Pennsylvania Government Contractor Agreement - Self-Employed

Description

How to fill out Government Contractor Agreement - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

Using the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Pennsylvania Government Contractor Agreement - Self-Employed in just moments.

If you already have an account, Log In and download the Pennsylvania Government Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make adjustments. Fill out, edit, print, and sign the downloaded Pennsylvania Government Contractor Agreement - Self-Employed. Each template you have added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Pennsylvania Government Contractor Agreement - Self-Employed with US Legal Forms, the most comprehensive library of legal document templates. Utilize countless professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your area/location.

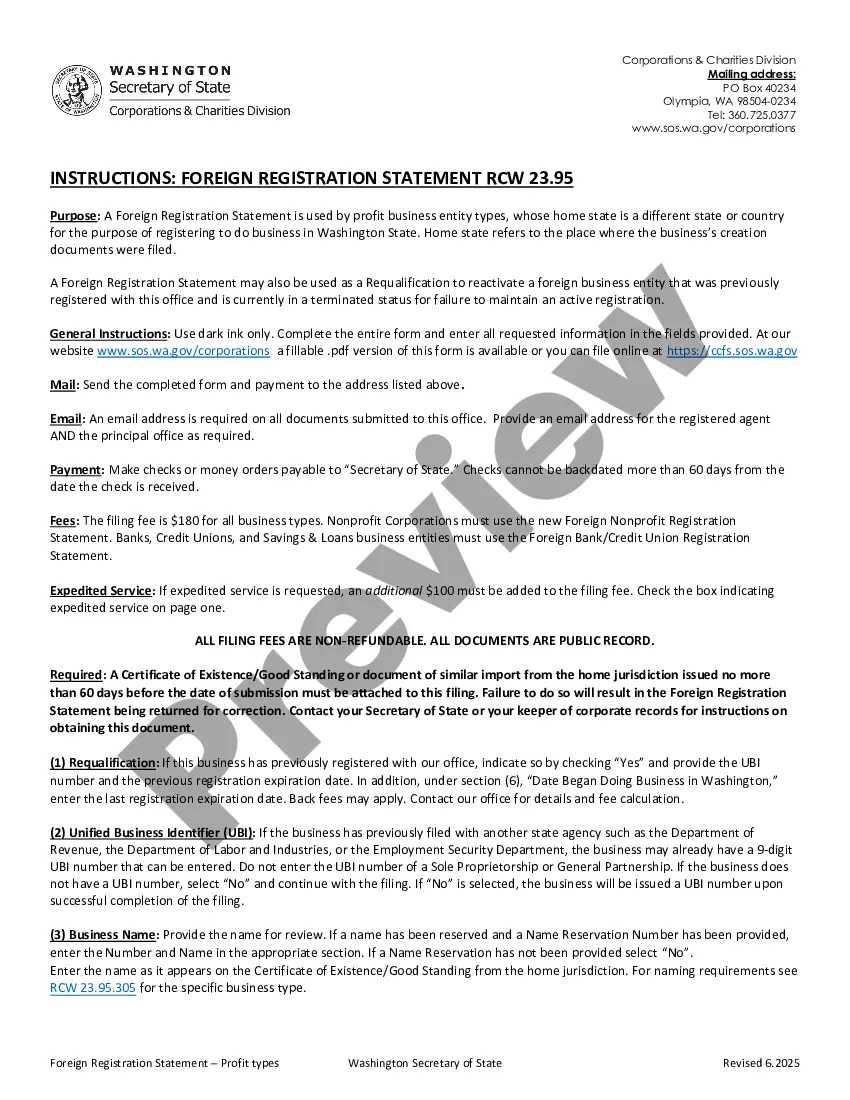

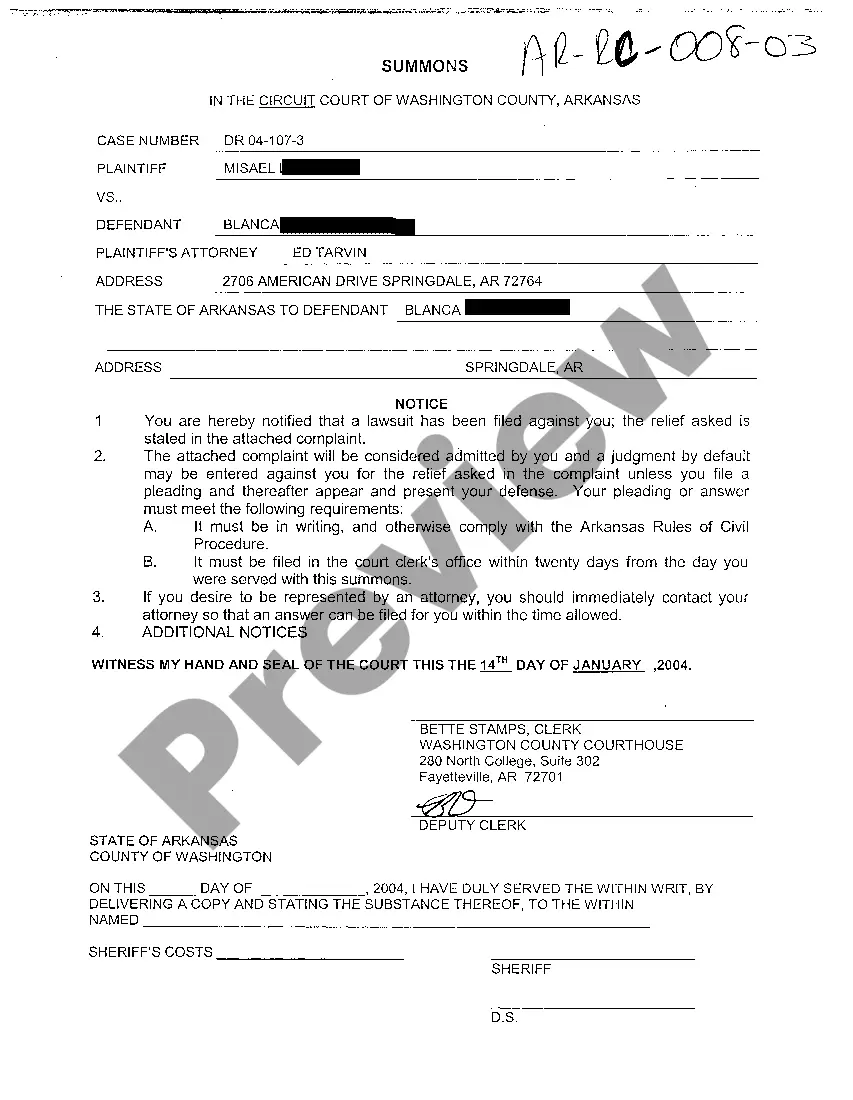

- Click the Preview button to review the form's contents.

- Check the form summary to ensure you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

A standard independent contractor clause typically defines the work relationship while emphasizing that the contractor is not an employee. It usually includes aspects such as liability, indemnification, and payment structure. Incorporating a solid Pennsylvania Government Contractor Agreement - Self-Employed can help reinforce this clause, providing clarity on responsibilities and expectations for both parties.

The purpose of an independent contractor agreement is to outline the terms of the working relationship between the contractor and the hiring party. It specifies payment terms, project scope, deadlines, and other essential details. Having a well-crafted Pennsylvania Government Contractor Agreement - Self-Employed can prevent misunderstandings and legal issues, ensuring both parties are on the same page.

An independent contractor in Pennsylvania is an individual or business that provides services to another entity under terms specified in a contract. This type of worker retains control over how they complete their work, setting their own hours and methods. Understanding the Pennsylvania Government Contractor Agreement - Self-Employed is crucial for establishing clear expectations and responsibilities in your working relationship.

A contract must typically include the names of the parties involved, a clear description of the services or products to be delivered, payment terms, deadlines, confidentiality clauses, and procedures for contract termination. Each of these items is vital in a Pennsylvania Government Contractor Agreement - Self-Employed. Including specified items helps ensure that both parties are protected and have a clear roadmap for the relationship.

