Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

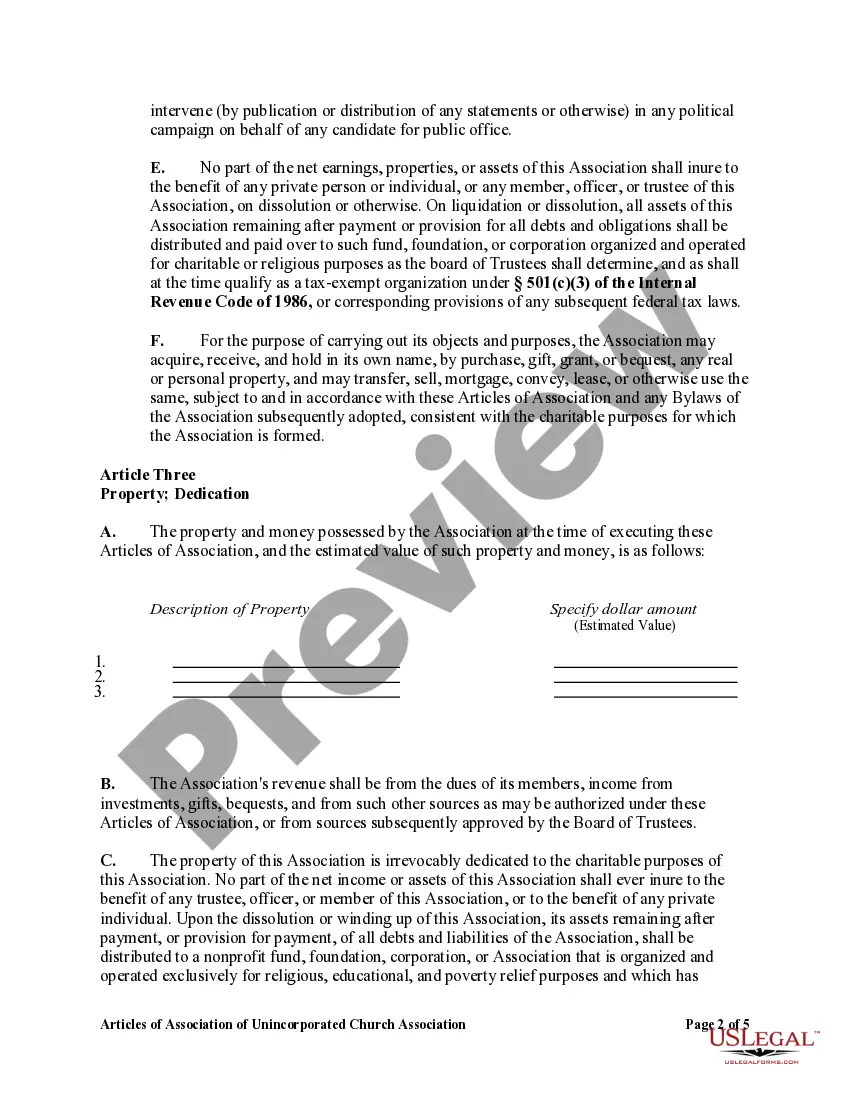

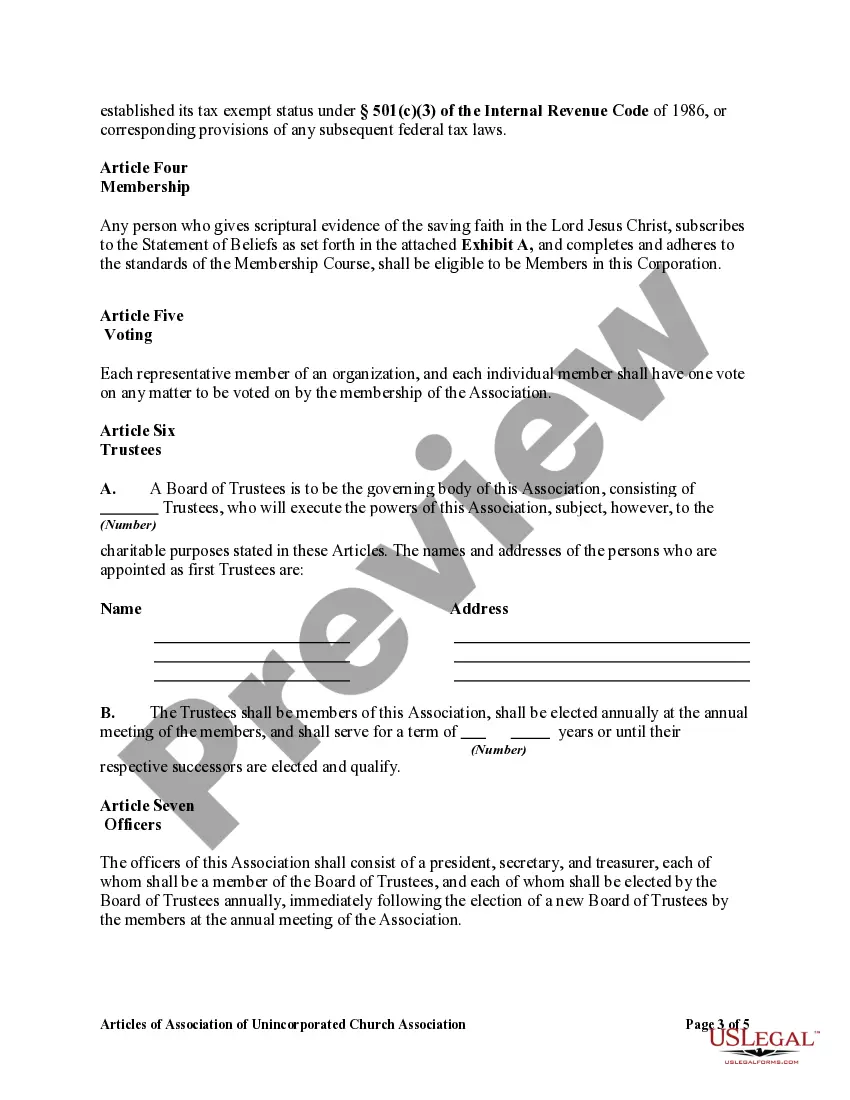

Pennsylvania Articles of Association of Unincorporated Church Association

Description

How to fill out Articles Of Association Of Unincorporated Church Association?

You might spend hours online searching for the legal document template that satisfies the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that are evaluated by experts.

You can easily download or print the Pennsylvania Articles of Association of Unincorporated Church Association from your service.

To obtain a duplicate of the form, use the Search field to find the template that meets your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and select the Acquire option.

- Afterward, you can fill out, modify, print, or sign the Pennsylvania Articles of Association of Unincorporated Church Association.

- Each legal document template you acquire is yours permanently.

- To access another copy of the purchased form, navigate to the My documents tab and click on the respective option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your area/town that you select.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

The primary purpose of an unincorporated association is to bring individuals together for a common goal or interest, such as religious worship or community service. A Pennsylvania Articles of Association of Unincorporated Church Association serves as a framework for these groups to organize their activities, pool resources, and support one another. By creating a space for cooperation, these associations strengthen their impact and enhance their members' experience.

An unincorporated association does not have ownership in the traditional sense, as it operates primarily through the collective efforts of its members. In a Pennsylvania Articles of Association of Unincorporated Church Association, members typically share control and decision-making responsibilities. This structure promotes collaboration among members, fostering a sense of community and shared purpose within the association.

Whether an unincorporated association needs to file a tax return depends on its income and activities. Generally, if your Pennsylvania Articles of Association of Unincorporated Church Association earns over a certain threshold, you may be required to file a tax return with the IRS. This requirement can vary based on your state laws as well, so it’s essential to consult a tax professional for specific guidance related to your association.

The primary distinction between a nonprofit and an unincorporated association lies in their legal status. A nonprofit is a legally recognized entity that operates for charitable purposes and is eligible for special tax benefits. In contrast, an unincorporated association, such as a Pennsylvania Articles of Association of Unincorporated Church Association, lacks a formal state recognition and operates based on a mutual agreement among its members. Understanding these differences can help you choose the right structure for your organization.

