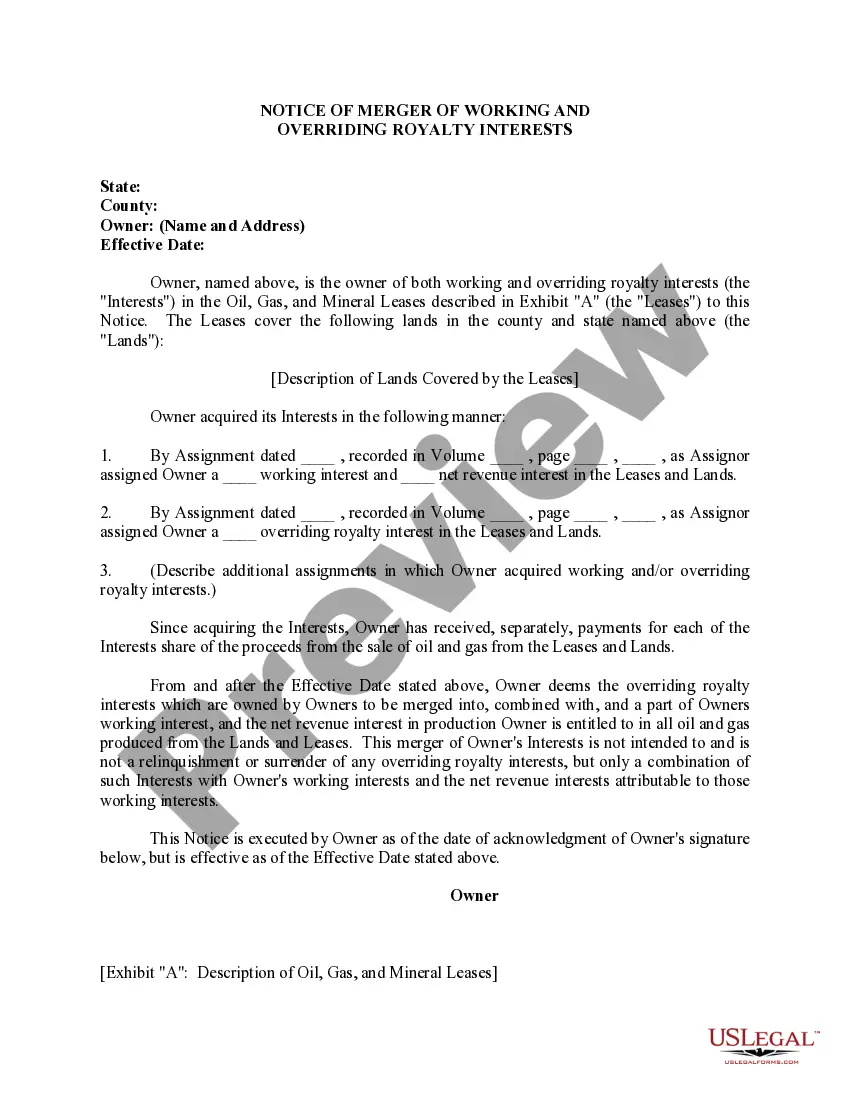

This form is used by the Owner to provide notice that the overriding royalty interests which are owned by Owners are to be merged into, combined with, and a part of Owners working interest, and the net revenue interest in production Owner is entitled to in all oil and gas produced from the Lands and Leases.

Pennsylvania Notice of Merger of Working and Overriding Royalty Interests

Description

How to fill out Notice Of Merger Of Working And Overriding Royalty Interests?

