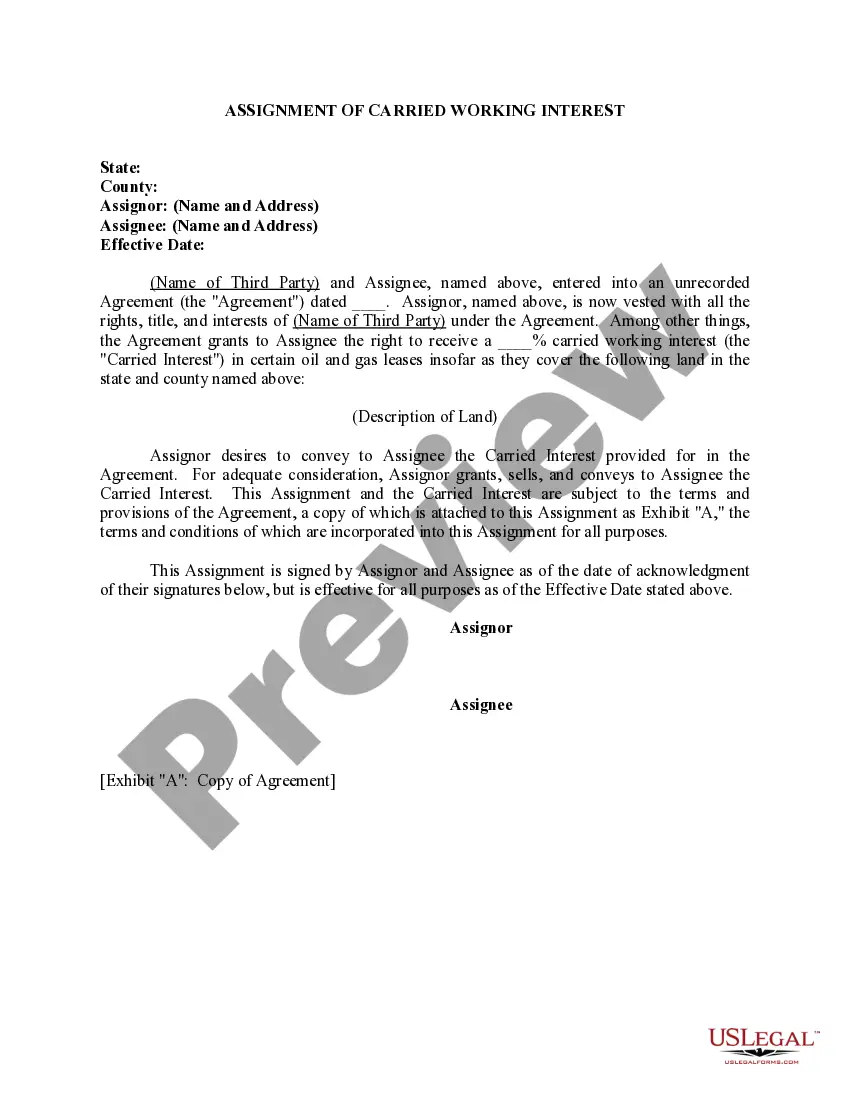

Pennsylvania Assignment of Carried Working Interest

Description

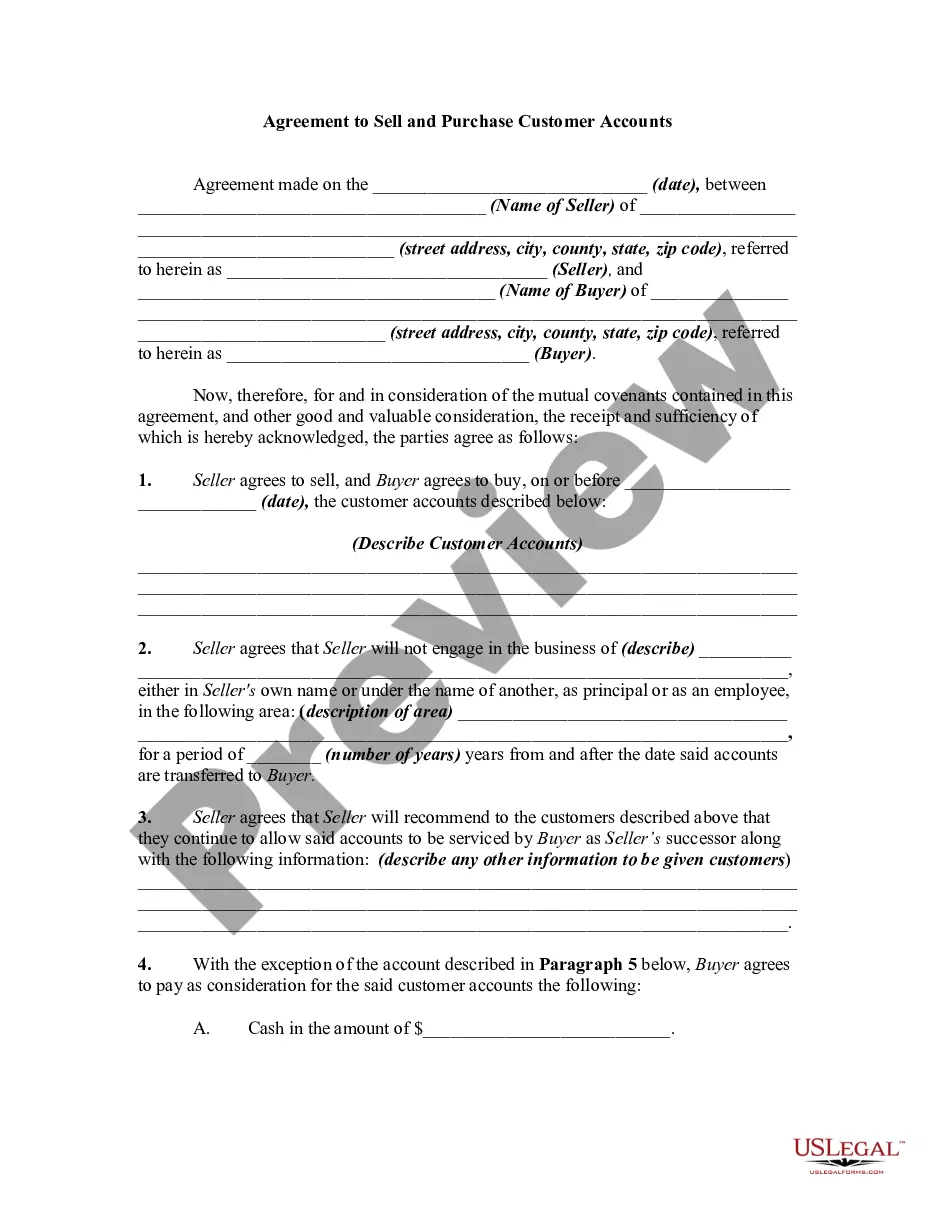

How to fill out Assignment Of Carried Working Interest?

US Legal Forms - one of the largest libraries of legal forms in the United States - gives a wide array of legal file web templates you are able to acquire or print. Utilizing the website, you will get thousands of forms for business and individual reasons, sorted by groups, claims, or keywords.You will discover the most recent models of forms just like the Pennsylvania Assignment of Carried Working Interest within minutes.

If you have a subscription, log in and acquire Pennsylvania Assignment of Carried Working Interest through the US Legal Forms catalogue. The Obtain key will appear on each develop you perspective. You have access to all previously delivered electronically forms within the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, here are easy directions to help you get started out:

- Be sure to have selected the best develop for your city/region. Click the Review key to check the form`s content. See the develop explanation to actually have chosen the appropriate develop.

- When the develop doesn`t suit your needs, utilize the Search industry on top of the display to find the one which does.

- In case you are satisfied with the form, verify your decision by visiting the Purchase now key. Then, opt for the pricing strategy you prefer and provide your references to sign up for an profile.

- Procedure the deal. Make use of charge card or PayPal profile to finish the deal.

- Find the structure and acquire the form on your product.

- Make alterations. Complete, revise and print and signal the delivered electronically Pennsylvania Assignment of Carried Working Interest.

