Maryland Revocable Trust Agreement when Settlors Are Husband and Wife

Description

How to fill out Revocable Trust Agreement When Settlors Are Husband And Wife?

Choosing the best lawful papers format could be a have a problem. Obviously, there are plenty of layouts accessible on the Internet, but how can you discover the lawful form you want? Use the US Legal Forms web site. The services gives a large number of layouts, like the Maryland Revocable Trust Agreement when Settlors Are Husband and Wife, which you can use for enterprise and private demands. Each of the forms are inspected by professionals and fulfill federal and state needs.

In case you are currently authorized, log in to the accounts and then click the Download key to obtain the Maryland Revocable Trust Agreement when Settlors Are Husband and Wife. Use your accounts to search throughout the lawful forms you have purchased earlier. Go to the My Forms tab of your respective accounts and obtain one more backup of the papers you want.

In case you are a whole new consumer of US Legal Forms, listed below are basic recommendations so that you can stick to:

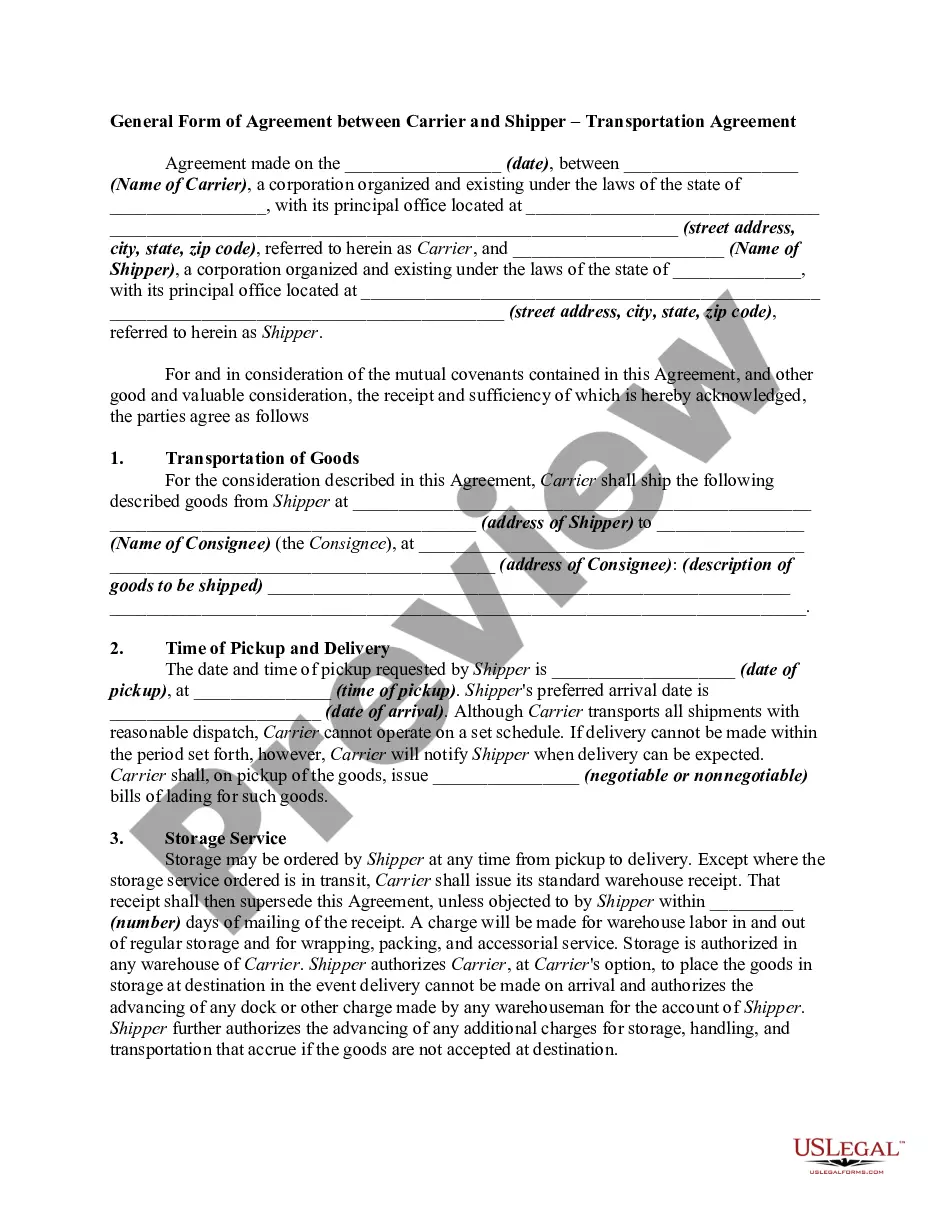

- First, be sure you have chosen the right form for the metropolis/area. You are able to examine the shape making use of the Review key and read the shape information to make certain this is basically the right one for you.

- If the form fails to fulfill your requirements, make use of the Seach field to discover the right form.

- When you are positive that the shape is acceptable, go through the Get now key to obtain the form.

- Choose the costs strategy you would like and enter the essential info. Build your accounts and pay money for the order using your PayPal accounts or Visa or Mastercard.

- Select the document file format and down load the lawful papers format to the product.

- Full, edit and produce and sign the attained Maryland Revocable Trust Agreement when Settlors Are Husband and Wife.

US Legal Forms is definitely the greatest collection of lawful forms for which you can find various papers layouts. Use the company to down load expertly-manufactured papers that stick to status needs.

Form popularity

FAQ

Hear this out loud PauseThe surviving spouse is the sole Settlor/Trustee/Beneficiary if one dies. In short, nothing changes.

Hear this out loud PauseA Joint Trust is a single Trust document that covers both spouses and offers provisions for what happens upon the death of each. These specific types of Trusts may be particularly useful for married couples who live in a Community Property state.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Hear this out loud PauseA Declaration of Trust is a legal document that declares who owns an asset or property and who will benefit from it. On the other hand, a Trust Agreement is an agreement between two parties where one party agrees to hold assets for another party's benefit.

A joint trust gives the surviving spouse more flexibility to use all of the assets of the trust after the death of the first spouse. A joint revocable trust is also easier to fund and maintain during a couple's lifetime. All assets simply go into the same place; there's no need to decide which trust an asset goes into.

A basic revocable joint trust agreement (also referred to as a trust instrument or declaration of trust) for married couples that can be customized for use in any US jurisdiction. Married individuals as joint settlors may use this trust to hold and administer their assets and property during their lifetimes.

Two Settlor and One-Settlor Trusts - Trusts can be created by multiple persons, for example couples (married or otherwise), or one person.

Hear this out loud PauseFor example, if you gave your child enough money to pay for their entire deposit, a declaration of trust could ensure they got that back if the relationship broke down. This agreement is typically made when the property is purchased.