A shareholder has the right to authorize another to vote the shares owned by the shareholder. This is known as voting by proxy.

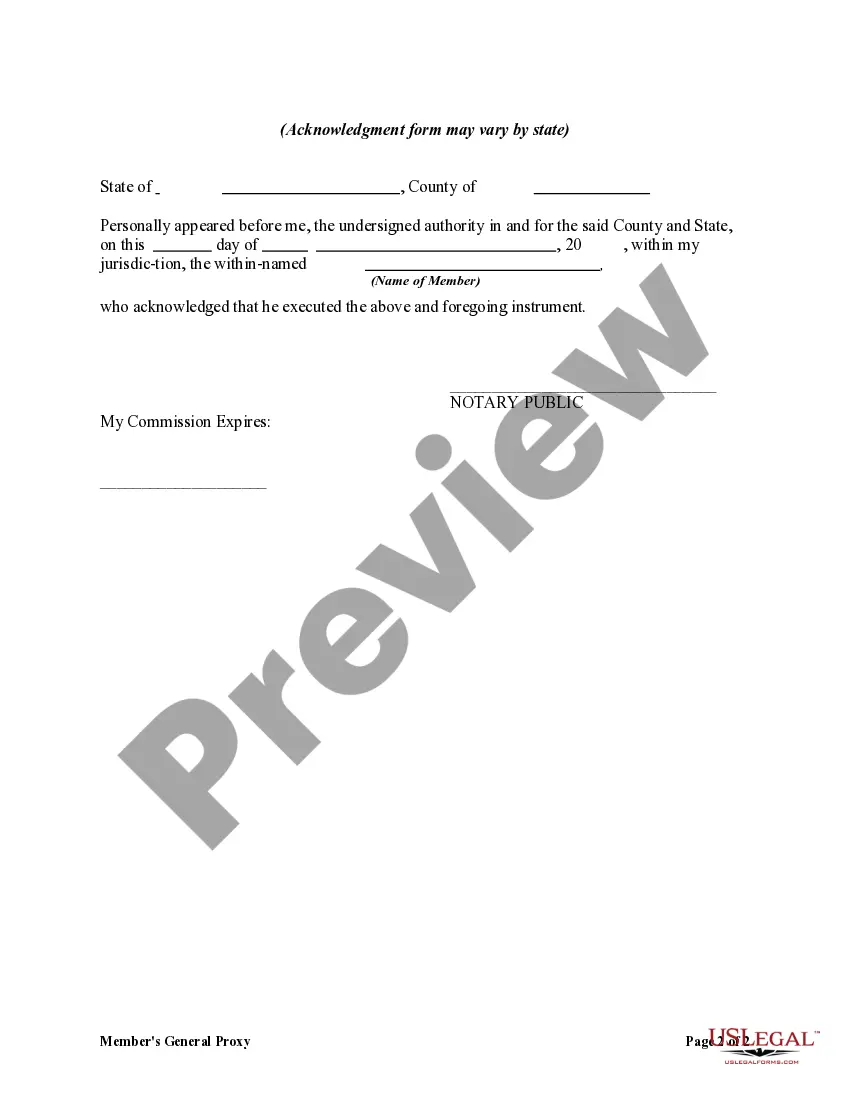

Pennsylvania Members General Proxy For Meetings of the Members of a Nonprofit Corporation

Description

How to fill out Members General Proxy For Meetings Of The Members Of A Nonprofit Corporation?

Finding the appropriate official document format can be challenging. Clearly, there are numerous templates available online, but how can you secure the exact type you need? Leverage the US Legal Forms website.

The platform offers thousands of templates, including the Pennsylvania Members General Proxy For Meetings of the Members of a Nonprofit Corporation, which you can utilize for both business and personal requirements. All forms are verified by specialists and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Pennsylvania Members General Proxy For Meetings of the Members of a Nonprofit Corporation. Use your account to review the legal forms you may have previously acquired.

Select your desired payment plan and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the official document to your device. Complete, edit, print, and sign the obtained Pennsylvania Members General Proxy For Meetings of the Members of a Nonprofit Corporation. US Legal Forms is indeed the largest repository of legal forms where you can find various document templates. Use the service to obtain well-crafted paperwork that adheres to state requirements.

- Navigate to the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are easy instructions that you can follow.

- First, ensure you have selected the correct form for your area/county.

- You can review the form using the Review button and examine the form summary to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search box to find the appropriate form.

- Once you are certain that the form is correct, click the Acquire now button to obtain the form.

Form popularity

FAQ

Yes, a proxy can be appointed for a board meeting, and this is a common practice. In Pennsylvania, utilizing a Pennsylvania Members General Proxy For Meetings of the Members of a Nonprofit Corporation allows members to delegate their voting power to another individual, ensuring that essential decisions can be made without delay. This approach enhances participation and accountability within the organization.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders.

Board members don't do their duty to give, get AND get off! This means giving personally financially, expertise, time getting others to contribute the same, and getting off the board when it's time.

You'll want to identify at least three board members to meet IRS requirements. Pennsylvania law requires every nonprofit corporation to have a President, Treasurer, and Secretary (i.e. officers who perform comparable duties) and a single person may hold all three offices.

The Role of the Board of Directors Recruit, supervise, retain, evaluate and compensate the manager. Provide direction for the organization. Establish a policy based governance system. Govern the organization and the relationship with the CEO.More items...

All nonprofit organizations need a board. Although the specific responsibilities may vary due to mission focus and different phases of an organization's existence, the basic role and purpose of all nonprofit boards remain the same.

Typically, you'll find that a CEO or other employee may legally serve on a nonprofit entity's volunteer board of directors.

Nonprofit meeting minutes are a necessary form of record-keeping for all non-profit organizations. Nonprofit meeting minutes serve as the official (and legal) record of board and committee meetings.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.