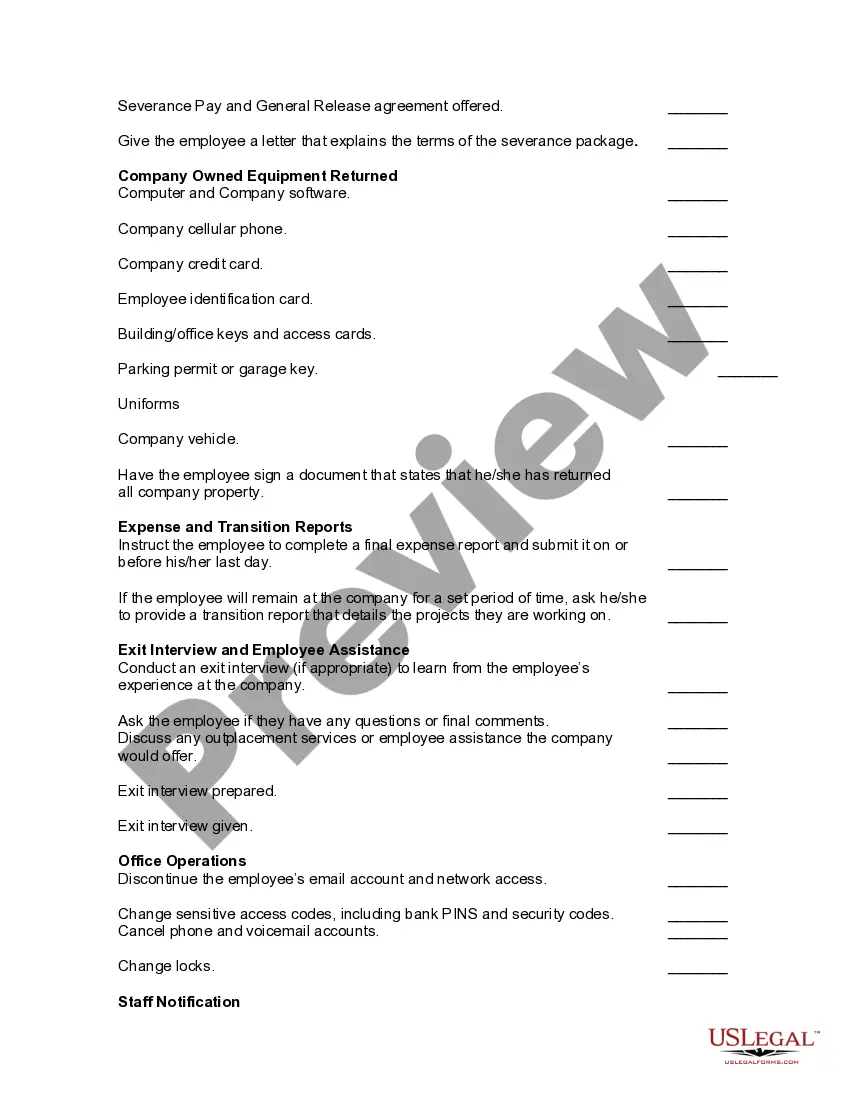

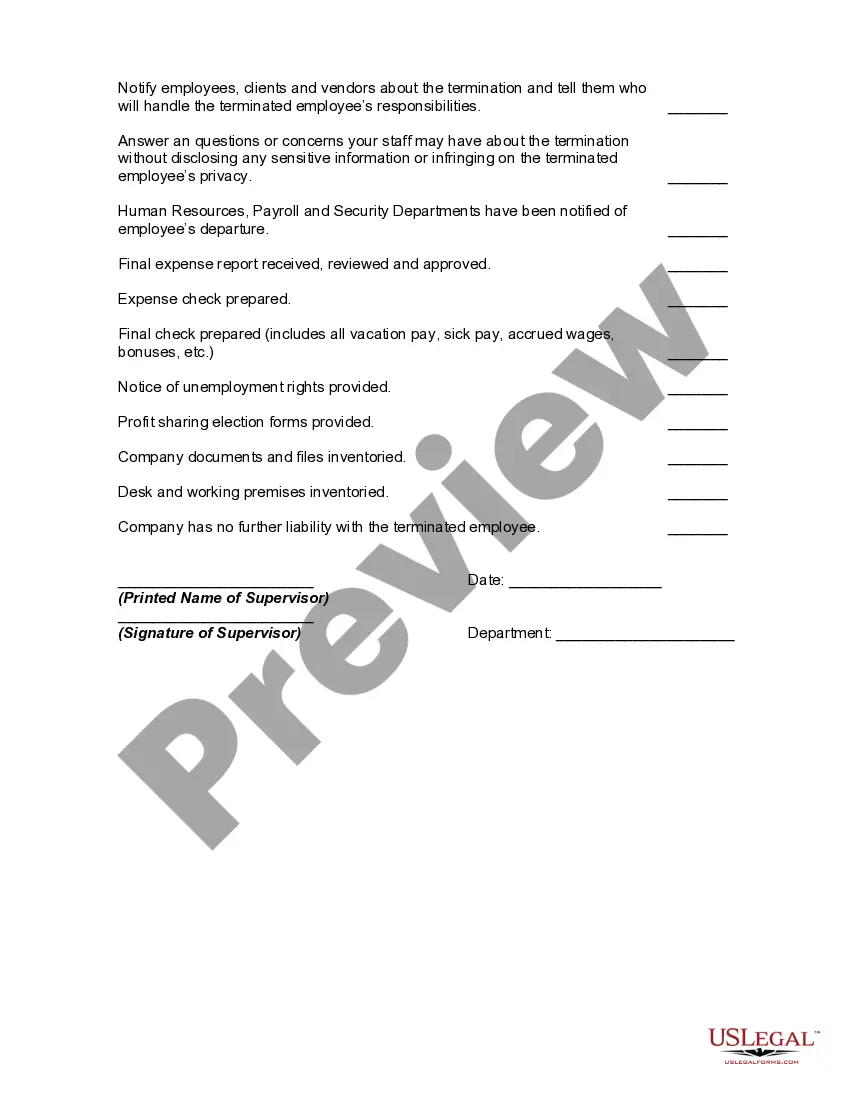

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Pennsylvania Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

Are you presently in a situation where you frequently require documents for either business or personal reasons? There is a multitude of legal form templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Pennsylvania Worksheet - Termination of Employment, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you will be able to download the Pennsylvania Worksheet - Termination of Employment template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can acquire another copy of the Pennsylvania Worksheet - Termination of Employment whenever necessary. Just click the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service offers professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify it is suitable for your specific city/county.

- Utilize the Preview option to review the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search section to find the form that fits your needs.

- Once you find the right form, click Get now.

- Choose your preferred pricing plan, enter the necessary information to create your account, and process the payment with your PayPal or credit card.

Form popularity

FAQ

UC-2: Employer's Report for Unemployment Compensation. This form is used to report an employer's quarterly gross and taxable wages, and UC contributions due. Reimbursable Employers should use the UC-2R.

In Pennsylvania, employment is at-will, which means employers have the right to terminate an employee without reason and without giving him or her prior notice.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Note that an employer's PA UC account number consists of seven numeric digits. Mail report. Use the enclosed return envelope. If the envelope is missing, mail report to the PA Department of Labor & Industry, Office of Unemployment Compensation Tax Services, PO Box 68568, Harrisburg, PA 17106-8568.

Employers are not allowed to wrongfully terminate an employee. Pennsylvania follows the doctrine of employment at will. This means that employers and employees are allowed to terminate their relationship at any time and for any reason. However, they cannot do so in a manner that is unlawful.

Required Employment Forms in PennsylvaniaSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (template here)Federal W-4 Form.Pennsylvania New Hire Reporting Form.Employee Personal Data Form (template here)Company Health Insurance Policy Forms.More items...?

P A Form U C - 2 A, Employer's Quarterly Report of Wages Paid to Each Employee.

Unemployment Compensation (UC)

Employee contributions (UC withholding) is 0.06 percent (60 cents per $1,000 gross wages). This applies to all employees, including employees of reimbursable employers, and is not subject to appeal. There is no cap on the gross wages upon which employee withholding is calculated.