Pennsylvania Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

US Legal Forms - one of several largest libraries of legitimate forms in America - offers an array of legitimate file templates you may acquire or print out. Making use of the website, you can find thousands of forms for organization and personal purposes, categorized by types, states, or keywords.You can find the most up-to-date versions of forms just like the Pennsylvania Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 within minutes.

If you already possess a monthly subscription, log in and acquire Pennsylvania Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 in the US Legal Forms library. The Obtain option will show up on every kind you perspective. You gain access to all in the past downloaded forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed here are easy directions to get you began:

- Ensure you have selected the correct kind for your personal area/county. Go through the Review option to analyze the form`s information. Read the kind explanation to ensure that you have chosen the right kind.

- In case the kind doesn`t satisfy your demands, take advantage of the Lookup discipline near the top of the display screen to discover the one that does.

- When you are pleased with the shape, affirm your decision by simply clicking the Acquire now option. Then, pick the prices prepare you favor and provide your references to sign up on an bank account.

- Approach the transaction. Make use of credit card or PayPal bank account to finish the transaction.

- Select the formatting and acquire the shape on your device.

- Make alterations. Load, revise and print out and indication the downloaded Pennsylvania Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Every format you put into your money lacks an expiration time and is also your own eternally. So, if you want to acquire or print out yet another duplicate, just check out the My Forms portion and click on the kind you require.

Get access to the Pennsylvania Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 with US Legal Forms, probably the most extensive library of legitimate file templates. Use thousands of skilled and condition-certain templates that satisfy your organization or personal requirements and demands.

Form popularity

FAQ

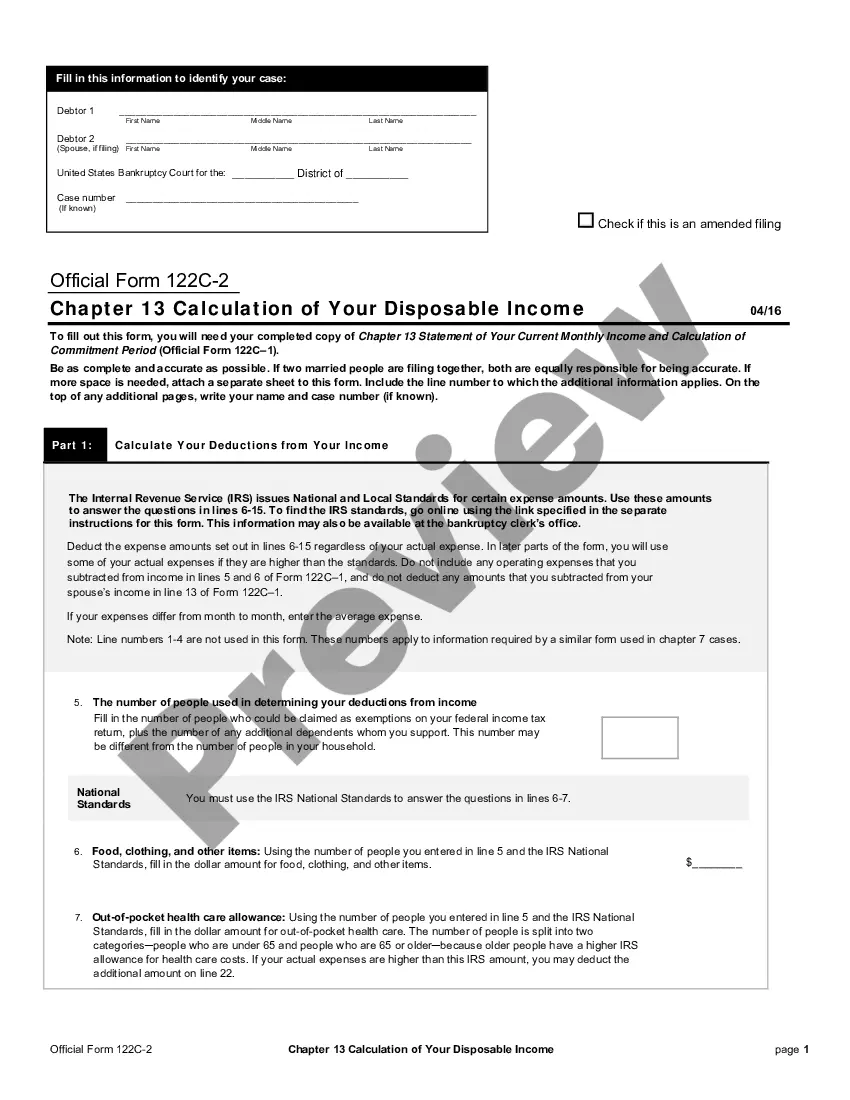

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

A debtor must have enough income, after deducting allowable expenses, for all debt obligations. A debtor may include income from a working spouse even if the spouse has not filed jointly for bankruptcy, wages and salary, self-employment income, Social Security benefits, and unemployment benefits.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