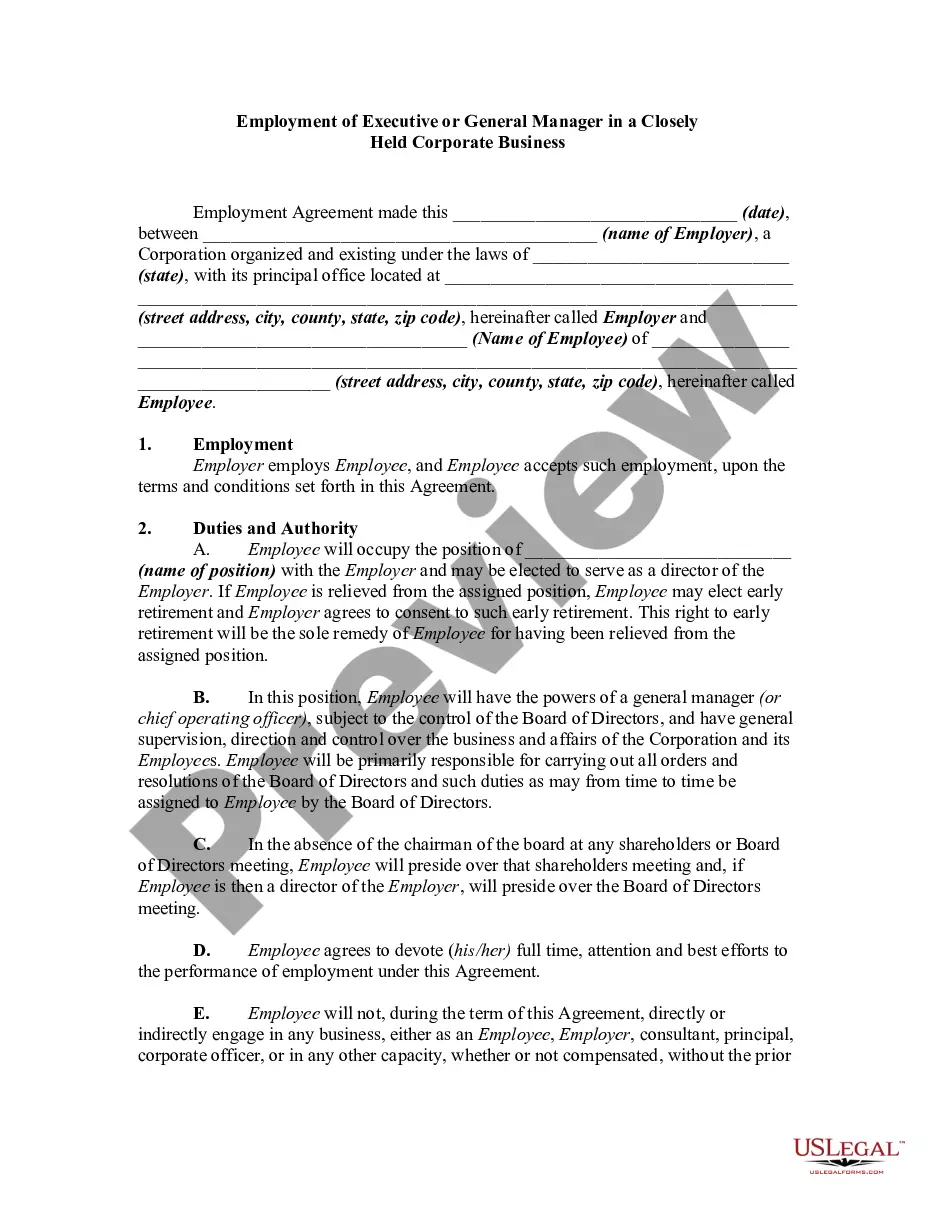

US Legal Forms - one of the largest libraries of lawful varieties in the States - provides an array of lawful record themes it is possible to obtain or printing. Utilizing the internet site, you will get a huge number of varieties for organization and specific purposes, sorted by types, suggests, or keywords.You can get the latest types of varieties just like the Pennsylvania Notice of Merger of Working and Overriding Royalty Interests in seconds.

If you have a monthly subscription, log in and obtain Pennsylvania Notice of Merger of Working and Overriding Royalty Interests through the US Legal Forms catalogue. The Download key can look on every single develop you look at. You have accessibility to all formerly saved varieties within the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed here are basic recommendations to get you started out:

- Make sure you have chosen the proper develop to your area/county. Select the Preview key to examine the form`s information. Read the develop explanation to ensure that you have chosen the correct develop.

- When the develop does not suit your demands, take advantage of the Search industry at the top of the screen to obtain the the one that does.

- When you are content with the shape, validate your choice by simply clicking the Buy now key. Then, choose the pricing plan you favor and offer your credentials to register for an bank account.

- Approach the financial transaction. Make use of your credit card or PayPal bank account to complete the financial transaction.

- Choose the formatting and obtain the shape on your gadget.

- Make changes. Load, modify and printing and indication the saved Pennsylvania Notice of Merger of Working and Overriding Royalty Interests.

Each template you included in your account lacks an expiry date and it is your own permanently. So, if you would like obtain or printing one more backup, just proceed to the My Forms section and click on the develop you want.

