This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Pennsylvania Deed of Trust Securing Obligations Pursuant to Indemnification Agreement

Description

How to fill out Deed Of Trust Securing Obligations Pursuant To Indemnification Agreement?

Choosing the best legal file design might be a have a problem. Needless to say, there are tons of layouts accessible on the Internet, but how do you discover the legal develop you will need? Take advantage of the US Legal Forms site. The service gives 1000s of layouts, like the Pennsylvania Deed of Trust Securing Obligations Pursuant to Indemnification Agreement, which can be used for company and personal needs. All of the varieties are examined by professionals and meet up with federal and state needs.

In case you are currently listed, log in to your profile and then click the Download option to get the Pennsylvania Deed of Trust Securing Obligations Pursuant to Indemnification Agreement. Utilize your profile to search from the legal varieties you possess acquired in the past. Go to the My Forms tab of the profile and have one more backup of the file you will need.

In case you are a fresh end user of US Legal Forms, allow me to share basic guidelines that you should stick to:

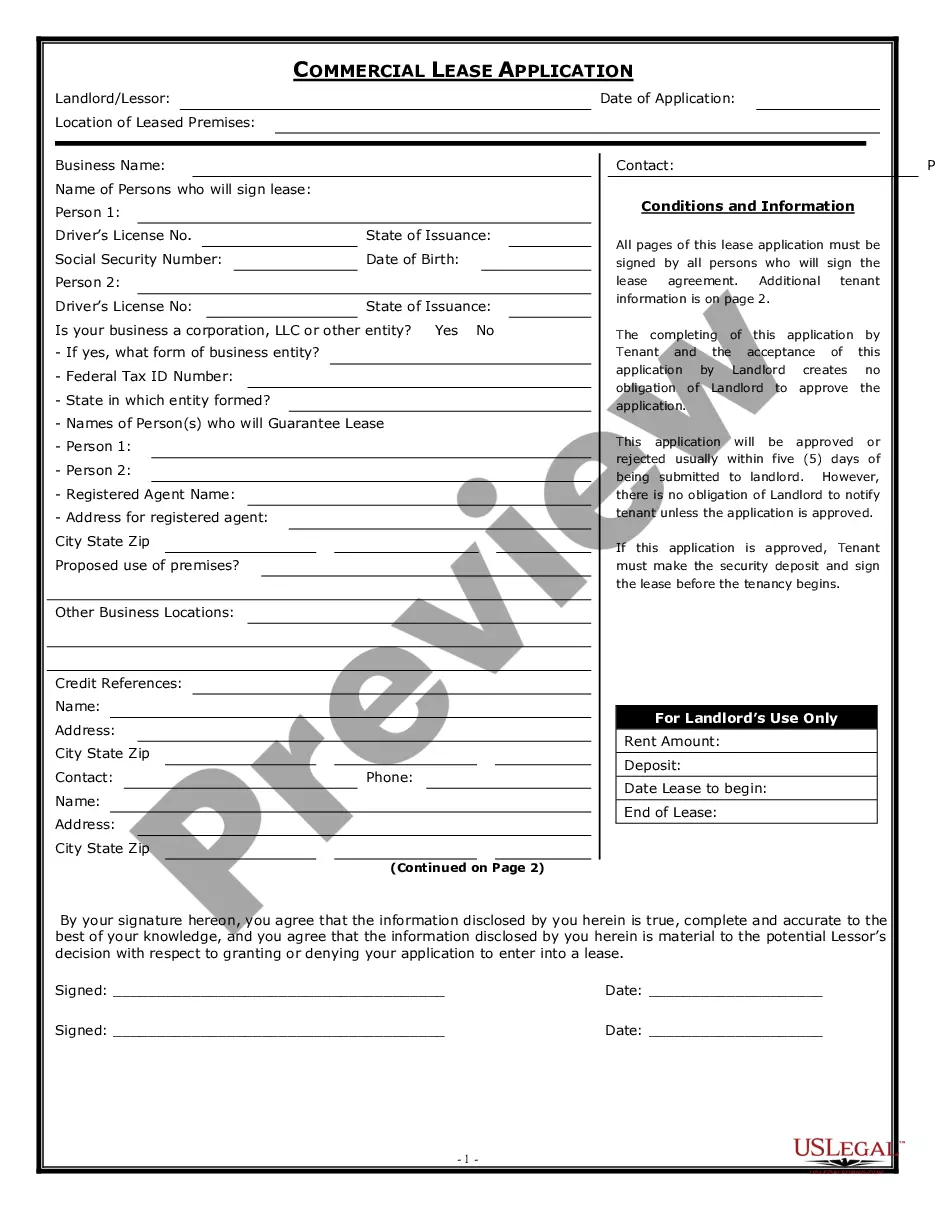

- Initial, be sure you have selected the proper develop for your city/county. You are able to check out the form while using Preview option and browse the form information to guarantee this is basically the right one for you.

- When the develop does not meet up with your needs, use the Seach area to find the proper develop.

- When you are positive that the form is suitable, select the Acquire now option to get the develop.

- Select the pricing prepare you need and enter the required information and facts. Build your profile and pay for your order with your PayPal profile or bank card.

- Opt for the data file structure and obtain the legal file design to your gadget.

- Total, change and produce and indication the obtained Pennsylvania Deed of Trust Securing Obligations Pursuant to Indemnification Agreement.

US Legal Forms is the greatest local library of legal varieties in which you can discover numerous file layouts. Take advantage of the service to obtain expertly-made paperwork that stick to status needs.

Form popularity

FAQ

Yes. An indemnity agreement is a legally binding contract between two or more parties that outlines the rights and responsibilities of each party in the event of a dispute.

Normally, consideration is money. If a contract and a course of dealing exist between two parties, if one party now wants an indemnification agreement signed, there must be new consideration. You have to pay for the new agreement to be a contract and to be binding.

Indemnification clauses are generally enforceable, but there are important qualifications. Some courts hold that broad form or ?no fault? indemnifications, which are blind to fault on the part of either party, violate public policy.

A common formulation for the negligence exception is: "The Indemnifying Party is not obligated to indemnify the Indemnified Party for any claim arising out of the Indemnified Party's negligence or a more culpable act or omission, including recklessness or willful misconduct."

The obligation to indemnify requires the indemnifying party to: Reimburse the indemnified party for its paid costs and expenses, referred to as losses. Advance payment to the indemnified party for its unpaid costs and expenses, such as: Liabilities.

Under Pennsylvania law, courts follow the ?Perry-Ruzzi? rule, under which ?provisions to indemnify for another party's negligence are to be narrowly construed, requiring a clear and unequivocal agreement before a party may transfer its liability to another party.? See Bernotas v. Super Fresh Food Markets, 963 A.

THIS DEED OF TRUST IS GIVEN TO SECURE: Payment and performance of the Guaranteed Obligations; advances made by Beneficiary to protect the Premises or the lien of this Deed of Trust or to pay taxes, assessments, insurance premiums, and all other amounts that Grantor has agreed to pay pursuant to the provisions hereof; ...

Under Pennsylvania law, courts follow the ?Perry-Ruzzi? rule, under which ?provisions to indemnify for another party's negligence are to be narrowly construed, requiring a clear and unequivocal agreement before a party may transfer its liability to another party.? See Bernotas v. Super Fresh Food Markets, 963 A.