Pennsylvania Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made."

How to fill out Angel Fund Promissory Note Term Sheet?

US Legal Forms - among the most significant libraries of legitimate forms in the USA - provides a variety of legitimate file layouts you may down load or print out. Utilizing the web site, you may get a large number of forms for organization and specific functions, sorted by types, says, or search phrases.You will find the most up-to-date versions of forms such as the Pennsylvania Angel Fund Promissory Note Term Sheet in seconds.

If you already possess a monthly subscription, log in and down load Pennsylvania Angel Fund Promissory Note Term Sheet in the US Legal Forms library. The Download option can look on each type you view. You get access to all formerly downloaded forms from the My Forms tab of the account.

If you would like use US Legal Forms for the first time, here are easy instructions to help you began:

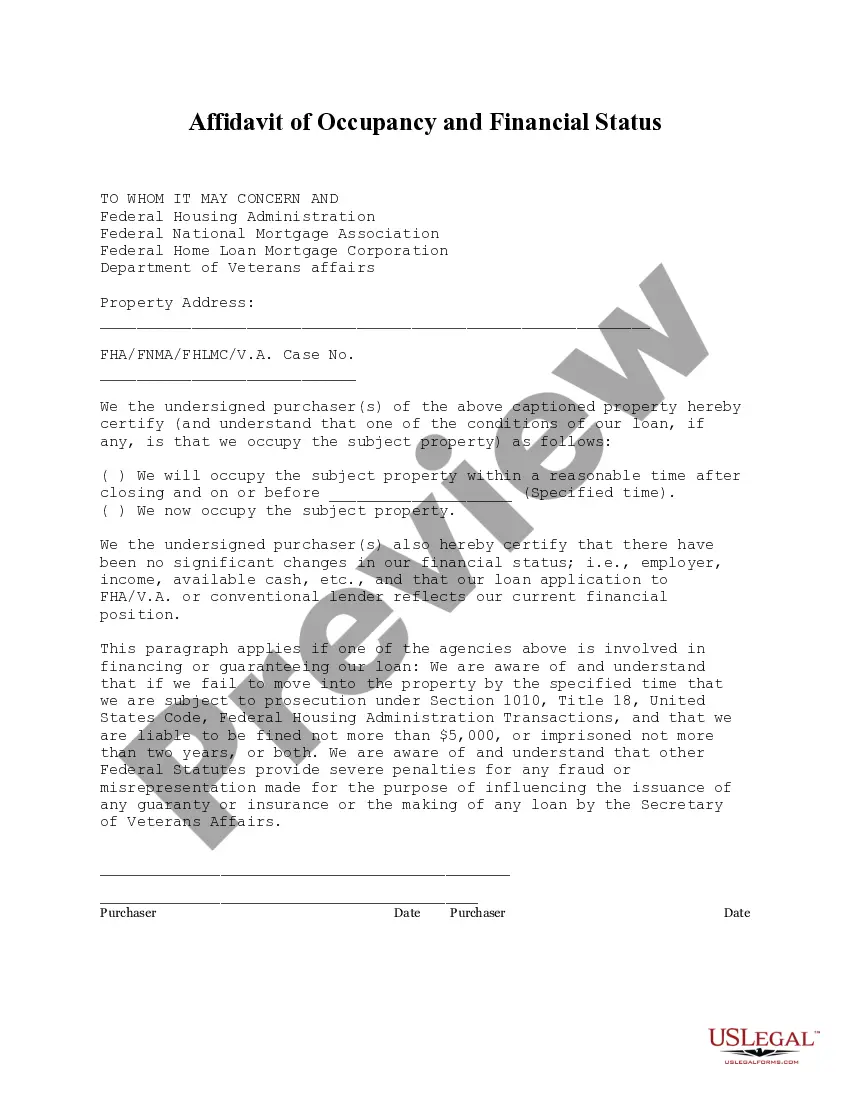

- Make sure you have picked the right type for your metropolis/state. Click on the Preview option to review the form`s information. Look at the type explanation to actually have chosen the appropriate type.

- When the type doesn`t match your requirements, take advantage of the Lookup discipline on top of the display screen to find the one who does.

- In case you are happy with the form, confirm your choice by clicking the Acquire now option. Then, choose the costs program you prefer and give your credentials to register for the account.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal account to perform the purchase.

- Find the structure and down load the form on your own device.

- Make modifications. Fill out, revise and print out and sign the downloaded Pennsylvania Angel Fund Promissory Note Term Sheet.

Every template you added to your money does not have an expiry particular date and it is your own property eternally. So, in order to down load or print out another version, just visit the My Forms area and click on about the type you require.