Gain access to the Pennsylvania Notice of Merger of Working and Overriding Royalty Interests with US Legal Forms, by far the most substantial catalogue of lawful record themes. Use a huge number of specialist and state-distinct themes that satisfy your business or specific needs and demands.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An override provision allows for ongoing royalty payment on future albums, sometimes including those not produced by the original producer.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

Like Royalty Interest (RI), an ORRI ends when the oil and gas lease ends. ORRI and MI/RI (mineral/royalty) interests in the same tract of land may be valued differently. Unlike the mineral interest, which lasts in perpetuity, overriding royalties expire with the lease.

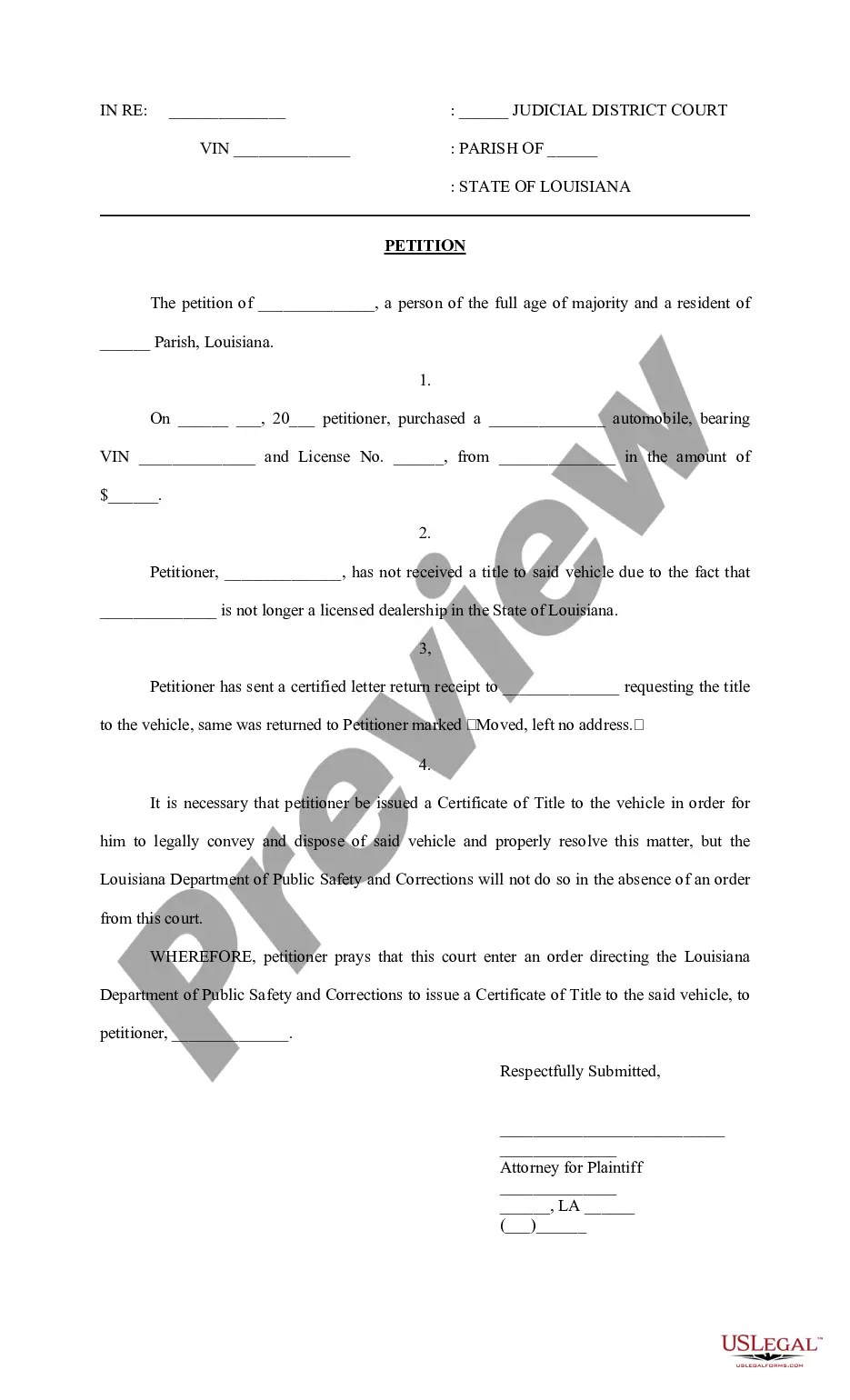

How to transfer mineral rights in Pennsylvania? A copy of the deed for the site must be obtained from a local courthouse in Pennsylvania by the new owner. Verify that the deed matches the description and that the so-called mineral rights are included in the property deed.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.