Pennsylvania Catering Services Contract - Self-Employed Independent Contractor

Description

How to fill out Catering Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the foremost collections of legal documents in the United States - offers a vast selection of legal template documents that you can download or print.

With the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest documents like the Pennsylvania Catering Services Contract - Self-Employed Independent Contractor in moments.

If you already have a subscription, Log In and access the Pennsylvania Catering Services Contract - Self-Employed Independent Contractor in the US Legal Forms library. The Download button will appear on each document you view. You can find all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document to your device. Make edits. Fill out, modify, print, and sign the saved Pennsylvania Catering Services Contract - Self-Employed Independent Contractor.

Each template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you want.

Access the Pennsylvania Catering Services Contract - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/state.

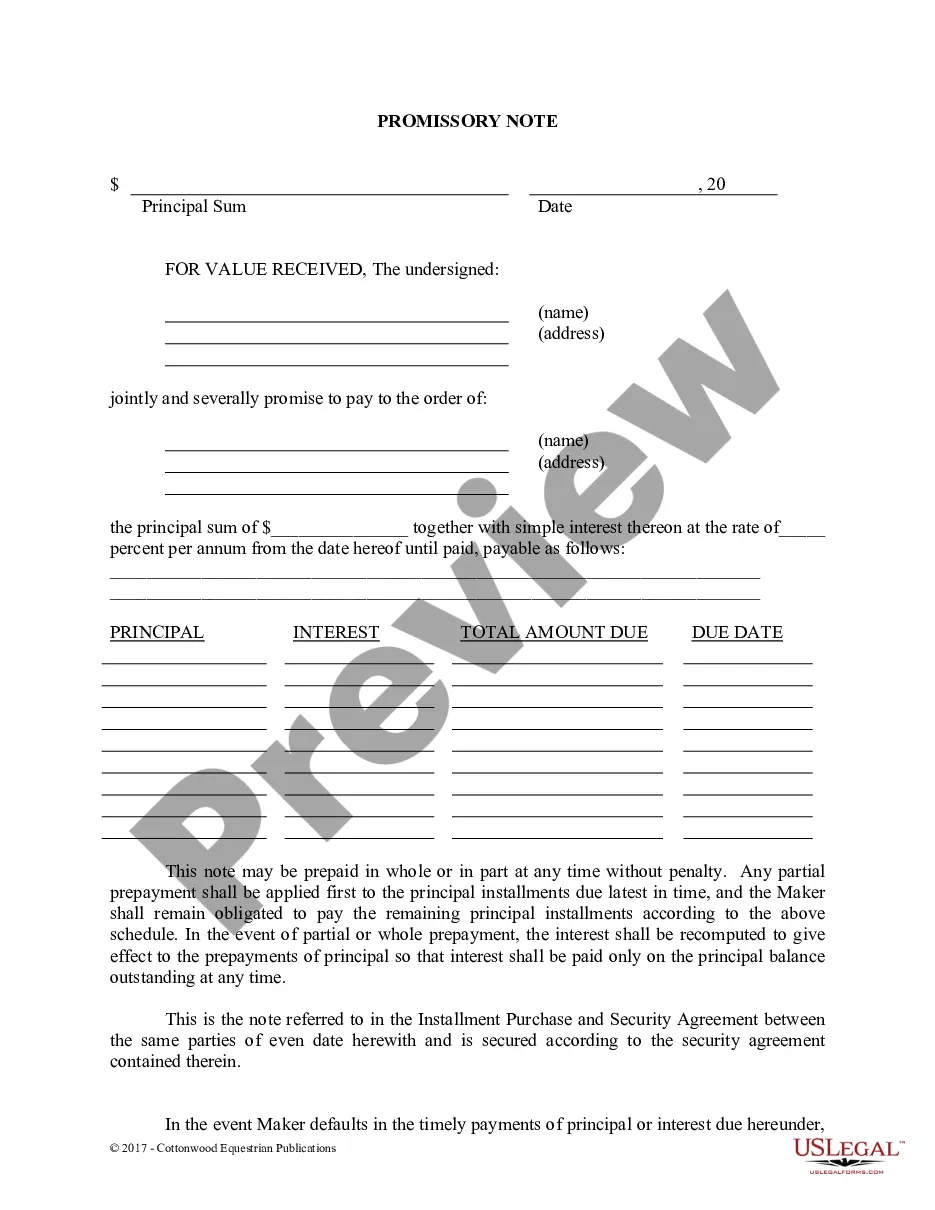

- Review the Preview button to examine the form's content.