Writing a self-employed contract involves detailing the services you provide, payment schedules, and working conditions. Be sure to specify any relevant legal requirements in a Pennsylvania Government Contractor Agreement - Self-Employed. This document should reflect both parties’ understanding and include terms that protect your rights and responsibilities, ensuring smooth collaboration.

A contractor's contract should include the scope of work, payment terms, deadlines, and the procedure for resolving disputes. Additionally, a well-drafted Pennsylvania Government Contractor Agreement - Self-Employed may specify ownership of work product and confidentiality obligations. By including comprehensive details, you create a robust contract that supports a successful outcome for both parties.

To fill out an independent contractor agreement, start by entering the basic information of both parties, including names and contact details. Clearly outline the tasks to be performed, payment terms, and deadlines to align with a Pennsylvania Government Contractor Agreement - Self-Employed. Ensure all parties review the document before signing, as doing so can help avoid future disputes and foster professional relationships.

Filling out a declaration of independent contractor status form requires you to provide accurate information about your business and employment status. You must state that you are independently contracted and not an employee under the Pennsylvania Government Contractor Agreement - Self-Employed. Be sure to include details about your work arrangements and services offered, along with supporting documentation as needed.

A Pennsylvania contract should include essential elements like the names of the parties, the scope of work, payment terms, deadlines, and confidentiality clauses if necessary. Including these components in your Pennsylvania Government Contractor Agreement - Self-Employed fosters clarity and protects both parties' interests. Using a detailed contract can also mitigate the risks often associated with contractor relationships.

In Pennsylvania, a contractor contract must include specific details such as the services to be provided, compensation, project timeline, and conditions for termination. It is important for the Pennsylvania Government Contractor Agreement - Self-Employed to outline the responsibilities of both parties clearly. This ensures that expectations are set and reduces the potential for misunderstandings.