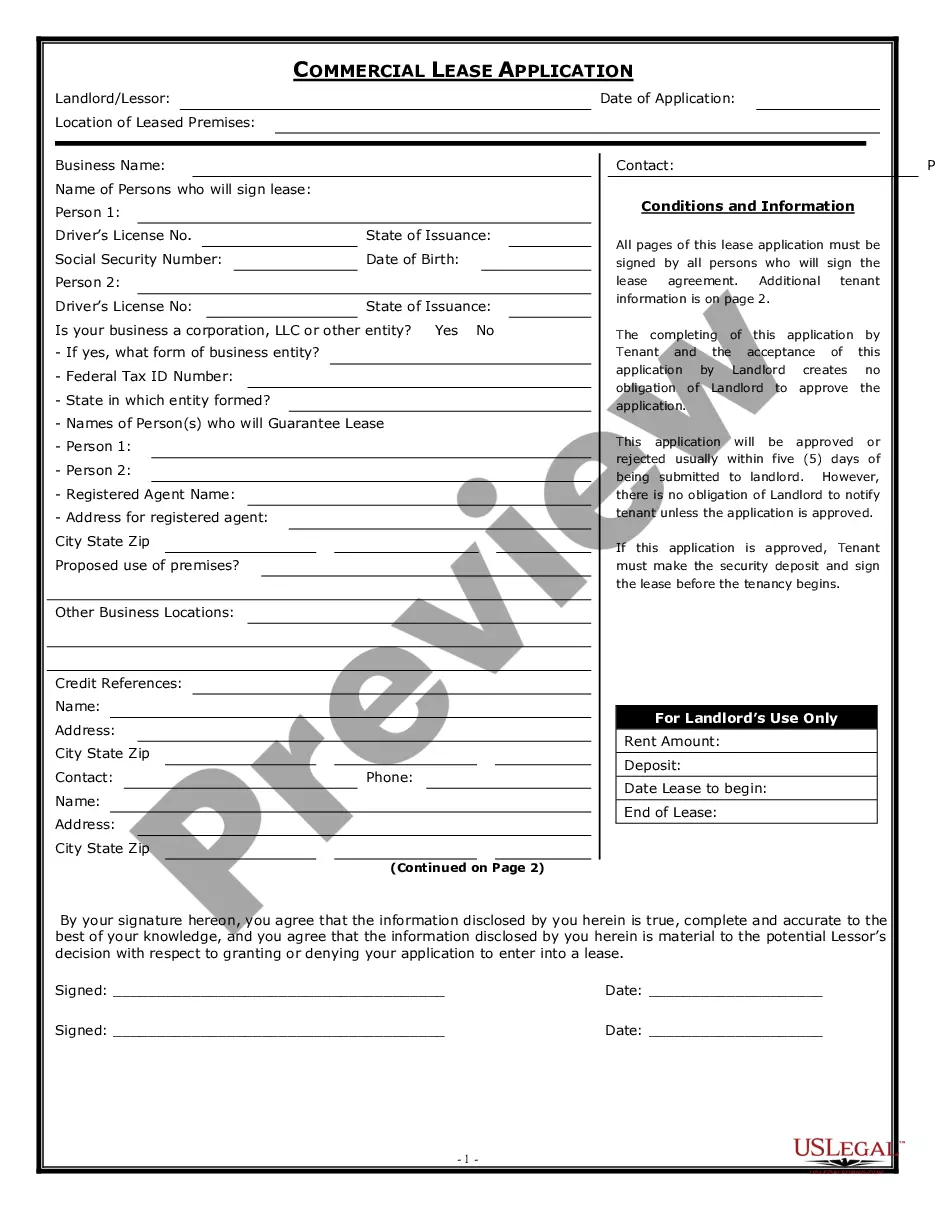

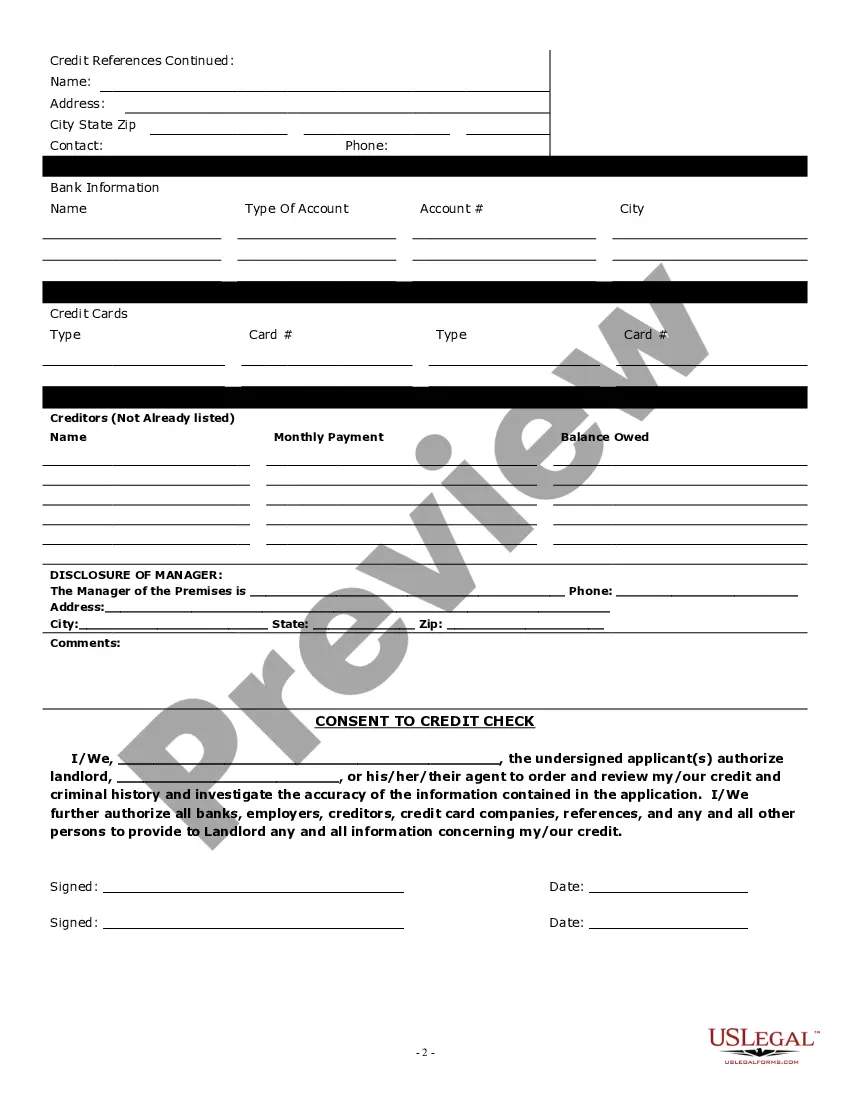

Minnesota Commercial Rental Lease Application Questionnaire

Description

How to fill out Minnesota Commercial Rental Lease Application Questionnaire?

Obtain any version from 85,000 legal documents like the Minnesota Commercial Rental Lease Application Questionnaire online through US Legal Forms. Every template is composed and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. Once you are on the form's page, click on the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the steps below: Check the state-specific prerequisites for the Minnesota Commercial Rental Lease Application Questionnaire you wish to utilize. Browse through the description and preview the sample. Once you are certain the template meets your needs, simply click Buy Now. Select a subscription plan that truly fits your budget. Establish a personal account. Make payment in one of two convenient methods: by credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the file to the My documents tab. Once your reusable template is prepared, print it out or save it to your device.

- With US Legal Forms, you will consistently have instant access to the appropriate downloadable template.

- The service grants you access to forms and categorizes them to simplify your search.

- Utilize US Legal Forms to acquire your Minnesota Commercial Rental Lease Application Questionnaire quickly and effortlessly.

Form popularity

FAQ

In Minnesota, a month-to-month lease allows tenants to rent a property on a short-term basis, with the lease automatically renewing each month. Either party can terminate the lease with proper notice, typically 30 days in advance. This flexibility can be beneficial for those who may not want a long-term commitment. For a clear understanding of your rights and responsibilities, refer to the Minnesota Commercial Rental Lease Application Questionnaire available through US Legal Forms.

To rent an apartment in Minnesota, landlords typically require a completed rental application, proof of income, and a credit check. Additionally, you may need to provide references from previous landlords to demonstrate your reliability as a tenant. Understanding these requirements can streamline the application process. Utilizing the Minnesota Commercial Rental Lease Application Questionnaire can help ensure you gather all necessary information for a smooth rental experience.

When engaging in a commercial lease, it's important to ask about the lease terms, rental rates, and any additional fees. You should also inquire about the maintenance responsibilities and the process for renewing the lease. Furthermore, understanding the zoning laws and any restrictions on the property can save you future headaches. For a comprehensive approach, consider using the Minnesota Commercial Rental Lease Application Questionnaire from US Legal Forms to cover all necessary aspects.

