Pennsylvania Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

How to fill out Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

If you wish to full, obtain, or print out lawful file layouts, use US Legal Forms, the largest variety of lawful types, which can be found online. Make use of the site`s simple and hassle-free search to find the paperwork you want. Various layouts for enterprise and specific reasons are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the Pennsylvania Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 in a couple of mouse clicks.

If you are currently a US Legal Forms buyer, log in to the account and click on the Obtain key to get the Pennsylvania Statement of Current Monthly Income for Use in Chapter 11 - Post 2005. You can even entry types you previously downloaded from the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape for your appropriate area/land.

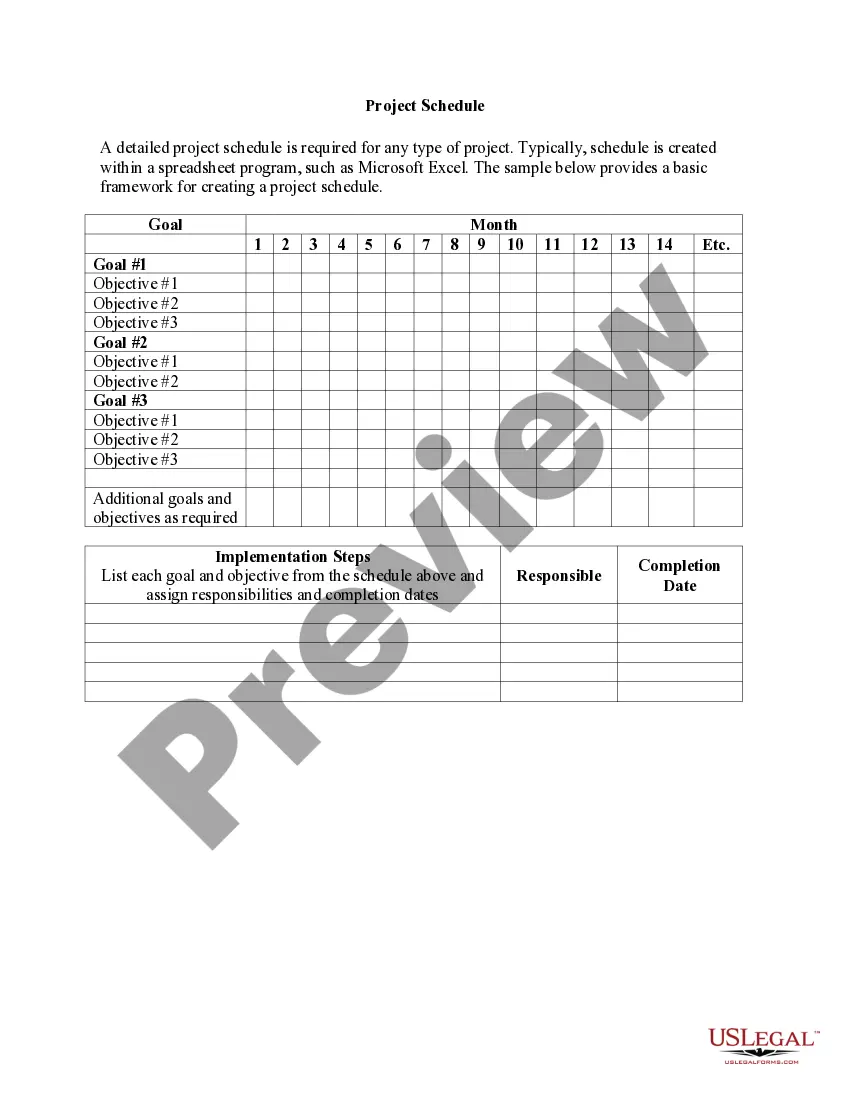

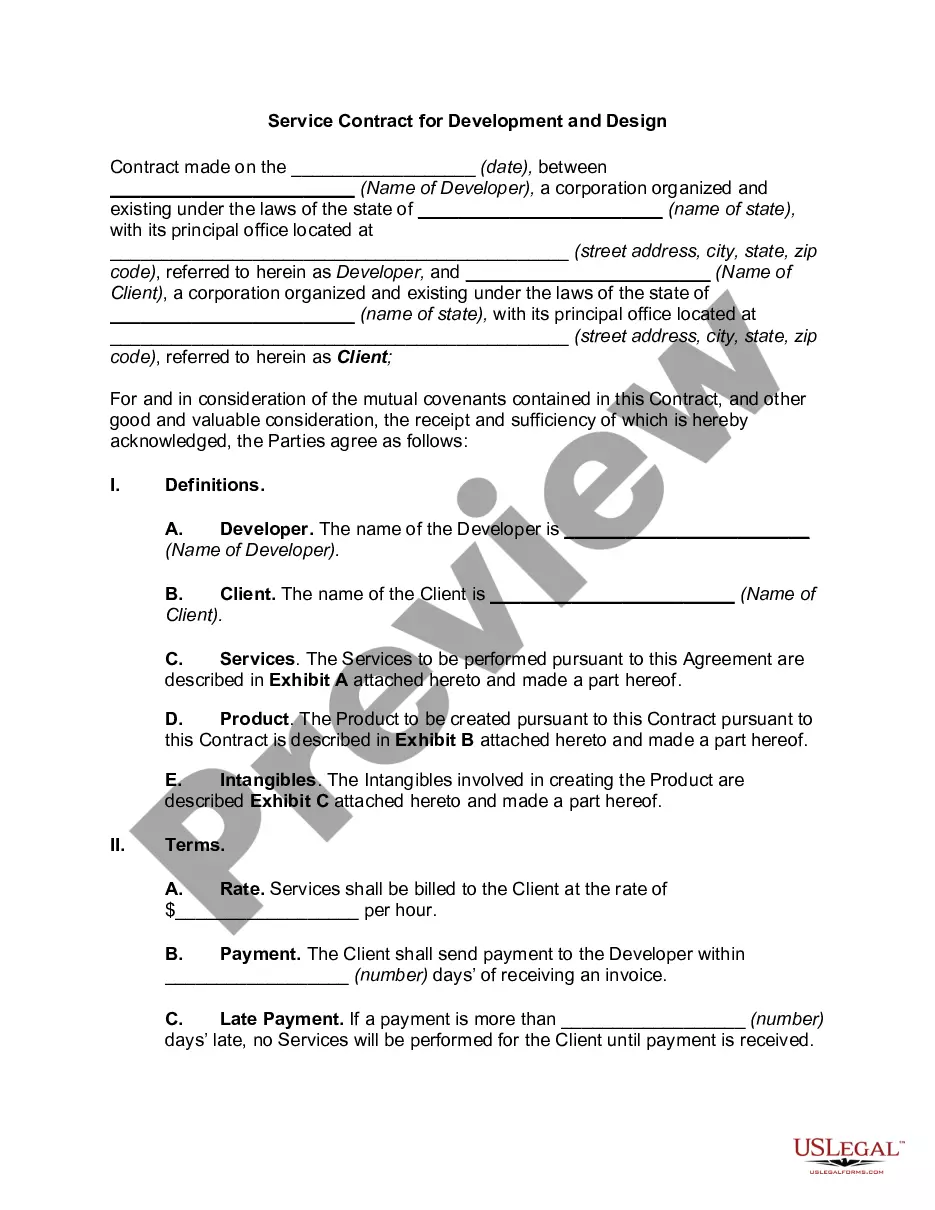

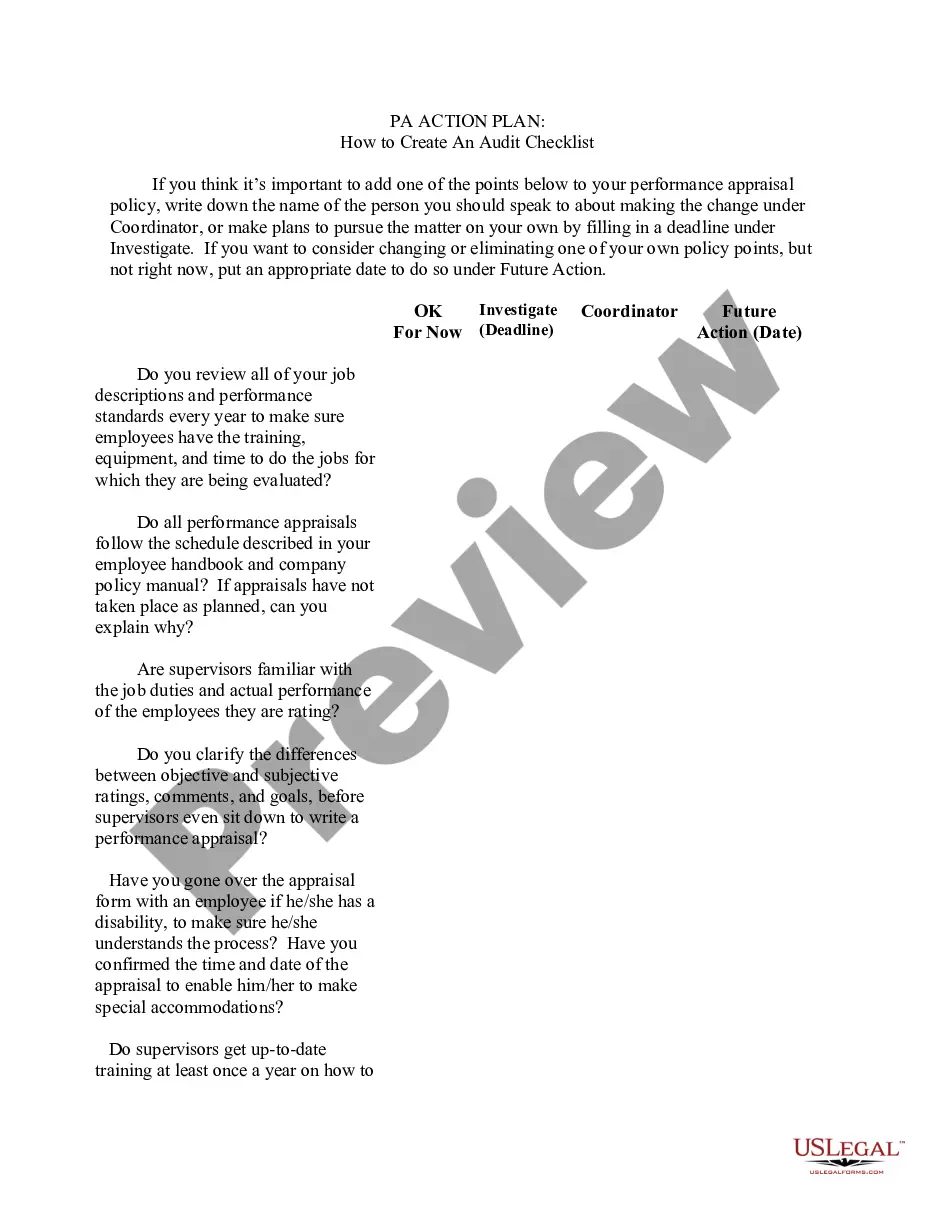

- Step 2. Make use of the Review option to examine the form`s content material. Do not overlook to read through the description.

- Step 3. If you are not satisfied using the type, use the Research discipline towards the top of the monitor to locate other models from the lawful type web template.