Gain access to the Pennsylvania Angel Fund Promissory Note Term Sheet with US Legal Forms, the most comprehensive library of legitimate file layouts. Use a large number of specialist and express-distinct layouts that fulfill your organization or specific requires and requirements.

Form popularity

FAQ

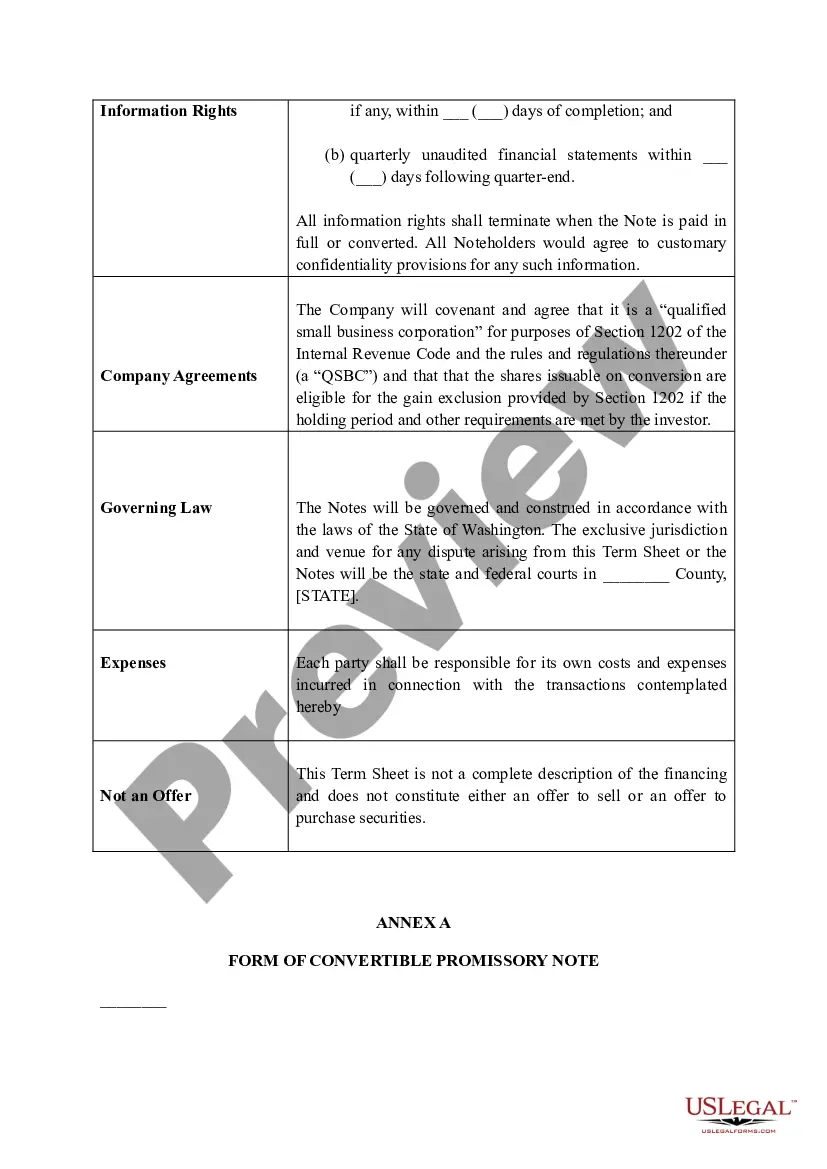

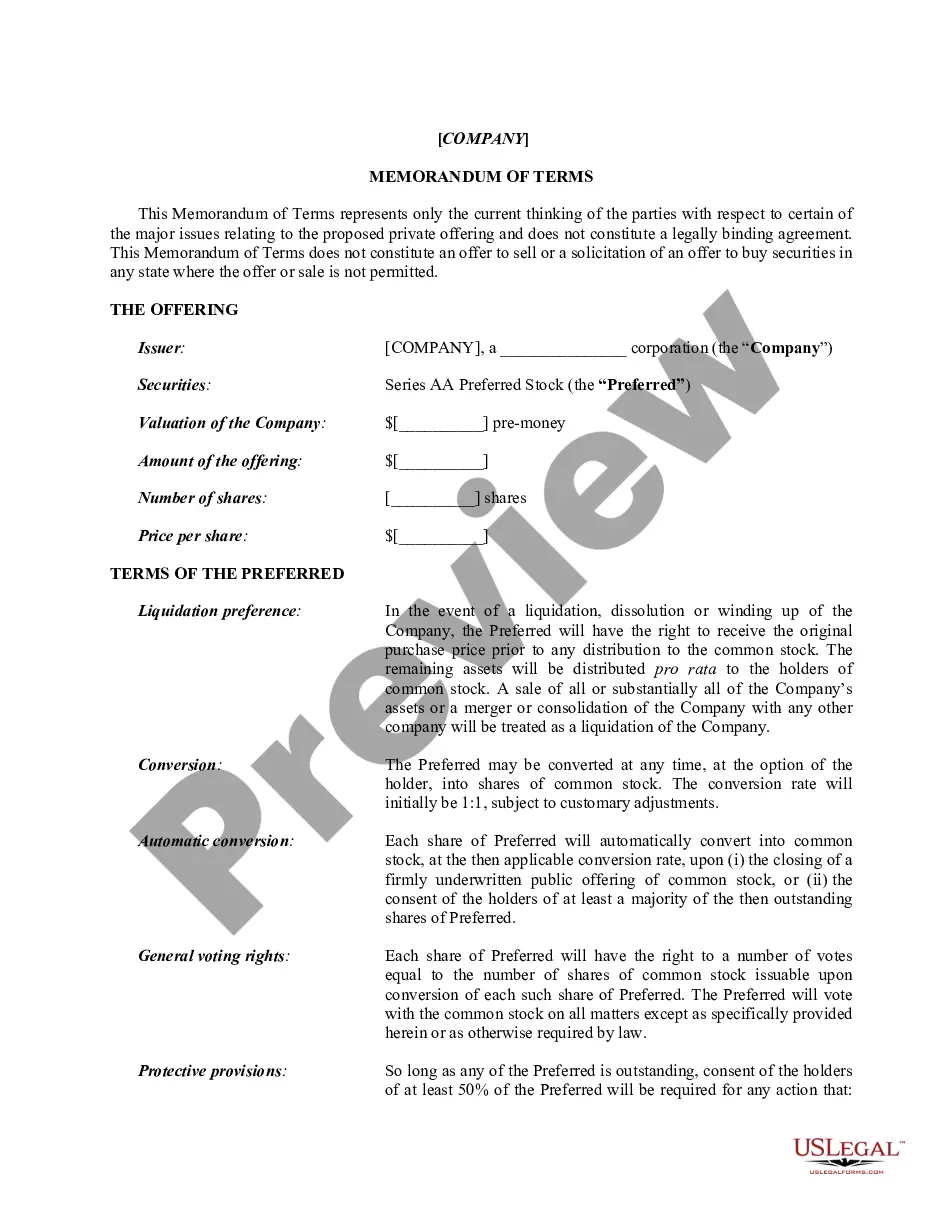

A venture capital (VC) term sheet is a statement of the proposed terms and conditions for a proposed investment. Most of the terms are non-binding, except for certain confidentiality and exclusivity rights. Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