To properly fill out a lease agreement, carefully read each section and ensure you understand the terms and conditions. Include all necessary details like rental amount, duration, and maintenance responsibilities. Utilizing the Minnesota Commercial Rental Lease Application Questionnaire can help you prepare the key information needed for the lease agreement. This preparation will help you negotiate terms confidently and protect your rights as a tenant.

Red flags on a rental application include inconsistent information, multiple previous evictions, or a low credit score. Landlords may view these factors as indicators of potential issues. To avoid these pitfalls, ensure your Minnesota Commercial Rental Lease Application Questionnaire reflects your true financial situation and rental history. Being transparent about any challenges can also help build trust with potential landlords.

To fill out a rental application form, start by gathering essential information about yourself, including your employment details, income, and rental history. Be honest and thorough in your responses, as landlords often verify this information. Using the Minnesota Commercial Rental Lease Application Questionnaire can simplify this process, providing clear sections to guide you. Completing this form accurately will increase your chances of approval.

The new rental laws in Minnesota focus on enhancing tenant rights and ensuring fair rental practices. These laws may include provisions for security deposit limits, eviction procedures, and the regulation of rental fees. Staying informed about these changes is essential for both landlords and tenants to ensure compliance and maintain a healthy rental relationship.

When leasing a commercial space, it is crucial to ask about the lease terms, including rent, duration, and renewal options. Additionally, inquire about maintenance responsibilities, property taxes, and any restrictions on the use of the space. Understanding these details can help you make an informed decision and avoid potential issues down the road.

No, signing a Minnesota Commercial Rental Lease Application Questionnaire is not the same as signing a lease. The application is a preliminary step that allows landlords to evaluate potential tenants based on their business background and financial stability. A lease, on the other hand, is a legally binding contract that outlines the terms of your tenancy once you are approved.

Filling out a Minnesota Commercial Rental Lease Application Questionnaire involves several key steps. First, gather all necessary documents, including your business information and financial statements. Next, complete each section of the application thoroughly, ensuring accuracy and clarity. Finally, review your application before submission to confirm that all information is complete and correct.