Mississippi Revocable Trust Agreement when Settlors Are Husband and Wife

Description

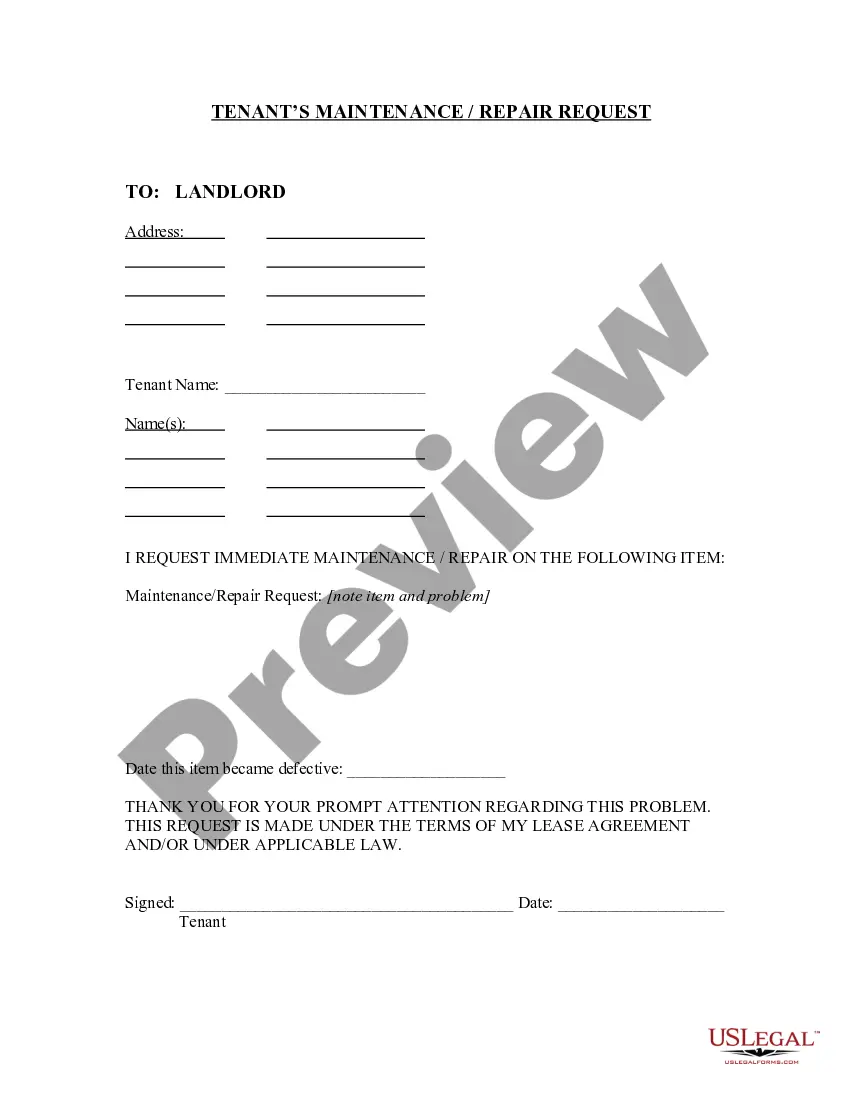

How to fill out Revocable Trust Agreement When Settlors Are Husband And Wife?

If you want to comprehensive, download, or print out legal document themes, use US Legal Forms, the biggest assortment of legal types, which can be found on the Internet. Make use of the site`s simple and practical research to get the paperwork you require. Numerous themes for business and specific reasons are sorted by types and states, or search phrases. Use US Legal Forms to get the Mississippi Revocable Trust Agreement when Settlors Are Husband and Wife in just a handful of click throughs.

If you are previously a US Legal Forms buyer, log in to your profile and click on the Acquire button to get the Mississippi Revocable Trust Agreement when Settlors Are Husband and Wife. Also you can gain access to types you in the past saved in the My Forms tab of the profile.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form to the right metropolis/nation.

- Step 2. Utilize the Review method to look over the form`s content material. Never overlook to learn the explanation.

- Step 3. If you are not satisfied with the form, use the Lookup area at the top of the monitor to find other types of the legal form web template.

- Step 4. Upon having found the form you require, go through the Purchase now button. Select the costs strategy you favor and add your references to register on an profile.

- Step 5. Procedure the purchase. You should use your charge card or PayPal profile to perform the purchase.

- Step 6. Pick the file format of the legal form and download it on your product.

- Step 7. Comprehensive, edit and print out or indication the Mississippi Revocable Trust Agreement when Settlors Are Husband and Wife.

Each legal document web template you purchase is the one you have forever. You have acces to each and every form you saved with your acccount. Click on the My Forms section and decide on a form to print out or download again.

Remain competitive and download, and print out the Mississippi Revocable Trust Agreement when Settlors Are Husband and Wife with US Legal Forms. There are many specialist and status-specific types you can utilize for the business or specific needs.

Form popularity

FAQ

Hear this out loud PauseUsually you'll consider the grantor/trustor and/or the beneficiary(ies) when picking a name. This leads to the vast majority of trusts being named after the family - Thompson Family Trust for example. Add first names for some variety/specificity - Tye and Tina Thompson Family Trust for example. How to Name Your Trust | Estate Planning - Bethel Law Corporation bethellaw.com ? blog ? how-to-name-your-t... bethellaw.com ? blog ? how-to-name-your-t...

The surviving spouse is the sole Settlor/Trustee/Beneficiary if one dies. In short, nothing changes.

Hear this out loud PauseIn general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk. Joint Trusts vs Separate Trusts for Married Couples | Trust & Will trustandwill.com ? learn ? joint-trust-vs-separate-tr... trustandwill.com ? learn ? joint-trust-vs-separate-tr...

Recommended for you For married couples, a Joint Revocable Trust might be able to offer a sense of confidence that begins the day you both sign. Read more about Joint Trusts and whether or not they're a smart choice for your circumstances.

A joint trust gives the surviving spouse more flexibility to use all of the assets of the trust after the death of the first spouse. A joint revocable trust is also easier to fund and maintain during a couple's lifetime. All assets simply go into the same place; there's no need to decide which trust an asset goes into.

Hear this out loud PauseA joint spousal trust is an inter vivos trust created after 1999 by a spouse who was aged 65 or over at the time, or by both spouses if they were both aged 65 or over at the time. The spouses have the exclusive right, during their lifetimes, to receive all income from the trust. Joint Spousal Trust | Revenu Quebec revenuquebec.ca ? trusts ? types-of-trusts ? j... revenuquebec.ca ? trusts ? types-of-trusts ? j...

The disclaimer trust approach Disclaimer trusts offer maximum flexibility where there is substantial trust between spouses, and each spouse wants the other to keep and use the household's combined property after the first spouse passes away.

Hear this out loud PauseThe Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust. Joint Trusts: A Useful Tool for Some Married Couples wardandsmith.com ? articles ? joint-trusts-a-... wardandsmith.com ? articles ? joint-trusts-a-...