Pennsylvania Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

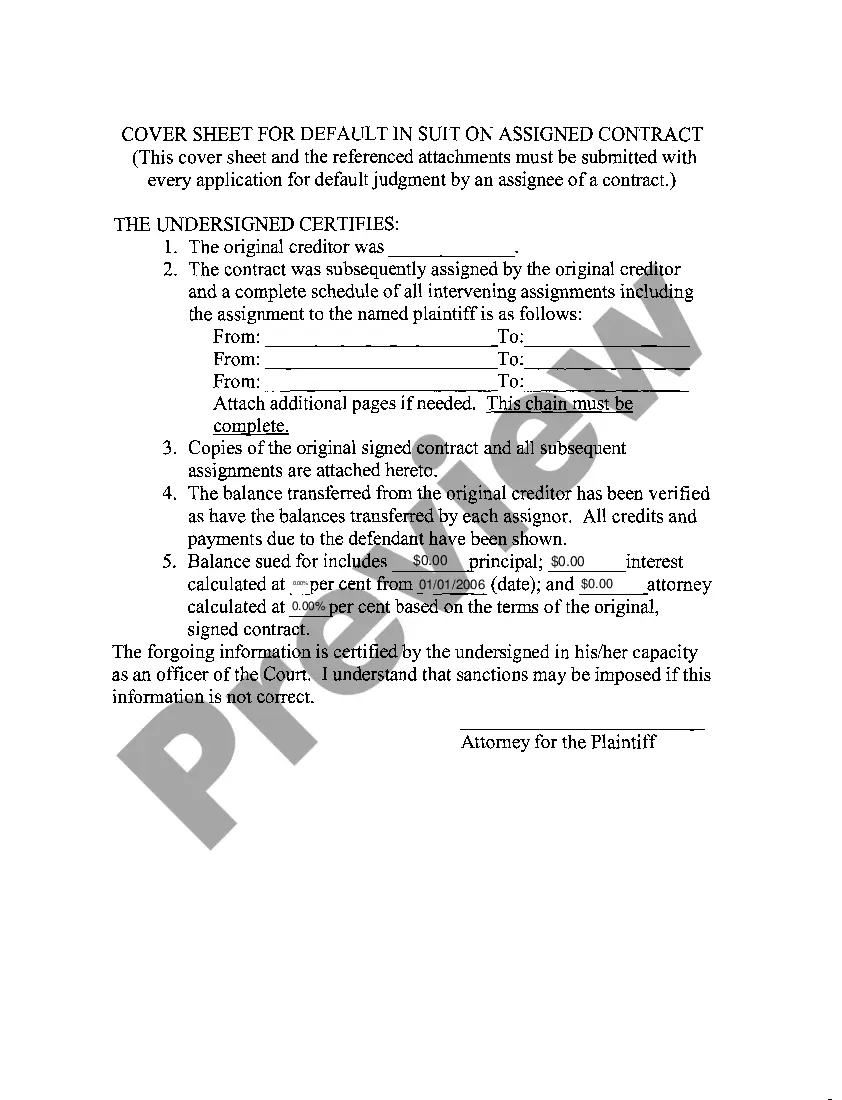

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

US Legal Forms - among the greatest libraries of legitimate kinds in the USA - gives a wide range of legitimate papers layouts you may acquire or printing. Utilizing the website, you may get thousands of kinds for business and individual uses, sorted by types, suggests, or keywords and phrases.You will find the most recent models of kinds like the Pennsylvania Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 in seconds.

If you have a monthly subscription, log in and acquire Pennsylvania Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 through the US Legal Forms collection. The Down load switch will appear on every type you see. You get access to all in the past downloaded kinds in the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, listed below are basic instructions to help you get started out:

- Ensure you have picked the correct type for your area/region. Go through the Preview switch to check the form`s content. Read the type outline to actually have selected the right type.

- In case the type does not fit your demands, make use of the Lookup area near the top of the monitor to find the one who does.

- When you are happy with the shape, validate your option by clicking the Purchase now switch. Then, pick the rates program you want and supply your accreditations to sign up for the accounts.

- Procedure the purchase. Make use of charge card or PayPal accounts to finish the purchase.

- Find the file format and acquire the shape on the system.

- Make modifications. Fill up, revise and printing and signal the downloaded Pennsylvania Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

Every single template you included with your account does not have an expiration date and is your own forever. So, if you want to acquire or printing yet another version, just visit the My Forms area and then click around the type you require.

Obtain access to the Pennsylvania Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 with US Legal Forms, one of the most extensive collection of legitimate papers layouts. Use thousands of specialist and status-specific layouts that fulfill your business or individual needs and demands.

Form popularity

FAQ

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor's discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee.

Filing for Chapter 7 bankruptcy will wipe out your mortgage obligation. Still, if you aren't willing to pay the mortgage, you'll have to give up the home because your lender's right to foreclose doesn't go away when you file for Chapter 7.

A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in ance with the provisions of the Bankruptcy Code.

A Notice of Intention to Make a Proposal (commonly referred to as "NOI") is a procedure under the Bankruptcy and Insolvency Act (?BIA?) that allows financially troubled corporations the opportunity to restructure their affairs.

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Whether the trustee can take money you receive after filing your case depends on whether you were entitled to the money at the time your case was filed and how it was listed on your forms, if at all.