Pennsylvania Self-Employed Independent Contractor Esthetics Agreement

Description

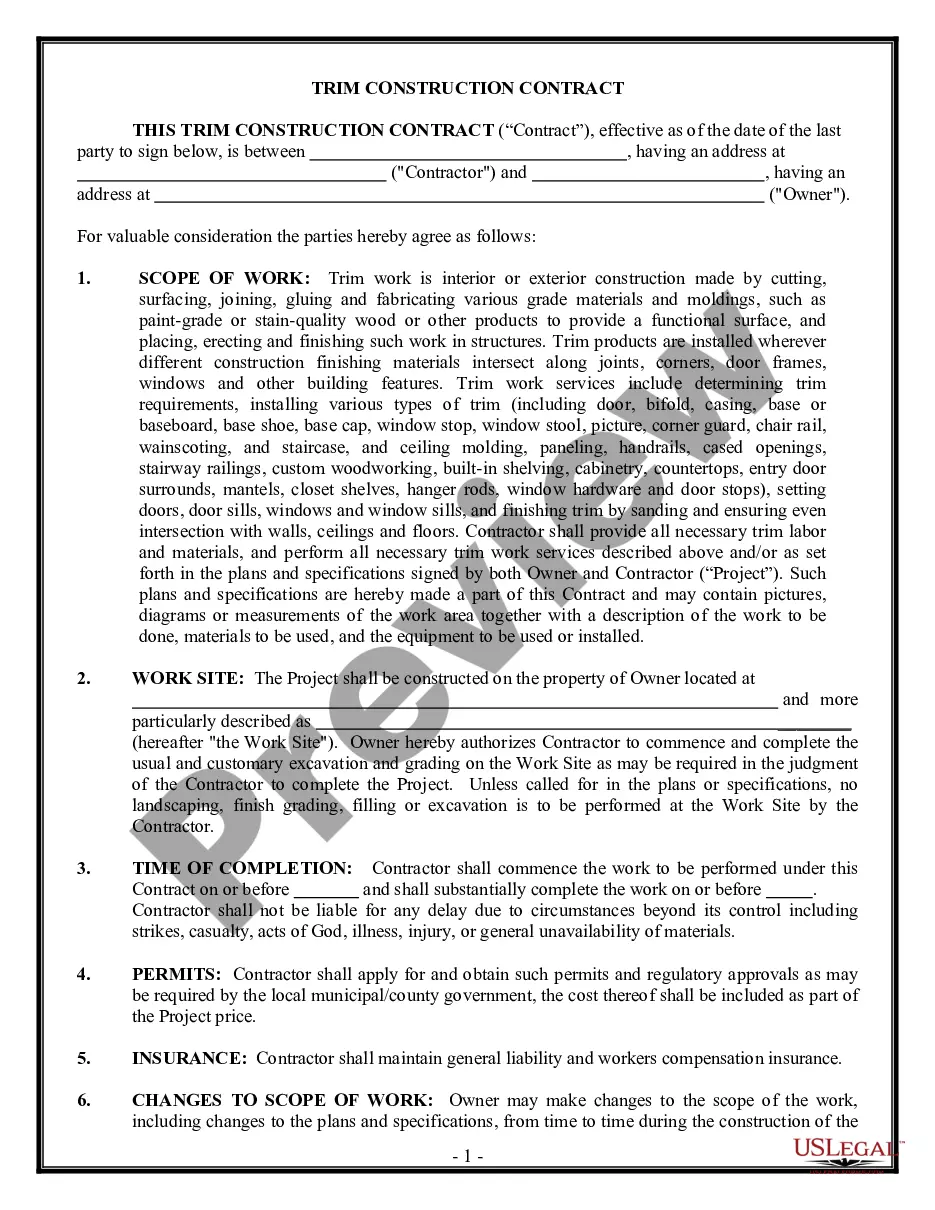

How to fill out Self-Employed Independent Contractor Esthetics Agreement?

US Legal Forms - one of the largest collections of legal documents in the country - provides a vast array of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms like the Pennsylvania Self-Employed Independent Contractor Esthetics Agreement in moments.

If you already have a subscription, Log In and download the Pennsylvania Self-Employed Independent Contractor Esthetics Agreement from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Make edits. Fill out, modify, and print and sign the downloaded Pennsylvania Self-Employed Independent Contractor Esthetics Agreement.

Every template you added to your account does not have an expiration date and belongs to you indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Pennsylvania Self-Employed Independent Contractor Esthetics Agreement with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state. Click the Review button to examine the form's content. Check the form details to make sure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your credentials to register for the account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

To become an independent contractor in Pennsylvania, start by determining the services you want to offer and registering your business. Next, establish a Pennsylvania Self-Employed Independent Contractor Esthetics Agreement to outline your commitments and responsibilities with clients. This agreement protects both you and your clients. Moreover, ensure you understand any tax obligations and obtain the necessary insurance to operate legally and safely.

In Pennsylvania, you do not need a general contractor license to work as an independent contractor. However, specific trades may require licensing or permits based on local regulations. Additionally, when establishing a Pennsylvania Self-Employed Independent Contractor Esthetics Agreement, you should verify these requirements to ensure compliance. It's essential to conduct research or consult with local authorities to stay informed about any necessary licenses related to your profession.

An independent contractor agreement in Pennsylvania is a legal document detailing the relationship between a contractor and a client. It outlines the scope of work, payment terms, and obligations of both parties. Understanding this agreement is vital for compliance with Pennsylvania's laws, especially when establishing a Pennsylvania Self-Employed Independent Contractor Esthetics Agreement. Using trusted platforms like uslegalforms can provide you with the right templates and guidance.

To fill out an independent contractor agreement, begin with the basics like the names and addresses of both parties. Clearly describe the services to be provided, including payment terms and project deadlines. Always strive for clarity, and if you need assistance, consider using uslegalforms to create your Pennsylvania Self-Employed Independent Contractor Esthetics Agreement efficiently.

Yes, an independent contractor is typically considered self-employed. This means they operate their own business and are responsible for managing their taxes and expenses. Understanding this distinction is crucial when drafting your Pennsylvania Self-Employed Independent Contractor Esthetics Agreement. Make sure your agreement reflects this self-employment status accurately.

Filling out an independent contractor form requires attention to specific details. Begin by entering your personal information and the nature of the work. Additionally, specify compensation rates and payment schedules. Utilizing resources like uslegalforms can guide you in creating a Pennsylvania Self-Employed Independent Contractor Esthetics Agreement tailored to your needs.

To write an independent contractor agreement, start by clearly outlining the nature of the work and the expectations. Include critical elements such as payment terms, deadlines, and confidentiality clauses. A well-structured Pennsylvania Self-Employed Independent Contractor Esthetics Agreement can help both parties understand their rights and responsibilities. For a comprehensive template, consider using platforms like uslegalforms.