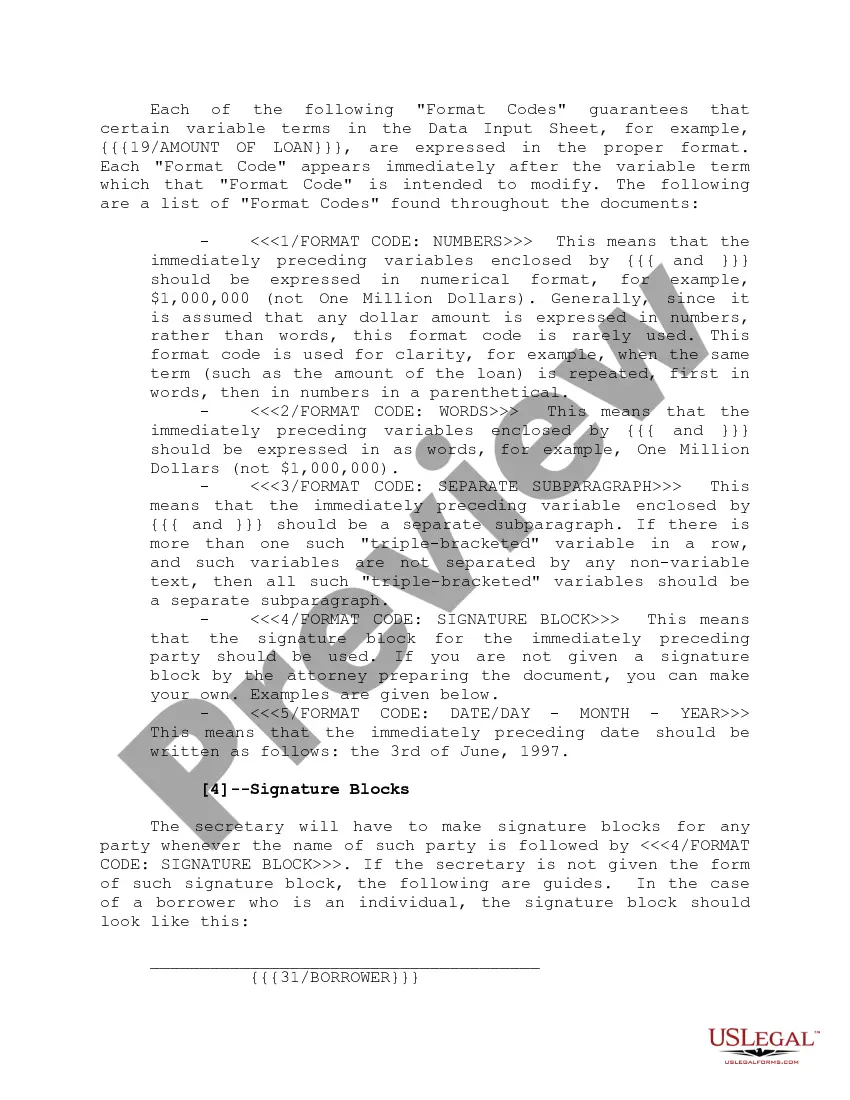

"Data Input Sheet" is a American Lawyer Media form. This is a form is an instructional form on how to fill out the different real estate forms.

Pennsylvania Data Input Sheet

Description

How to fill out Data Input Sheet?

If you need to comprehensive, down load, or printing lawful record templates, use US Legal Forms, the biggest assortment of lawful kinds, that can be found on the Internet. Make use of the site`s basic and practical lookup to discover the paperwork you will need. Different templates for company and specific reasons are sorted by categories and states, or keywords and phrases. Use US Legal Forms to discover the Pennsylvania Data Input Sheet in just a number of clicks.

When you are currently a US Legal Forms customer, log in to the profile and then click the Obtain switch to obtain the Pennsylvania Data Input Sheet. You may also gain access to kinds you previously delivered electronically within the My Forms tab of your profile.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that correct metropolis/country.

- Step 2. Make use of the Preview option to look through the form`s information. Never neglect to read through the outline.

- Step 3. When you are not happy with the type, utilize the Search discipline at the top of the display screen to find other variations of the lawful type format.

- Step 4. When you have found the form you will need, click the Acquire now switch. Opt for the rates prepare you like and include your references to sign up for the profile.

- Step 5. Method the purchase. You may use your bank card or PayPal profile to accomplish the purchase.

- Step 6. Choose the format of the lawful type and down load it on your system.

- Step 7. Comprehensive, change and printing or indicator the Pennsylvania Data Input Sheet.

Each lawful record format you get is your own property permanently. You have acces to each type you delivered electronically in your acccount. Click the My Forms area and pick a type to printing or down load once more.

Contend and down load, and printing the Pennsylvania Data Input Sheet with US Legal Forms. There are millions of specialist and condition-certain kinds you can utilize for your personal company or specific requires.

Form popularity

FAQ

Do I Have to Pay Income Tax in Pennsylvania? Full-year residents, part-year residents, and nonresidents are all required to file an income tax return in Pennsylvania once they have made over $1 in taxable income, even if no tax is due.

Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

Check or Money Order Carefully enter the amount of the payment. Make the check or money order payable to the PA DEPARTMENT OF REVENUE. Please write on the check or money order: The last four digits of the primary taxpayer's SSN; ? "2022 PA-40 V"; and ? Daytime telephone number of the taxpayer(s).

Income received as wages, salaries, commissions, rental income, royalty payments, stock options, dividends and interest, and self-employment income are taxable. Unemployment compensation generally is taxable.

Arrange your documents in the following order when submitting your 2022 PA tax return: Original PA-40. Do not mail a photocopy of your PA-40 or a copy of your electronic PA tax return. Federal Forms, W-2, 1099-R, 1099-MISC, 1099-NEC.

How Income Taxes Are Calculated. First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

Most likely, the difference between the federal and state compensation is the amount you contributed toward an employer sponsored pension plan, which is excluded from tax on your federal return, but not on your state income tax return.

For individual filers, calculating federal taxable income starts by taking all income minus ?above the line? deductions and exemptions, like certain retirement plan contributions, higher education expenses and student loan interest, and alimony payments, among others.