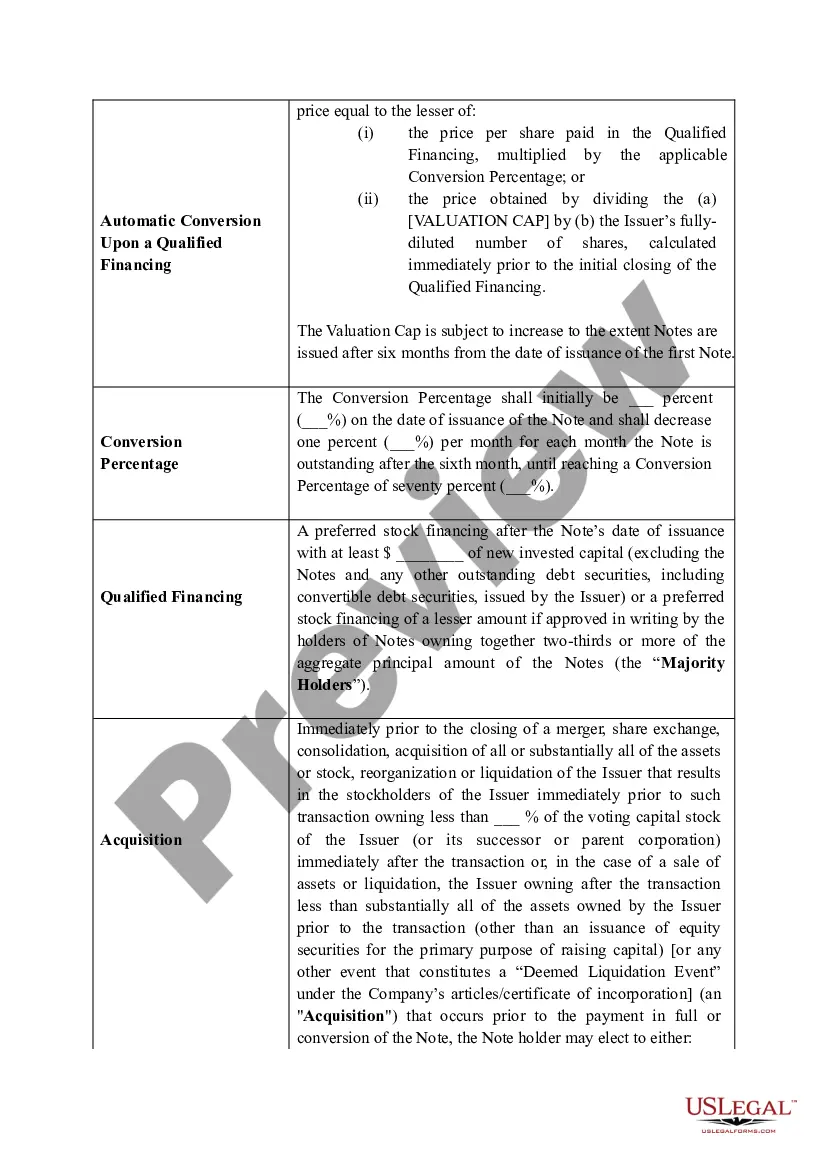

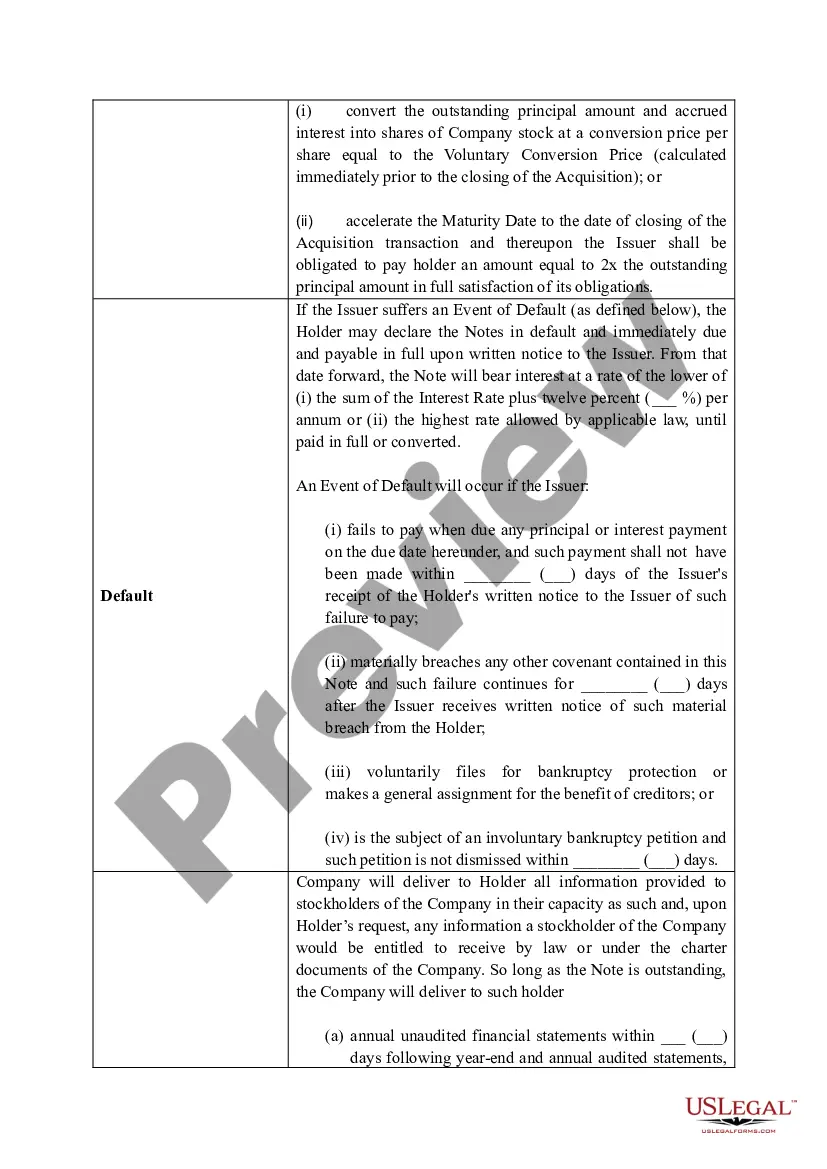

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

A convertible note is a short-term debt agreement that converts into equity at a future date. Usually, this happens when one of these events takes place: The company raises enough capital to reach a pre-determined benchmark. The term of the loan expires.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Convertible notes have a few key components: Conversion discount. Valuation cap. Interest rate. Maturity Date.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Convertible notes are debts that convert into equity. The SAFE note allows holders to acquire shares at a future equity financing event at a fixed and discounted price. With SAFE notes, the investors will purchase the preferred stock or an initial public offering filed by the company.