Pennsylvania Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

If you need to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search functionality to locate the documents you need.

Various templates for business and personal needs are categorized by type and state, or by keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose your pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Pennsylvania Agreement to Sell Partnership Interest to Third Party in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and then click the Download button to receive the Pennsylvania Agreement to Sell Partnership Interest to Third Party.

- You can also access forms you previously submitted online from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific area/state.

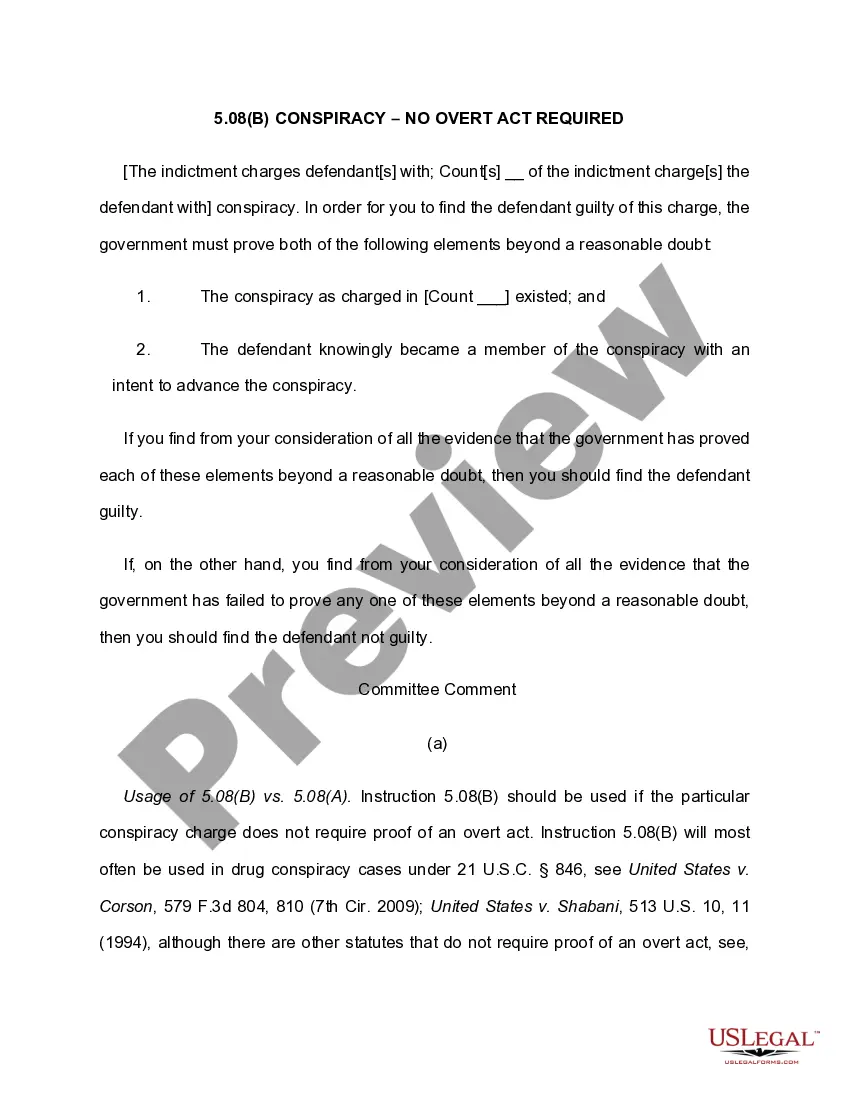

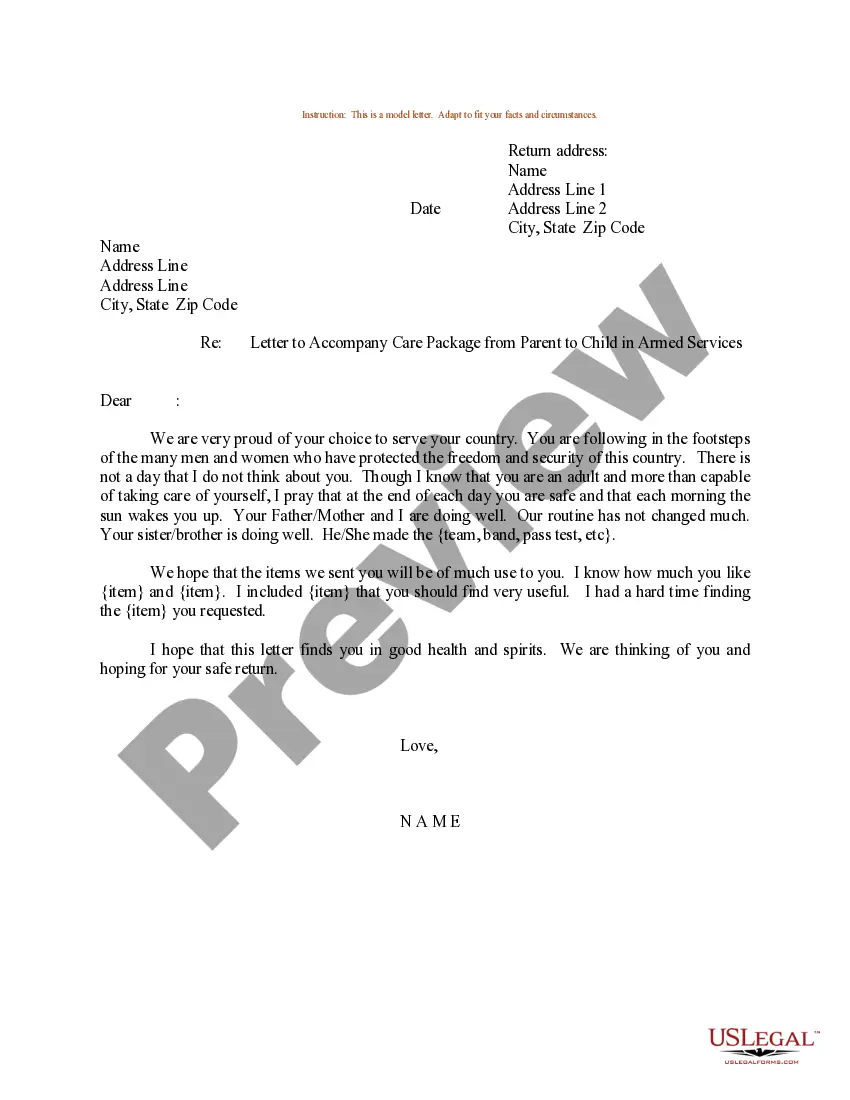

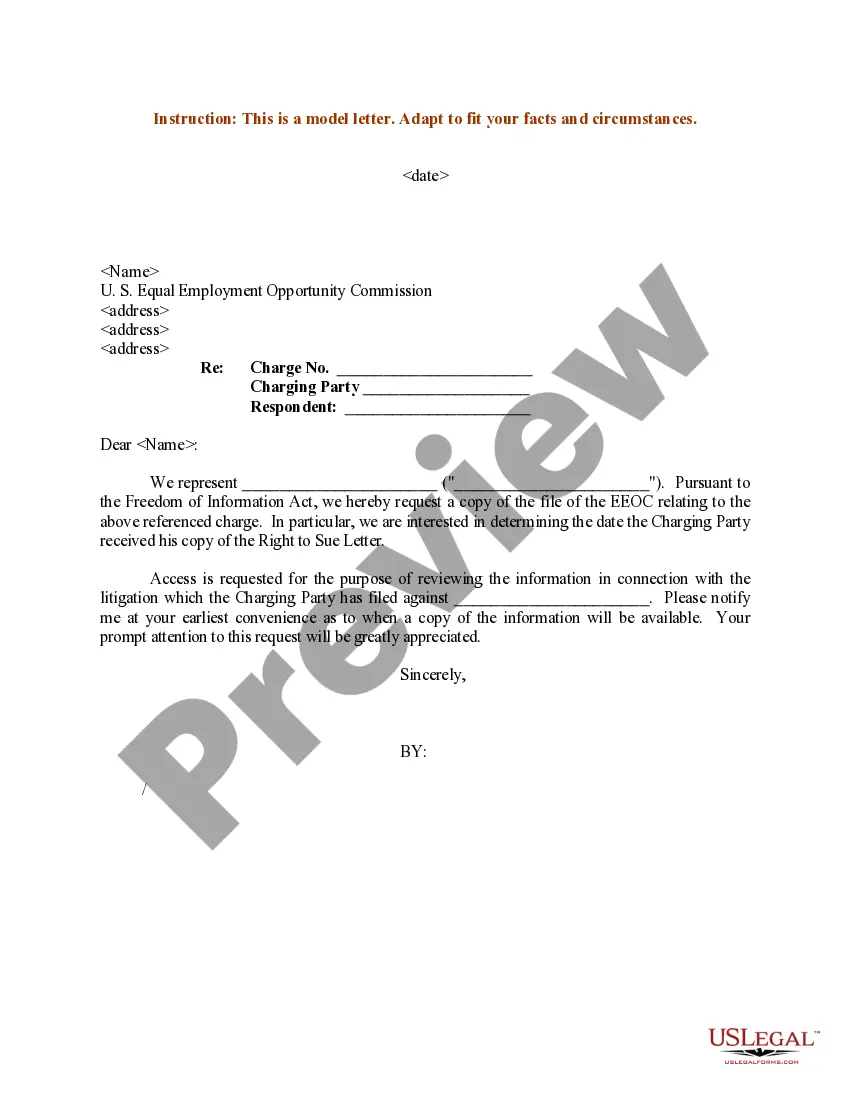

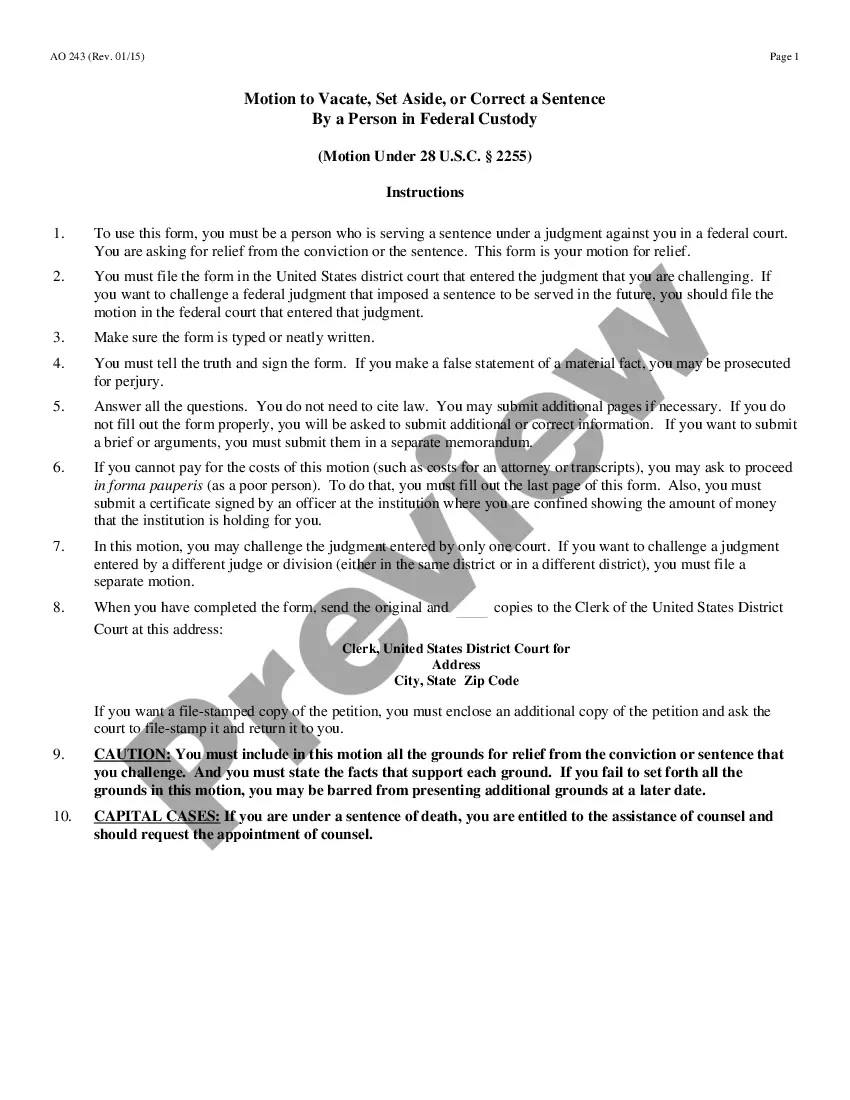

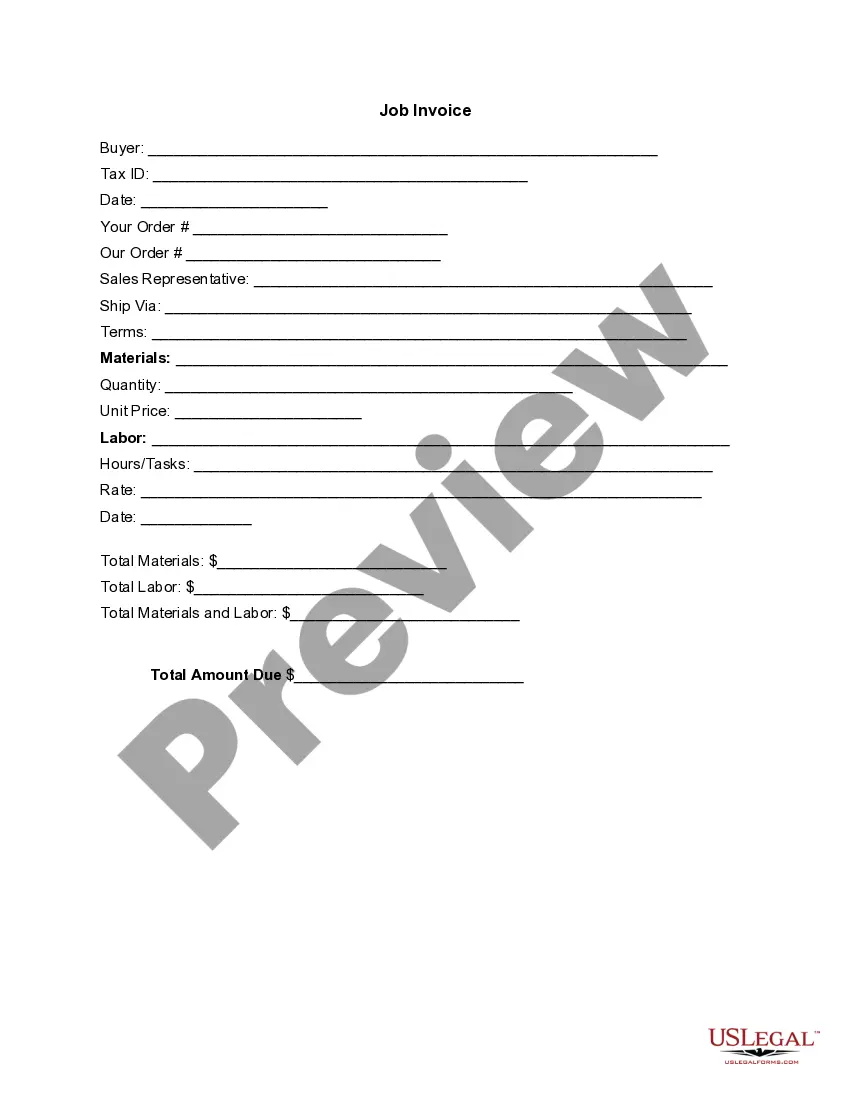

- Step 2. Use the Preview feature to review the form’s contents. Be sure to check the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document format.

Form popularity

FAQ

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Multiply the percentage of ownership by the appraised value of the business to determine the amount necessary to buy your partner's share. For example, if your partner owns 25 percent of a business that appraised for $1 million, the value of your partner's share is $250,000.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

The liability of all the partners is joint and several even though the act of the firm may have been done by one of them. Thus a third party, if he so likes, can bring an action against any one of them severally or against any two or more of them jointly.

Under the purchase scenario, one or more remaining partners may buy out the terminating partner's interest for fair market value (FMV) plus any relief of debt realized by the partner.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

How to Buy Out Your Business PartnerFigure out what you want from a buyout.Communicate your expectations.Consult a business attorney and accountant.Get an independent valuation of the business.Clarify the terms of your buy and sell agreement.Research financing options.More items...?

Buyouts over time agree that the purchasing partner will pay the bought out partner a predetermined amount over time until their ownership has been fully purchased. Similarly, an earn-out pays the partner out over time but requires the partner to stay with the company during a defined transition period.

Partners in a firm are jointly and severally liable for any breach of trust committed by one partner, in which they were implicated. Persons other than partners may have authority to deal with third parties on behalf of the firm; however, such persons have no implied mandate.