Pennsylvania Book Value Phantom Stock Plan of First Florida Banks, Inc.

Description

How to fill out Book Value Phantom Stock Plan Of First Florida Banks, Inc.?

Have you been in a place in which you need paperwork for either enterprise or individual functions virtually every day time? There are plenty of lawful papers web templates available on the net, but locating versions you can rely is not easy. US Legal Forms delivers a large number of type web templates, just like the Pennsylvania Book Value Phantom Stock Plan of First Florida Banks, Inc., that are composed to satisfy state and federal needs.

Should you be presently informed about US Legal Forms site and also have an account, basically log in. Afterward, you can down load the Pennsylvania Book Value Phantom Stock Plan of First Florida Banks, Inc. template.

Should you not provide an accounts and want to start using US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is to the appropriate metropolis/county.

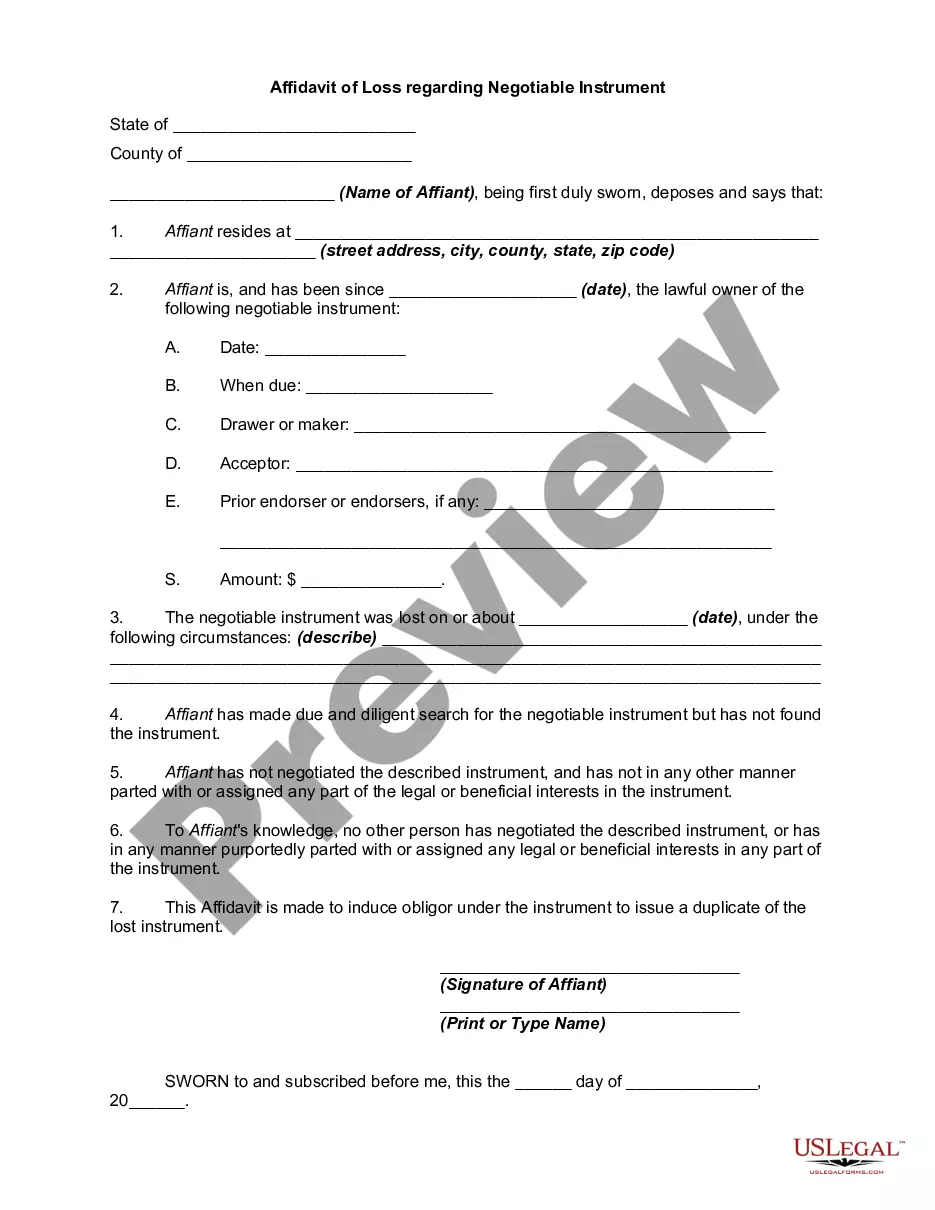

- Utilize the Preview key to examine the form.

- Read the description to actually have chosen the right type.

- When the type is not what you are seeking, utilize the Look for discipline to find the type that meets your needs and needs.

- Once you discover the appropriate type, click Buy now.

- Opt for the rates strategy you need, fill out the specified information and facts to generate your bank account, and buy the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient paper format and down load your copy.

Find each of the papers web templates you might have purchased in the My Forms food selection. You can get a further copy of Pennsylvania Book Value Phantom Stock Plan of First Florida Banks, Inc. any time, if possible. Just select the necessary type to down load or print out the papers template.

Use US Legal Forms, by far the most comprehensive selection of lawful kinds, to conserve some time and avoid mistakes. The assistance delivers expertly produced lawful papers web templates which you can use for an array of functions. Create an account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

If a business is sold, employees that own phantom stock receive money that is equal to the amount they would have received had they owned actual stock in the company. For that reason, it's financially beneficial to employees to own phantom stock, as they don't need to worry about dilution.

It is possible to create a phantom stock plan that avoids the application of 409A rules. The key requirement would be to (a) use cliff vesting (any incremental vesting must trigger immediate payment), and (b) pay benefits within 2½ months of the end of the year in which the awards vest.

Phantom shares are usually paid out when the company gets acquired or IPOes. The phantom shares are paid out in cash for their corresponding value.

As a default, this form plan provides for forfeiture of all unvested phantom stock units upon a participant's termination of employment (subject to the terms of the award agreement).

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock).

Phantom stock plans are considered ?liability awards? for accounting purposes (assuming they will be settled in cash rather than stock). As such, the sponsoring company must recognize the plan expense ratably over the vesting period. Varying accrual schedules can be found in the market.

The plan may provide for a single payment, or it may provide for installment payments over a period of time after the phantom stock vests. In some cases, the employer may let the employee elect to receive the payout in the form of an equivalent amount of stock.

However, phantom stocks come with a considerable amount of disadvantages that can diminish participants' perceived control and influence, strain company liquidity, require extensive administrative efforts, introduce tax complexities, create disagreements, and subject participants to volatility in financial benefits ...

A cash payment from Company A as the difference between the current common share price and phantom stock issue price: ($70 ? $50) x 500 = $10,000; or. A cash payment from Company A equal to the current common share price: $50 x 500 = $25,000.