Pennsylvania Articles of Association of Unincorporated Charitable Association

Description

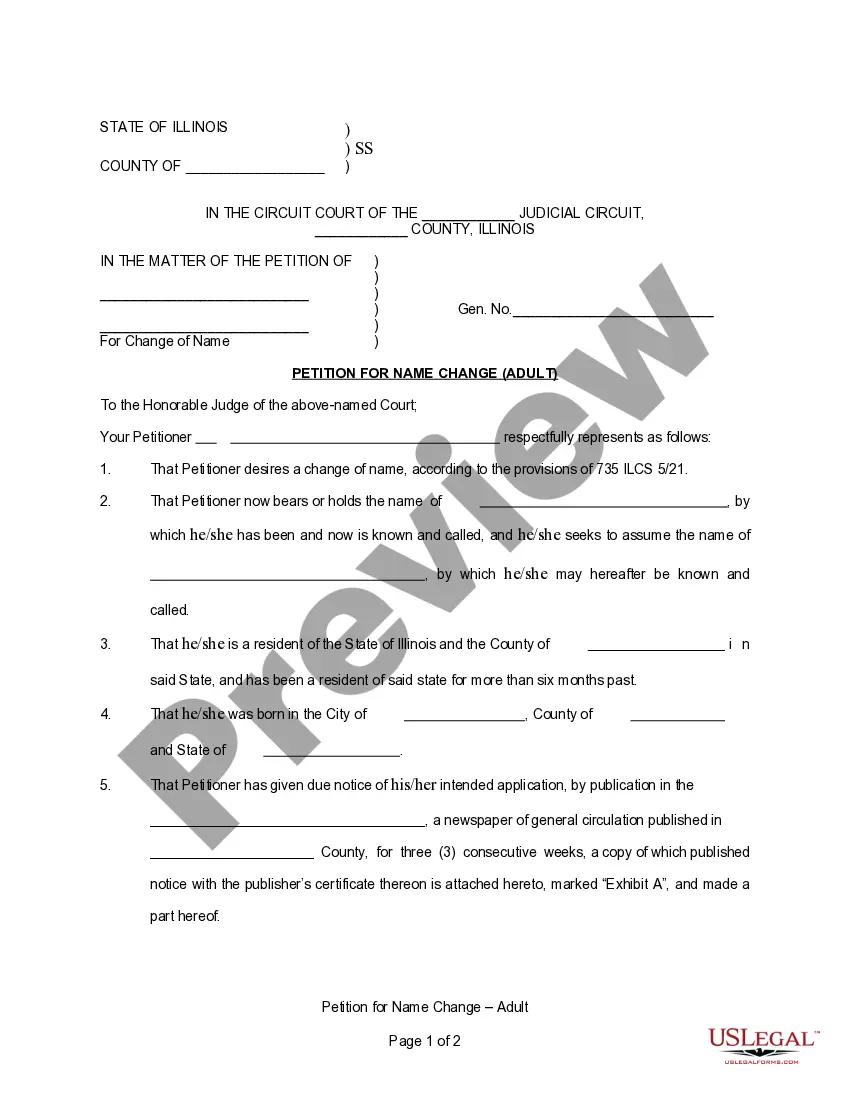

How to fill out Articles Of Association Of Unincorporated Charitable Association?

Are you in a circumstance where you require documentation for occasional business or personal reasons almost all the time.

There are numerous legal document samples accessible online, but finding ones you can trust is not straightforward.

US Legal Forms provides a sizeable collection of form templates, like the Pennsylvania Articles of Association of Unincorporated Charitable Association, that are created to comply with federal and state requirements.

Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania Articles of Association of Unincorporated Charitable Association template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for your specific area/county.

- Utilize the Review feature to examine the form.

- Verify the details to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field to find the form that satisfies your requirements.

- Once you locate the appropriate form, click Buy now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Pennsylvania Articles of Association of Unincorporated Charitable Association anytime if needed. Just click the desired form to download or print the document template.

Form popularity

FAQ

Yes, nonprofits must file articles of incorporation to gain legal recognition as a nonprofit organization. This process helps establish the organization’s structure and governance while ensuring compliance with state regulations. By filing the Pennsylvania Articles of Association of Unincorporated Charitable Association, you lay the foundation for lawful operation and eligibility for tax-exempt status.

The PA BCO 23 form is necessary for certain unincorporated associations or charitable organizations operating in Pennsylvania. This filing ensures compliance with state regulations regarding the activities and operations of these groups. If you plan to establish an unincorporated charitable association, consider guidance from resources like uslegalforms to streamline your filing process.

In Pennsylvania, an unincorporated association serves as a gathering of individuals aiming to achieve a shared objective without legal incorporation. These entities can take various forms, such as social clubs or charitable groups. Even though they must comply with Pennsylvania laws, they enjoy a level of operational simplicity not found in incorporated organizations.

An unincorporated association in Pennsylvania refers to a group formed for a common purpose without formal incorporation. In this context, these associations often engage in community service, fundraising, or other charitable goals. They typically operate under the principles outlined in the Pennsylvania Articles of Association of Unincorporated Charitable Association, though formal filing is not required.

Unlike a corporation, an unincorporated association does not have owners in the traditional sense. Instead, it is managed by its members, who collectively make decisions about the association's activities and direction. This member-driven nature allows for flexibility, as no single individual possesses ownership.

A nonprofit is a business formed to operate for a public or mutual benefit, often requiring formal registration. An unincorporated association lacks this formal structure and is typically formed by a group of people for a specific purpose. While both can engage in charitable activities, the key distinction lies in their legal recognition and liabilities.

The purpose of an unincorporated association is to organize individuals around a common interest or goal without the formal structure of a corporation. These associations enable members to collaborate, share resources, and promote activities that benefit the group. Importantly, they can operate without needing to file elaborate paperwork like the Pennsylvania Articles of Association of Unincorporated Charitable Association.

To file the Pennsylvania Articles of Association of Unincorporated Charitable Association, start by gathering the necessary documents. You will need to fill out the appropriate form and submit it to the Department of State. Additionally, make sure to comply with local laws and regulations to ensure a smooth process. Utilizing platforms like uslegalforms can simplify your filing experience.

Pennsylvania does not require articles of incorporation specifically for unincorporated associations. However, these articles are crucial for formal incorporation, which provides legal advantages and protections. If you are considering formalizing your organization, understanding the Pennsylvania Articles of Association of Unincorporated Charitable Association will be beneficial. Resources like uslegalforms can assist you in navigating these requirements.

An unincorporated association offers flexibility and simplicity in operation. It generally has fewer regulatory requirements than an incorporated entity. This structure can be appealing for small groups looking to engage in charitable activities without extensive paperwork. However, it's essential to understand the Pennsylvania Articles of Association of Unincorporated Charitable Association to ensure your association's effectiveness.