Pennsylvania Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

the remaining partners of a business partnership.

How to fill out Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

Are you in a situation where you regularly require documents for a company or individual nearly every day.

There are numerous legal document templates accessible online, but finding trustworthy ones is not easy.

US Legal Forms provides a vast selection of form templates, like the Pennsylvania Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners, designed to comply with federal and state regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Pennsylvania Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners at any time if necessary. Simply click on the desired form to download or print the template.

Utilize US Legal Forms, the largest collection of legal documents, to save time and avoid mistakes. The service provides expertly created legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Pennsylvania Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific area/state.

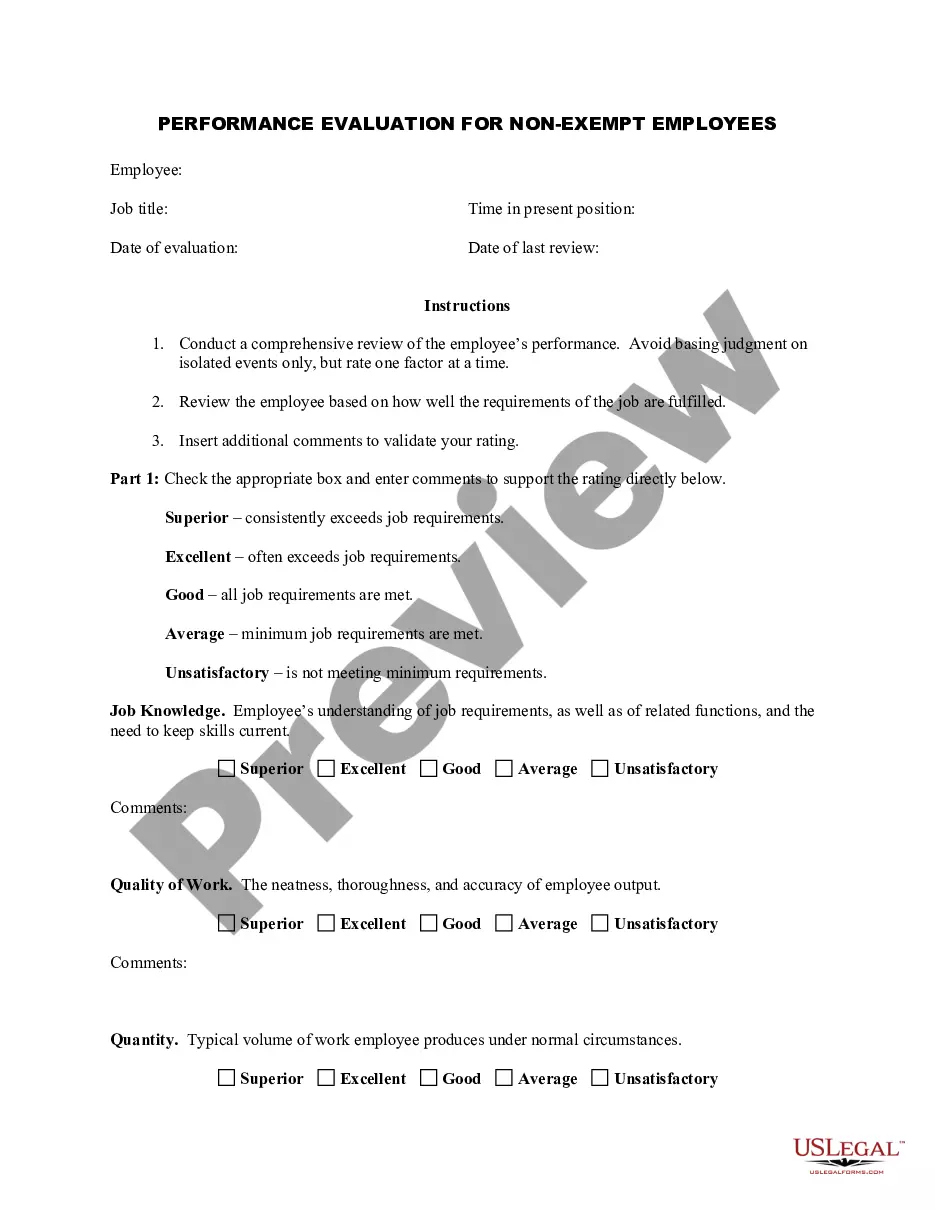

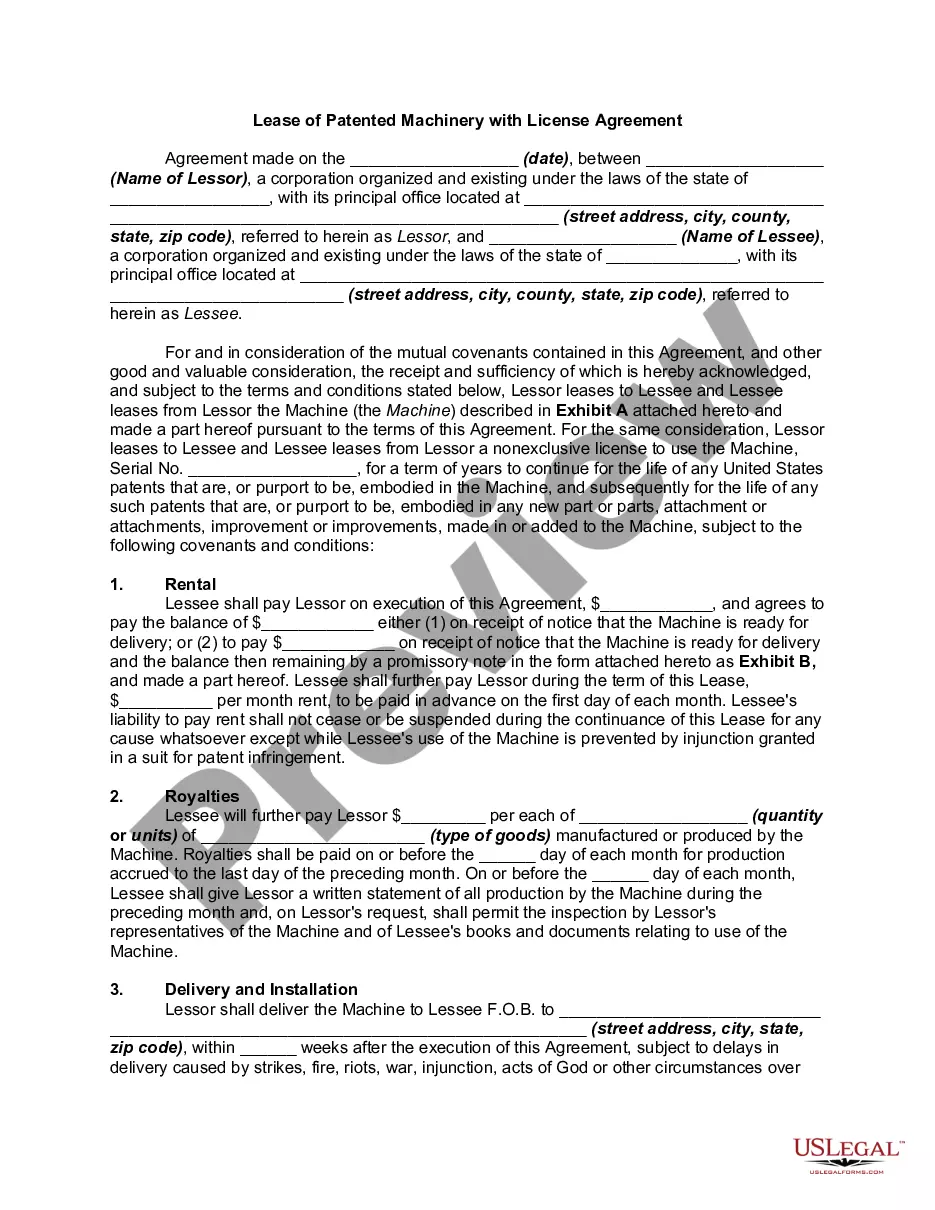

- Use the Preview button to check the form.

- Read the details to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search section to find a form that fits your needs and requirements.

- Once you find the correct form, click on Purchase now.

- Choose the pricing plan you want, enter the required details to create your account, and pay for an order using your PayPal or credit card.

Form popularity

FAQ

As a community property state, California law presumes all the property you or your spouse acquire during your marriage to be marital property, regardless of how it is titled.

