Pennsylvania Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

Are you in a situation where you require documents for either business or personal use almost every day.

There are numerous authentic document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of document templates, including the Pennsylvania Personal Financial Information Organizer, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Pennsylvania Personal Financial Information Organizer at any time, if needed. Just click on the desired document to download or print the template.

Utilize US Legal Forms, the most extensive collection of legitimate documents, to save time and avoid mistakes. The service provides properly designed legal document templates that can be employed for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Personal Financial Information Organizer template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for your specific city/county.

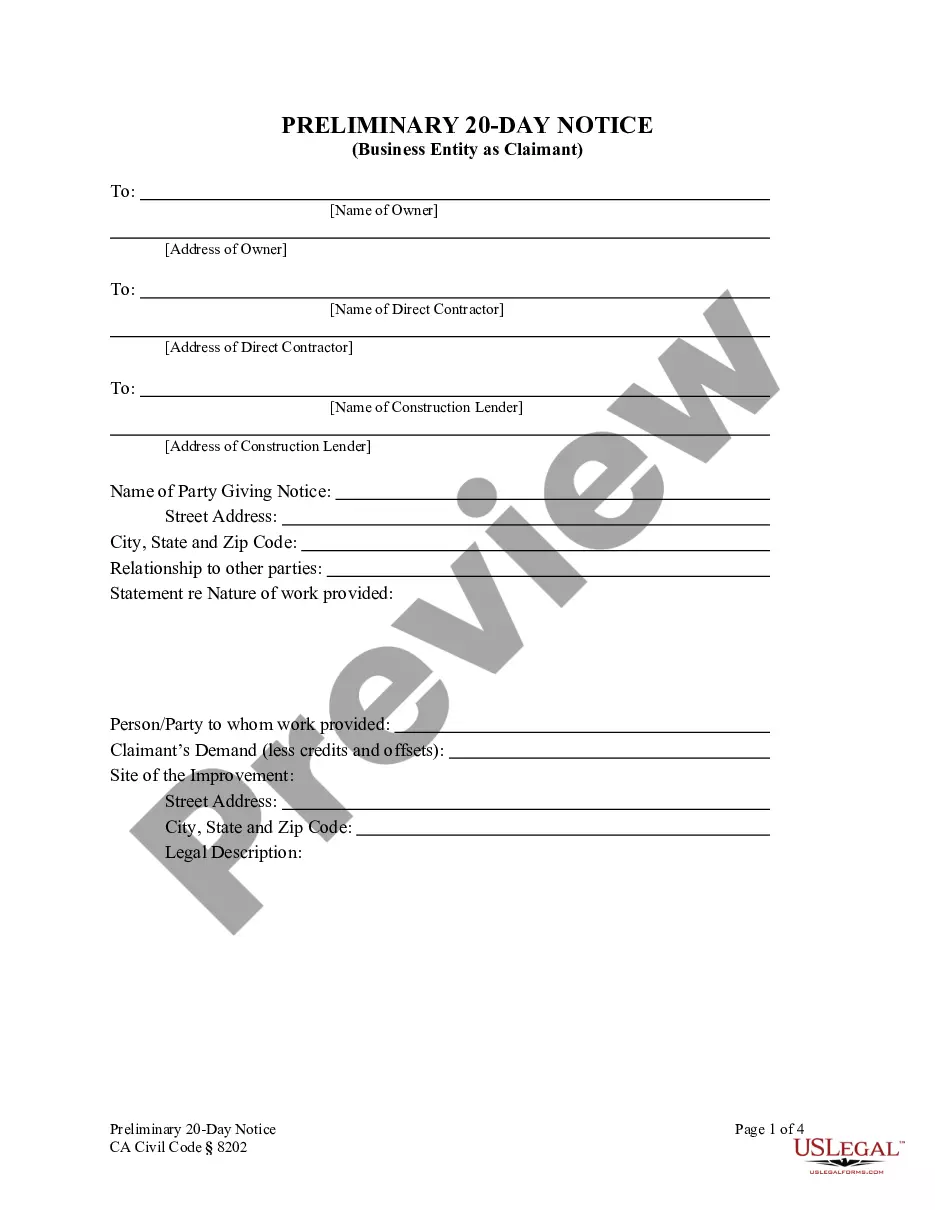

- Utilize the Preview feature to examine the document.

- Review the details to guarantee you have selected the right document.

- If the document does not meet your needs, use the Search section to find the document that fits you and your requirements.

- Once you find the correct document, click on Acquire now.

- Select the payment plan that meets your needs, fill in the required information to process your payment, and place an order using your PayPal or credit card.

Form popularity

FAQ

A financial plan is a comprehensive picture of your current finances, your financial goals and any strategies you've set to achieve those goals. Good financial planning should include details about your cash flow, savings, debt, investments, insurance and any other elements of your financial life.

Financial documents, also known as financial statements, are used for reporting financial information about a business, in a standardized format. They include a balance sheet, an income statement, and a cash flow statement. A balance sheet is a snapshot in time of the financial condition of your business.

6 Tips for Organizing Financial PaperworkSee What You Have.Set Up Your Filing System.Reconcile And File Receipts.Protect Your Investment Papers.Properly Store Your Bank Documents.Take Care Of Any Credit Card Issues.

How to Create a Personal Financial Plan in 8 Easy StepsStep 1: Review your current situation.Step 2: Set short-term and long-term goals.Step 3: Create a plan for your debts.Step 4: Establish your emergency fund.Step 5: Start estate planning.Step 6: Begin investing in your future.Step 7: Get protected.More items...?

5 considerations when developing your financial planHow long do I have left on my mortgage?What are my monthly living expenses and how will these change over time?What other expenses will I have throughout my life?How long will my children and/or grandchildren be dependent on me financially?More items...

Financial Planning Process: 5 Simple StepsStep One: Know Where You Stand. The first step to creating your financial plan is to understand your current financial situation.Step Two: Set Your Goals.Step Three: Plan for the Future.Step Four: Managing Money.Step Five: Review Your Plan.

Investment DocumentsTaxable Brokerage Account Statements.IRA (Traditional & Roth) Statements.Employer Retirement Plan Statements.529 Plan Account Statements.Custodial Account Statements.Business Brokerage and Bank Account Statements.Bank Account Statements.

Certified Financial Planner (CFP) Hold a bachelor's degree, plus 3 years experience. Personal Financial Specialist (PFS) Have 75 hours personal financial planning education; also, hold a CPA, which requires a degree, plus 2 years experience.

6 Tips for Organizing Financial PaperworkSee What You Have.Set Up Your Filing System.Reconcile And File Receipts.Protect Your Investment Papers.Properly Store Your Bank Documents.Take Care Of Any Credit Card Issues.

Organize Your Financial RecordsDesignate a Record-Keeping Location - Use a two-drawer filing cabinet or deep desk drawers.Purchase Filing Materials - Use plain manila folders, hanging file folders, and/or accordion files.More items...