Every format you added to your money lacks an expiry time which is your own eternally. So, in order to acquire or print another version, just go to the My Forms section and then click about the develop you want.

Gain access to the Pennsylvania Assignment of Carried Working Interest with US Legal Forms, probably the most comprehensive catalogue of legal file web templates. Use thousands of professional and state-specific web templates that meet your company or individual needs and needs.

Form popularity

FAQ

All Pennsylvania-taxable interest income must be reported on the PA-40, Individual Income Tax return.

You should have a Form W-2 from each employer. If you file a paper return, be sure to attach a copy of Form W-2 in the place indicated on the front page of your return. Attach it only to the front page of your paper return, not to any attachments.

PURPOSE OF SCHEDULE Partnerships and S corporations use PA Schedule RK-1 to report income and losses by class of income to each of its resident owners. A PA Schedule RK-1 is prepared for each individual partner or shareholder showing the share of income (losses) by class and other items required to be reported.

Corporations subject to the PA corporate net income tax (including PA S corporations that have Built-In-Gains) must continue to file RCT-101, PA Corporate Net Income Tax Report. RCT-101 is a revised, year specific, four page form and includes a revised Page 1, eliminating CS-FF and LOANS from Step D.

All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return.

If you are filing a paper return, you should attach any forms (such as a W-2) that show state withholding. If you are e-filing your return, there is no need to attach your W-2 to any of the forms.

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.