The surviving spouse generally stands to inherit first, followed by the decedent's children, their parents, their siblings and so forth. Under certain circumstances, stepchildren may have priority to inherit over other heirs.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Checklist for Settling an Estate in 9 Easy StepsOrganize important information.Determine need for probate or attorney help.File the Will and notify necessary persons.Take inventory and appraise all assets.Set up a bank account.Pay taxes.Pay off any debts.Distribute assets according to deceased person's Will.More items...

How does the executor's year work? The executors have a number of duties to both creditors and beneficiaries during the administration of the deceased's estate. Starting from the date of death, the executors have 12 months before they have to start distributing the estate.

In Pennsylvania, there is no set deadline for filing probate. However, the law requires that the inheritance tax be wholly paid within nine months after the person's passing unless there has been a request for an extension.

There is no specific deadline for filing probate after someone dies in Pennsylvania. However, the law does require that within three months of the death, creditors, heirs, and beneficiaries are notified of the death. Then, within six months, an inventory of assets must be prepared and filed with the Register of Wills.

Like other Trusts, a Deceased Estate is not a legal entity in its own right, involving a relationship between the trustee (the Executor of the Estate) and the Beneficiaries.

Finally, if an executor does not distribute the estate, he or she can face some serious penalties, such as being held in contempt of court, fined, or given a jail sentence. A civil lawsuit can also be filed against the executor in an attempt to reclaim what is rightfully yours.

How Long Does PA Probate Take? Generally, beneficiaries should expect to wait 2 years to receive their inheritance.