Choosing between incorporated and unincorporated often depends on your organization’s goals and risk tolerance. Incorporated nonprofits benefit from legal protection and enhanced credibility, which can facilitate fundraising efforts. However, unincorporated organizations like those discussed in the Pennsylvania Articles of Association of Unincorporated Church Association may offer simplicity and less regulatory burden, making them suitable for smaller groups.

When a nonprofit is incorporated, it means that it has taken steps to register as a legal entity with the state. This status protects its members from personal liability and allows the organization to apply for tax-exempt status, making it easier to attract donations. The Pennsylvania Articles of Association of Unincorporated Church Association serve as a foundation for those considering the transition from unincorporated to incorporated status.

The primary difference lies in legal structure and liability. An incorporated nonprofit is recognized as a separate legal entity, providing limited liability to its members, while an unincorporated nonprofit lacks this formal recognition and exposes its members to personal liability. By understanding the Pennsylvania Articles of Association of Unincorporated Church Association, you can grasp how unincorporated organizations function and their implications for members.

In Pennsylvania, at least three individuals must serve on the board of directors for a nonprofit organization. These board members do not need to reside in Pennsylvania, but it is essential that they are individuals, not corporations. Understanding this requirement is crucial when drafting the Pennsylvania Articles of Association of Unincorporated Church Association. If you need assistance in ensuring your nonprofit meets all state requirements, consider utilizing the resources available on USLegalForms.

The primary difference between incorporated and unincorporated nonprofits lies in their legal status; incorporated entities are formally registered and provide limited liability to their members, while unincorporated nonprofits do not have the same legal protections. Incorporated nonprofits must comply with state laws and regulations, which can be more demanding. In contrast, an organization following Pennsylvania Articles of Association of Unincorporated Church Association enjoys flexibility but should be mindful of the inherent risks.

The benefits of an unincorporated association include lower startup costs, more flexible management structures, and minimal regulatory requirements compared to incorporated entities. These associations allow members to easily collaborate for various objectives, often enhancing community engagement. By adhering to well-defined Pennsylvania Articles of Association of Unincorporated Church Association, groups can maintain organization while enjoying these benefits.