- Step 4. When you have found the shape you want, select the Get now key. Choose the costs plan you prefer and put your accreditations to sign up on an account.

- Step 5. Method the deal. You should use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Choose the file format from the lawful type and obtain it in your device.

- Step 7. Comprehensive, revise and print out or sign the Pennsylvania Statement of Current Monthly Income for Use in Chapter 11 - Post 2005.

Each and every lawful file web template you acquire is yours for a long time. You may have acces to every single type you downloaded in your acccount. Select the My Forms segment and choose a type to print out or obtain yet again.

Contend and obtain, and print out the Pennsylvania Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 with US Legal Forms. There are many professional and status-particular types you may use for your enterprise or specific demands.

Form popularity

FAQ

Unlike chapter 7, chapter 11 is not a liquidation of the debtor's assets. Rather, it is a reorganization of existing assets, principally as debt. The confirmed chapter 11 plan becomes a contract between the debtor and creditors, governing their rights and obligations; see In re Nylon Net Company.

After subtracting all the allowed expenses from your ?current monthly income,? the balance is your ?disposable income.? If you have no disposable income ? your allowed expenses exceed your ?current monthly income? ? then you've passed the means test.

You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person. However, if your disposable income is more than a certain sum, you will not be able to file.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

The Reorganization Process. Throughout a Chapter 11 reorganization, a debtor continues to operate in the ordinary course of business. Any activities outside of the ordinary course of business, such as selling the entire company or raising postpetition financing, require Bankruptcy Court approval.

While the average length of a Chapter 11 Bankruptcy case can last 17 months, larger and more complex cases can take up to five years. And following the conclusion of the bankruptcy case, it can still take months for Debtors to begin distributing payouts to the highest priority class of Creditors.

After filing for Chapter 11, the company's stock will be delisted from the major exchanges. Common stock shareholders are last in line to recover their investments, behind bondholders and preferred shareholders. As a result, shareholders may receive pennies on the dollar, if anything at all.