If you opt for a Chapter 13 bankruptcy filing, you will be required to pay back at least some of your debt under the plan. The amount you are required to pay back is your disposable income amount over the course of the bankruptcy. Any debt that remains beyond that will be discharged by the court.

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

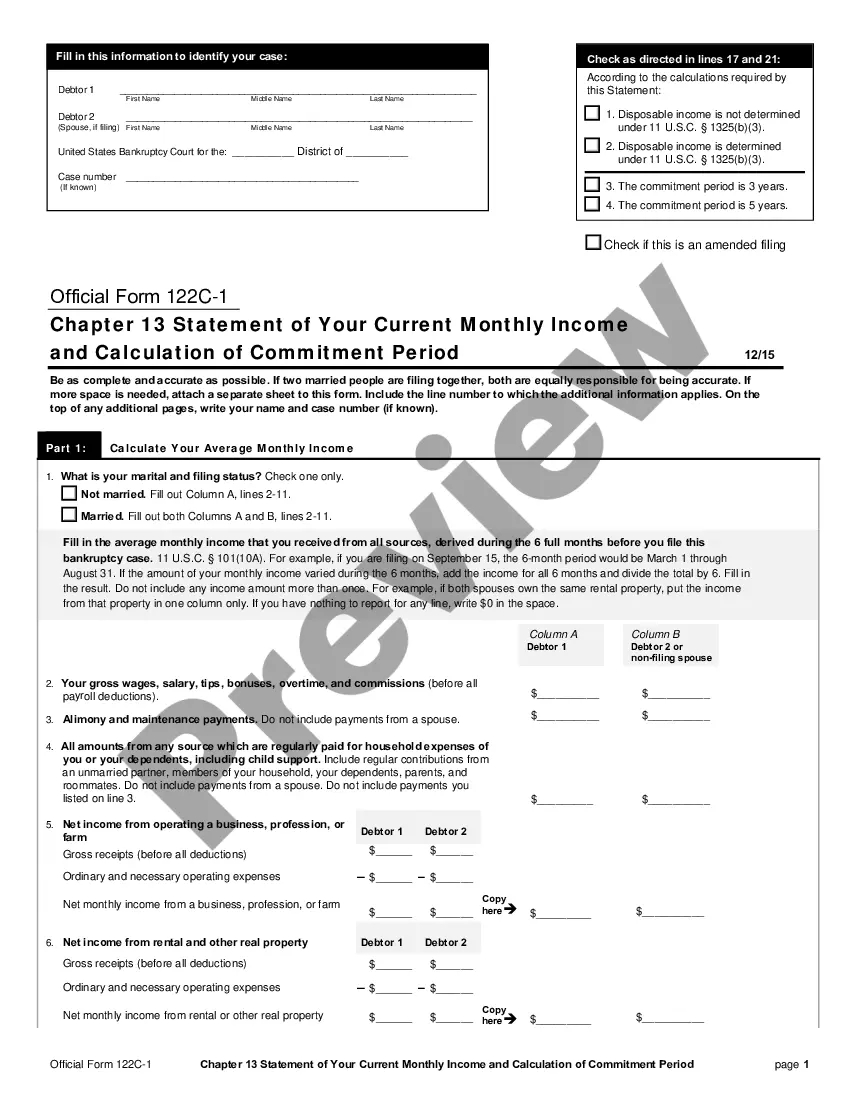

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

How Is Disposable Income Calculated? Your last six months of income divided by six to get average monthly income. If you own a business or work for yourself, you must calculate average monthly income. Any money you get from rent on an asset you own, interests, dividends or royalties.

All debts other than priority and secured obligations are general unsecured debt?and the amount you'll pay to your unsecured creditors in Chapter 13 bankruptcy will be the greater of your disposable income or the amount your creditors would have received had you filed for Chapter 7 bankruptcy. Disposable income.