Corporations must be formed under the enabling legislation of a state or the federal government, since corporations may lawfully exist only by consent or grant of the sovereign. Therefore, in drafting pre-incorporation agreements and other instruments preliminary to incorporation, the drafter must become familiar with and follow the particular statutes under which the corporation is to be formed.

Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association

Description

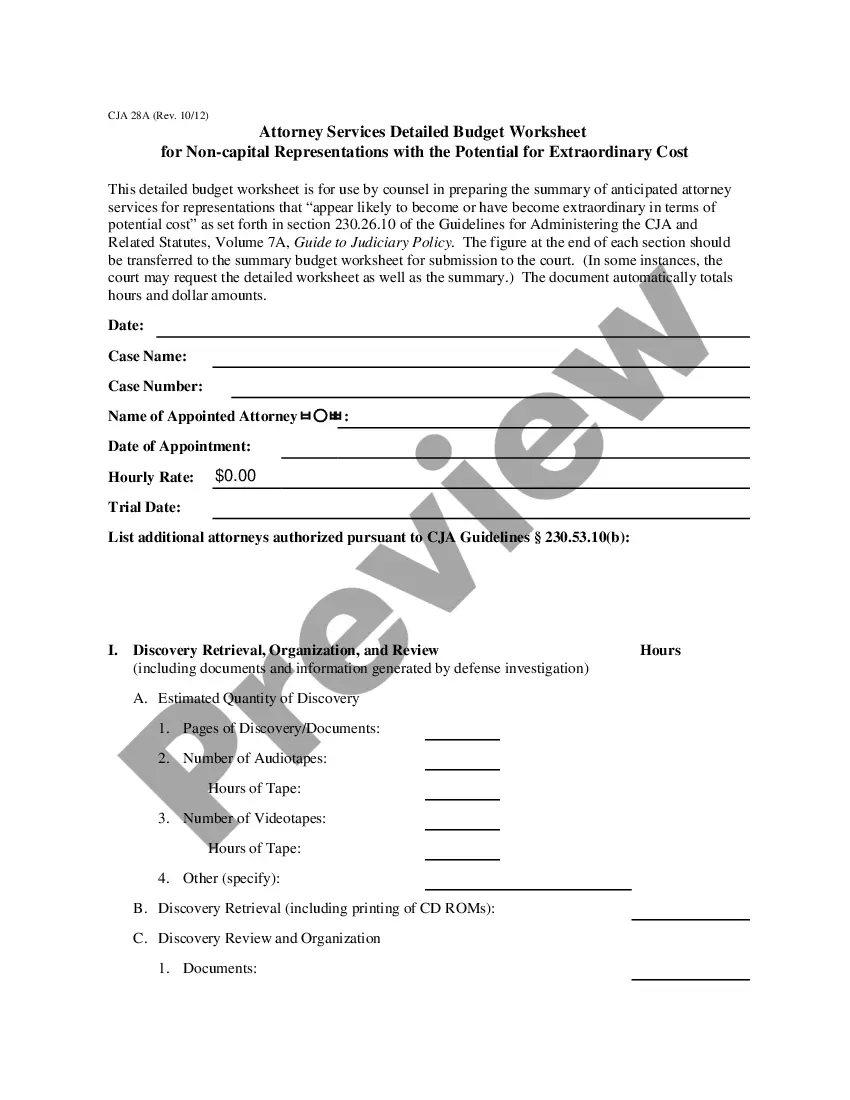

How to fill out Resolution To Incorporate As Nonprofit Corporation By Members Of A Church Operating As An Unincorporated Association?

If you require thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Employ the site's straightforward and convenient search tool to locate the documents you need.

Various templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. After finding the form you want, click the Purchase now button. Select the pricing plan you prefer and provide your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, revise, and print or sign the Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.

- Utilize US Legal Forms to locate the Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association with just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and then click the Download button to find the Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.

- You can also find forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

An unincorporated nonprofit is an organization that operates without being formally established as a corporation. While it can fulfill its mission and serve its community, it does not have the same legal protections as incorporated entities. If you are considering transitioning from an unincorporated association to a more structured Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church, legal guidance can be beneficial.

A 501(c)(3) nonprofit organization is a specific type of tax-exempt entity recognized by the Internal Revenue Service. This categorization allows for tax-deductible donations and provides the organization with certain benefits. If your goal is to achieve recognition for your Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, pursuing 501(c)(3) status might be advantageous.

A nonprofit corporation is a formal legal entity recognized by the state, which provides certain protections and benefits. An unincorporated association, on the other hand, operates without formal incorporation and lacks many legal protections. As you consider a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, understanding these differences will guide your decision.

A mutual benefit corporation is a type of nonprofit organization that is chartered by a state government specifically to serve its members. Such organizations often include associations like cooperatives and unions. If you are exploring a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, this type may be relevant.

The three main types of nonprofit corporations include public charities, private foundations, and social advocacy organizations. Each type serves distinct purposes and operates under specific regulations. Understanding these classifications is crucial when considering a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association.

Writing a resolution for a nonprofit involves several key steps. Begin by clearly stating the purpose of the resolution, followed by the specific actions you intend to take. For a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, ensure your document outlines the organization's mission, goals, and any pertinent regulatory details.

In the United States, state governments grant charters to nonprofit organizations. Specifically, the Secretary of State or a similar state agency oversees this process. If you are interested in a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association, it’s essential to follow the procedures outlined by the Pennsylvania Department of State.

Incorporated entities typically offer better legal protection and enhanced credibility, making them a safer option for many organizations, including churches. Unincorporated associations may be flexible, but they carry risks without limited liability. Evaluating the benefits of a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association can help churches decide which structure aligns with their mission.

Having a 501c3 determination letter is important for a church seeking federal tax-exempt status, allowing it to receive tax-deductible donations. This status can also open doors for grant opportunities and public support. Churches operating under a Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association should consider obtaining this letter to maximize their fundraising capabilities.

The primary difference lies in their legal status and liability. A nonprofit corporation is a formal entity with protection against personal liability for its members, while an unincorporated nonprofit association does not have this advantage. If a church is exploring options, understanding the Pennsylvania Resolution to Incorporate as Nonprofit Corporation by Members of a Church operating as an Unincorporated Association may help them make informed decisions.