Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

If you desire to be thorough, obtain, or download official document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site’s straightforward and efficient search to locate the documents you require. Various templates for business and personal applications are categorized by types and states, or keywords.

Use US Legal Forms to find the Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it onto your device. Step 7. Fill out, modify, and print or sign the Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor. Each legal document template you download is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

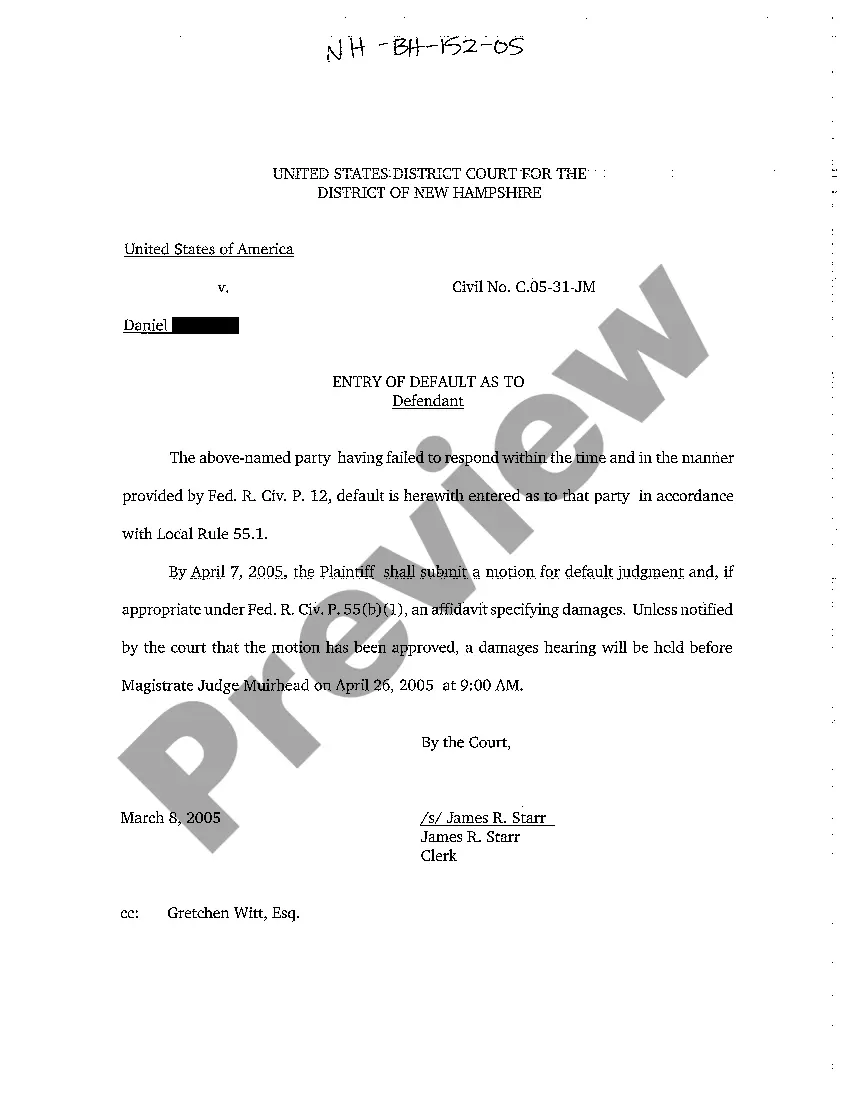

- Step 2. Use the Preview option to review the form’s content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms from the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the payment plan you prefer and enter your information to sign up for an account.

Form popularity

FAQ

To fill out a 1099 form for an independent contractor, enter your business information at the top and the contractor's information below. Report the total payments made to the contractor in Box 1. Finally, make sure to send copies to the contractor and the IRS before the deadline. Utilizing resources like uslegalforms can streamline this process for you, ensuring accuracy and compliance.

As a 1099 contractor, it's generally recommended to set aside about 25-30% of your earnings for taxes. This includes federal, state, and self-employment taxes. Being proactive about saving can prevent surprises come tax season, especially for a Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor. Tools like uslegalforms can help you calculate and track your tax obligations accurately.

An independent contractor typically needs to fill out a W-9 form to provide their taxpayer information to clients. They also may need to complete a 1099 form if they meet certain income thresholds. As a Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor, staying organized with these forms helps ensure compliance with tax laws. Platforms like uslegalforms can assist in managing these documents.

To show income as an independent contractor, keep detailed records of all payments received. You can use invoices to document your earnings and track payments. At tax time, these records will help you accurately report your income as a Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor. Consider using uslegalforms to create and manage your invoices efficiently.

Yes, an independent contractor is considered self-employed. This means you run your own business and are responsible for paying your taxes. As a Pennsylvania Self-Employed X-Ray Technician Self-Employed Independent Contractor, you have the freedom to choose your clients and set your schedule. This independence can lead to greater job satisfaction and financial opportunities.

Yes, independent contractors are synonymous with being self-employed. Both terms describe individuals who run their own businesses and are responsible for their work outcomes. For Pennsylvania self-employed X-ray technicians, understanding this distinction is important for managing their careers effectively and ensuring proper tax compliance.

The salary for an X-ray technician in Pennsylvania can vary based on experience and location, but on average, they earn between $50,000 and $70,000 annually. Those who operate as self-employed independent contractors may have the potential to earn more, depending on their client base and the services they offer. This flexibility appeals to many Pennsylvania self-employed X-ray technicians.

The main difference lies in the level of control and responsibility. Independent contractors, including Pennsylvania self-employed X-ray technicians, operate their own businesses and have more independence compared to employees, who typically follow their employer's directions. Additionally, independent contractors are responsible for their taxes and benefits, whereas employees usually receive these from their employers.

Yes, an independent contractor is indeed considered self-employed. This classification allows you to control your work schedule and business decisions. As a Pennsylvania self-employed X-ray technician independent contractor, you gain the freedom to choose your clients and set your rates.

Yes, if you work as an independent contractor, you are considered self-employed. This means you operate your own business and are responsible for managing your income and taxes. Many Pennsylvania self-employed X-ray technicians choose this path for its flexibility and potential for higher earnings.