- Check the form details to ensure you have selected the correct document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, select the pricing plan you want and provide your information to register for the account.

Form popularity

FAQ

To fill out an independent contractor form correctly, begin by providing your full name and contact information at the top. Then, specify the nature of the work under the Pennsylvania Catering Services Contract - Self-Employed Independent Contractor title, including payment terms and any other relevant details. Finally, review the completed form to ensure accuracy and clarity, making any necessary corrections before submission.

An independent contractor typically fills out forms such as the W-9 for tax purposes, which collects the contractor's basic information. Depending on your situation, you may also need to create or reference a Pennsylvania Catering Services Contract - Self-Employed Independent Contractor. Additionally, keep any invoices or payment records for your own documentation, as these will help you track your finances over time.

Writing an independent contractor agreement involves outlining the roles and expectations clearly. Start with an introduction that names the parties involved, followed by sections outlining the services, payment details, and project timeline. The Pennsylvania Catering Services Contract - Self-Employed Independent Contractor should serve as a guide for structuring your content. Be explicit about the deliverables and include termination clauses to safeguard all parties.

To fill out an independent contractor agreement, begin by entering the names of both parties, including the business and the contractor. Next, detail the scope of work to be completed under the Pennsylvania Catering Services Contract - Self-Employed Independent Contractor framework. Include payment terms and deadlines to ensure clarity. Lastly, both parties should sign and date the document to finalize the agreement.

An independent contractor agreement in Pennsylvania is a legal document that outlines the working relationship between a contractor and a client. This agreement specifies the terms of service, payment structures, confidentiality clauses, and liabilities. For those in the catering industry, a well-crafted agreement ensures all parties understand their roles and protections. You can find templates for a Pennsylvania Catering Services Contract - Self-Employed Independent Contractor for these requirements.

Independent contractors in Pennsylvania typically do not need workers' compensation coverage unless they have employees working for them. However, it can be beneficial to obtain coverage voluntarily to protect against work-related injuries. If you're a self-employed contractor in the catering field, prioritizing your protection is wise. Using a Pennsylvania Catering Services Contract - Self-Employed Independent Contractor can clarify your responsibilities.

Certain individuals are exempt from workers' compensation requirements in Pennsylvania, including independent contractors and sole proprietors without employees. However, it is essential to confirm your specific classification and obligations. You may want to review your status with a legal professional to avoid any compliance issues. Understanding these laws can also be supported by a Pennsylvania Catering Services Contract - Self-Employed Independent Contractor.

An independent contractor, particularly in the catering field, should consider obtaining liability insurance to protect against potential claims. Additionally, professional indemnity insurance may provide coverage for mistakes or omissions in your service. These insurance types help safeguard your financial interests as a self-employed contractor. A comprehensive Pennsylvania Catering Services Contract - Self-Employed Independent Contractor can further specify the necessary insurance details.

Yes, independent contractors typically file their taxes as self-employed individuals. You will report your income and expenses on Schedule C, included with your personal tax return. This process allows for the deduction of business expenses, enhancing your overall tax situation. Using a Pennsylvania Catering Services Contract - Self-Employed Independent Contractor can help you better manage and organize your earnings.

To create an independent contractor contract, begin by outlining the key terms of your relationship, like the scope of work, payment details, and deadlines. Make sure to include specific clauses related to termination, confidentiality, and liability, particularly for your catering business. Utilizing templates available on platforms like uslegalforms can simplify this process. A Pennsylvania Catering Services Contract - Self-Employed Independent Contractor template helps ensure you cover all essential aspects.