Are you in a situation where you require paperwork for either enterprise or person uses just about every day time? There are plenty of lawful record themes available on the net, but discovering kinds you can rely on is not easy. US Legal Forms provides a large number of form themes, just like the Pennsylvania Complaint for Wrongful Repossession of Automobile and Impairment of Credit, which can be published to satisfy federal and state needs.

If you are currently informed about US Legal Forms website and possess a merchant account, basically log in. Afterward, you are able to down load the Pennsylvania Complaint for Wrongful Repossession of Automobile and Impairment of Credit template.

Should you not offer an profile and would like to begin to use US Legal Forms, adopt these measures:

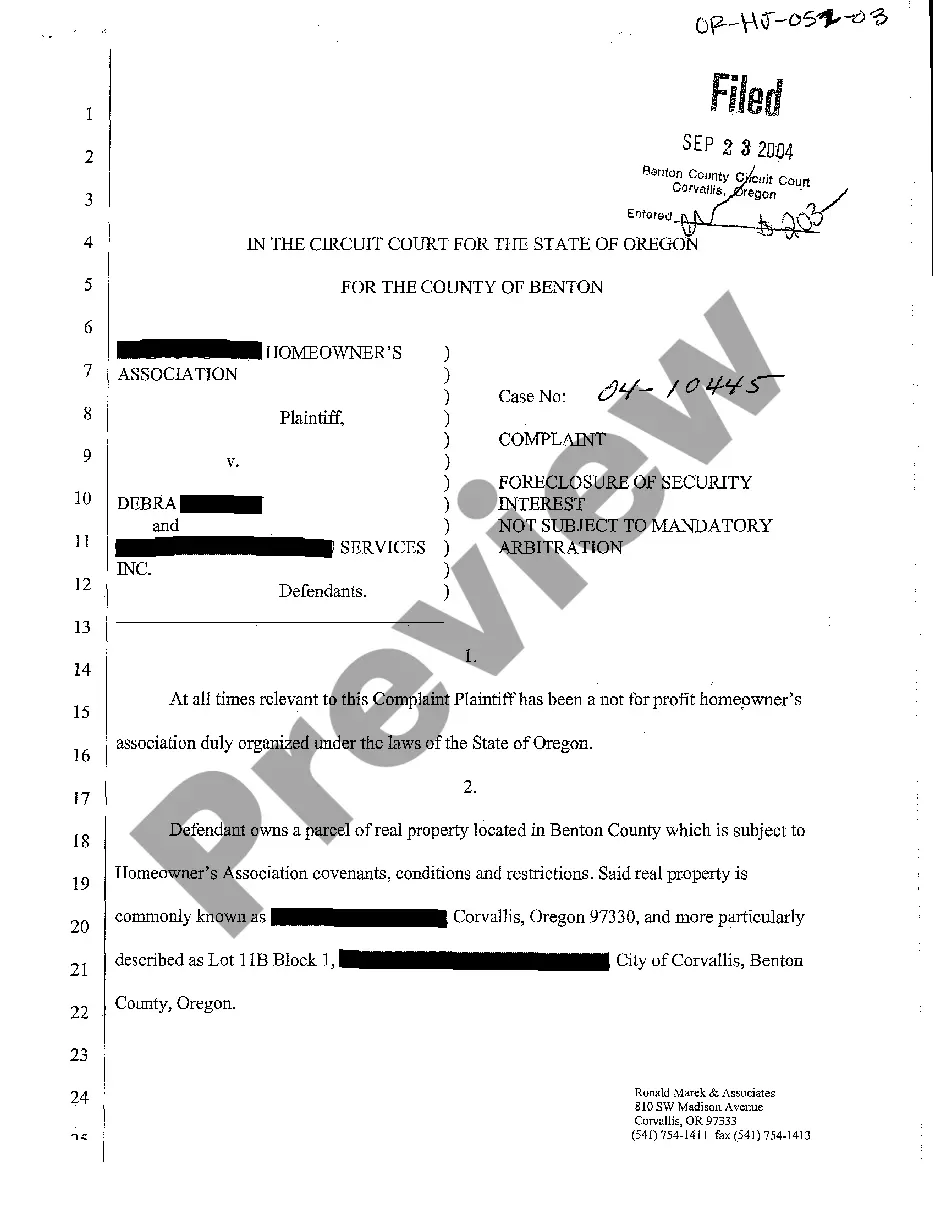

- Get the form you want and ensure it is to the proper city/area.

- Take advantage of the Preview button to examine the shape.

- Read the explanation to actually have selected the right form.

- In the event the form is not what you are trying to find, make use of the Research field to obtain the form that meets your needs and needs.

- When you obtain the proper form, simply click Buy now.

- Opt for the prices program you want, submit the necessary details to generate your bank account, and buy an order utilizing your PayPal or charge card.

- Pick a handy data file format and down load your duplicate.

Locate every one of the record themes you possess bought in the My Forms menu. You can aquire a extra duplicate of Pennsylvania Complaint for Wrongful Repossession of Automobile and Impairment of Credit any time, if possible. Just click on the necessary form to down load or print the record template.

Use US Legal Forms, one of the most substantial collection of lawful varieties, to save lots of efforts and prevent blunders. The assistance provides expertly made lawful record themes that can be used for an array of uses. Generate a merchant account on US Legal Forms and initiate generating your lifestyle easier.